- United States

- /

- Software

- /

- NasdaqGS:INTU

A Fresh Look at Intuit's (INTU) Valuation After Strong Revenue and Profit Growth

Reviewed by Simply Wall St

Intuit (INTU) just delivered its latest quarterly update, and the numbers are getting investor attention. The company posted a 16% jump in full-year revenue with Q4 up by 20%, leaning heavily on the strength of TurboTax Live and Credit Karma. Even with Mailchimp seeing a short-term dip, management sounded upbeat about its prospects bouncing back next year. For anyone tracking the stock, this kind of steady expansion and improving profitability keeps the spotlight on what Intuit could do next and whether its recent run has more potential.

Backing up the headline results, Intuit’s shares have moved up 8% over the past year, with some volatility along the way. After strong multi-year gains, momentum has cooled more recently as the stock dipped around 10% over the past month and 12% in the past three months. With annual revenue and net income both growing at double-digit rates, investors are considering both the company’s growth engine and whether market mood swings still present opportunity.

Are investors looking at an undervalued growth story, or is the market already pricing in everything that lies ahead for Intuit?

Most Popular Narrative: 18% Undervalued

The current narrative suggests that Intuit is trading well below its estimated fair value. Expectations of robust multi-year growth and expanding market opportunities fuel the bullish outlook.

The accelerating adoption of Intuit's AI-driven all-in-one platform, including virtual teams of AI agents and human experts, positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers. This supports higher average revenue per customer (ARPC) and net margin expansion over time.

What is energizing this undervalued call? It comes down to ambitious long-term projections for Intuit's core business and a powerful set of financial assumptions. The real surprise is that analysts are betting on expansion rates and profitability figures usually reserved for industry giants. Can you guess what numbers drive this high fair value? Continue reading to dive into the full breakdown of growth catalysts and bold financial forecasts.

Result: Fair Value of $819.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Mailchimp's sluggish growth and potential international saturation could challenge Intuit's outlook if improvements falter or customer expansion slows.

Find out about the key risks to this Intuit narrative.Another View: What Do Profit Multiples Say?

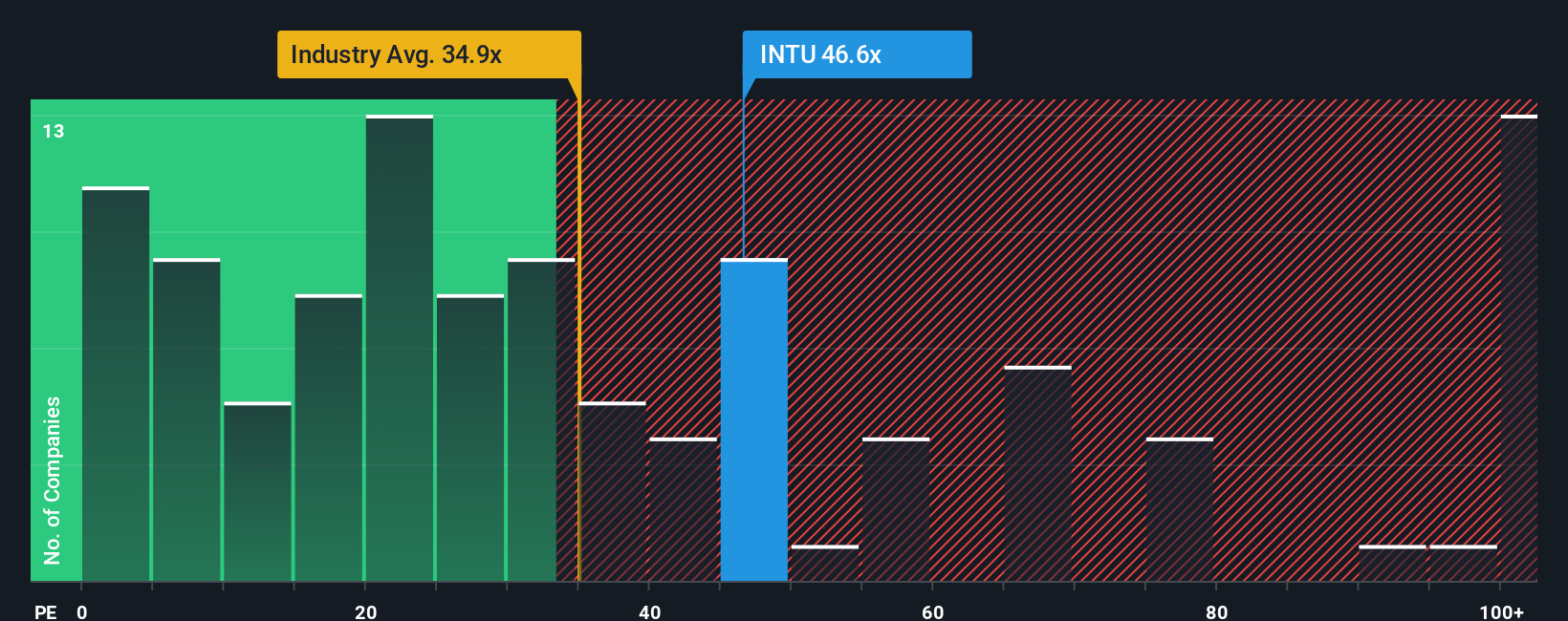

Looking through a different lens, Intuit’s valuation based on earnings looks less compelling. Compared to industry averages, the current share price appears on the expensive side. Does this cast doubt on long-term upside, or is growth still the bigger story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Intuit to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Intuit Narrative

If you see things differently or want to dig deeper into Intuit's numbers, you can easily build your own perspective in just a few minutes with Do it your way.

A great starting point for your Intuit research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity pass you by. Expand your horizons and find stocks you may have never considered using these standout picks on Simply Wall Street.

- Tap into future healthcare breakthroughs by browsing innovative companies powering the next wave of medicine through AI with healthcare AI stocks.

- Boost your income potential and sniff out companies offering high yields, steady payouts, and proven track records with dividend stocks with yields > 3%.

- Uncover undervalued gems trading below their true worth by starting your research with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)