- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Shareholders Would Not Be Objecting To Innodata Inc.'s (NASDAQ:INOD) CEO Compensation And Here's Why

We have been pretty impressed with the performance at Innodata Inc. (NASDAQ:INOD) recently and CEO Jack Abuhoff deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 08 June 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Innodata

How Does Total Compensation For Jack Abuhoff Compare With Other Companies In The Industry?

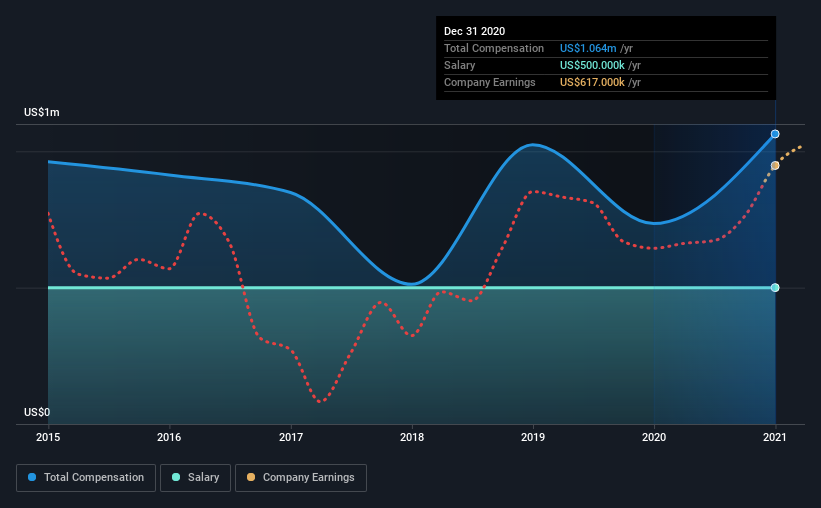

Our data indicates that Innodata Inc. has a market capitalization of US$167m, and total annual CEO compensation was reported as US$1.1m for the year to December 2020. That's a notable increase of 45% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$500k.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$1.0m. From this we gather that Jack Abuhoff is paid around the median for CEOs in the industry. Furthermore, Jack Abuhoff directly owns US$7.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$500k | US$500k | 47% |

| Other | US$564k | US$235k | 53% |

| Total Compensation | US$1.1m | US$735k | 100% |

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. It's interesting to note that Innodata pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Innodata Inc.'s Growth Numbers

Innodata Inc.'s earnings per share (EPS) grew 60% per year over the last three years. Its revenue is up 5.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Innodata Inc. Been A Good Investment?

We think that the total shareholder return of 452%, over three years, would leave most Innodata Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 4 warning signs for Innodata that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Innodata, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)