- United States

- /

- Software

- /

- NasdaqGS:HUT

Could Hut 8’s (HUT) New Energy Strategy Redefine Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- Hut 8 Corp. recently announced its transition from a primarily Bitcoin mining operation to a diversified energy-infrastructure company, focusing on leasing power capacity to crypto miners and high-performance computing users across advanced U.S. projects.

- This significant pivot toward managing more than 2.55 GW of power capacity highlights Hut 8's ambition to broaden its business model and attract new institutional interest, even as it faces capital and regulatory challenges.

- We'll explore how Hut 8's shift to energy-infrastructure could shape its investment narrative and growth opportunities outside traditional Bitcoin mining.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hut 8 Investment Narrative Recap

To be a Hut 8 shareholder today, you need to believe the company can successfully transform from a Bitcoin miner into a scaled power and infrastructure platform, tapping new recurring revenue streams while reducing dependence on Bitcoin cycles. This recent announcement underlines Hut 8’s pivot to energy infrastructure, which could boost revenue predictability, the central short-term catalyst, though persistent capital and regulatory hurdles remain the dominant near-term risks. The transition itself doesn't materially resolve these risks but highlights continued investor focus on execution and external headwinds.

Among recent announcements, Hut 8's plan to develop four new large-scale U.S. sites, amounting to 1,530 MW under development, most directly aligns with its new direction. This step supports the catalyst of building a robust, diversified base of contracted power assets, expanding the customer mix beyond self-mining and adding exposure to the AI and high-performance computing sectors.

Yet, despite management’s optimism, the scale and speed of these infrastructure projects could bring...

Read the full narrative on Hut 8 (it's free!)

Hut 8 is projected to reach $767.3 million in revenue and $140.6 million in earnings by 2028. This requires a 76.9% annual revenue growth rate, but earnings are expected to decrease by $13.4 million from the current $154.0 million.

Uncover how Hut 8's forecasts yield a $32.53 fair value, a 25% downside to its current price.

Exploring Other Perspectives

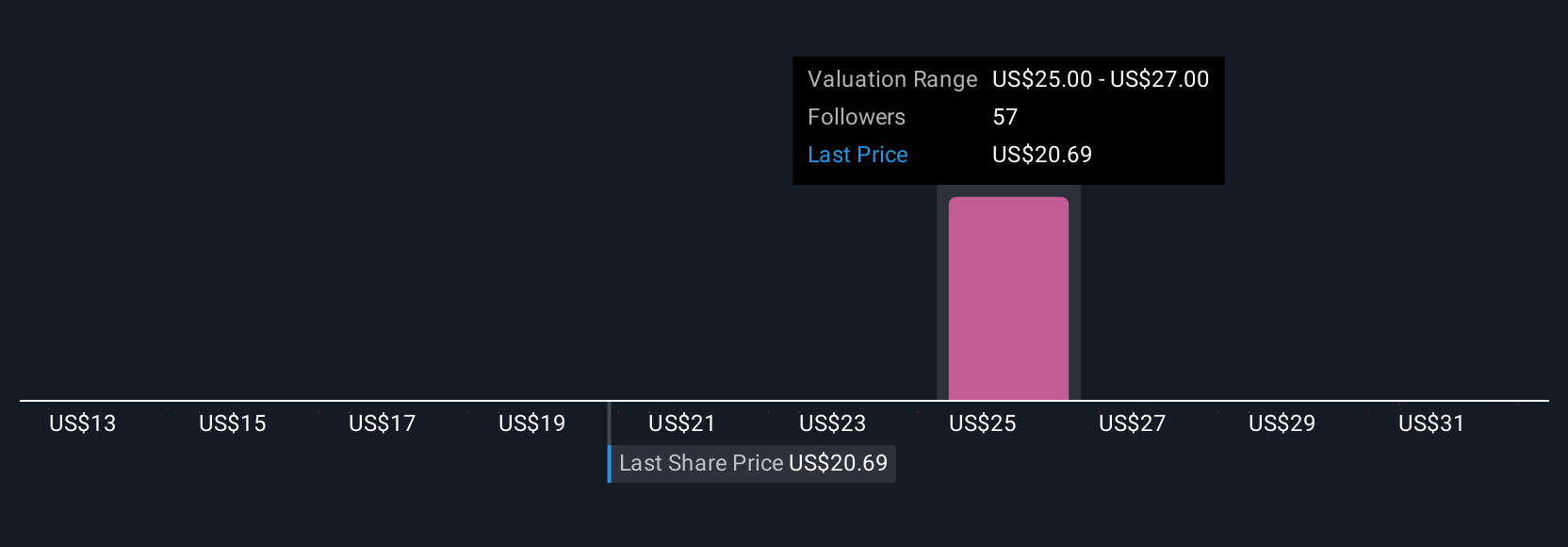

Four retail investors in the Simply Wall St Community placed their fair value estimates for Hut 8 between US$13 and US$36, reflecting a broad range of outlooks. As the company reallocates toward long-term contracted energy revenues, your own expectations about execution and risk may shift significantly, see how different opinions compare to your view.

Explore 4 other fair value estimates on Hut 8 - why the stock might be worth as much as $36.00!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)