- United States

- /

- Software

- /

- NasdaqGS:HCP

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.1% drop, yet it remains up by 21% over the past year with earnings projected to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on evolving market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.58% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing treatments for severe allergic reactions, with a market capitalization of $1.09 billion.

Operations: ARS Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to $2.57 million. The company is engaged in the development of treatments specifically targeting severe allergic reactions.

ARS Pharmaceuticals, despite its current unprofitability and modest revenue of $3M, is positioned for significant growth with an expected profit within three years. The company's aggressive expansion into new markets, underscored by recent approvals and licensing deals for its innovative epinephrine nasal spray 'neffy', highlights its strategic direction. Notably, the licensing agreement with ALK-Abelló could potentially bring in up to $465 million from milestones and royalties. This move not only diversifies ARS Pharma's revenue streams but also mitigates market penetration risks by partnering with established players in Europe, Canada, and beyond. Moreover, the inclusion of neffy in Express Scripts' formularies significantly boosts its accessibility across the U.S., promising a broader impact on future earnings.

- Take a closer look at ARS Pharmaceuticals' potential here in our health report.

Assess ARS Pharmaceuticals' past performance with our detailed historical performance reports.

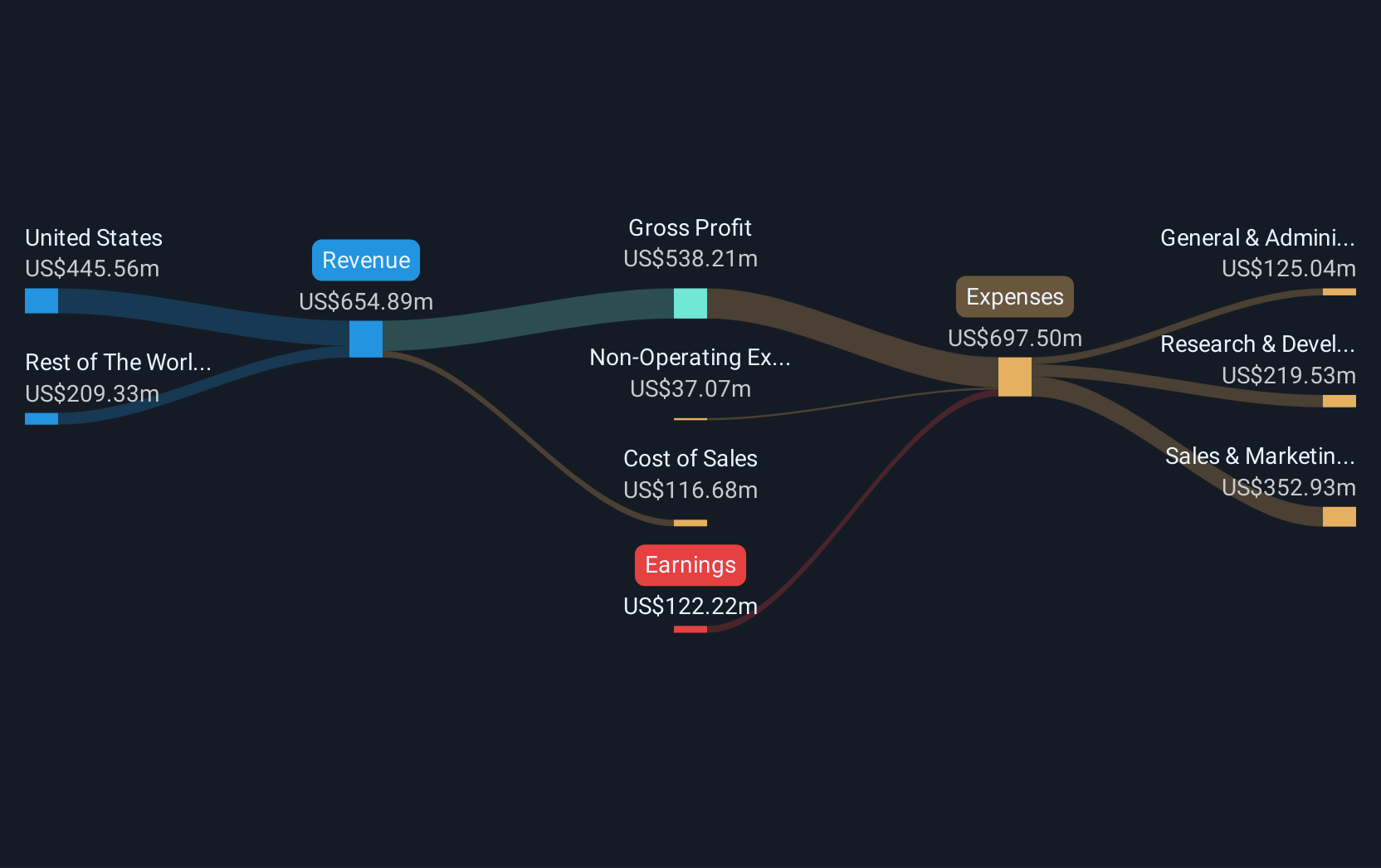

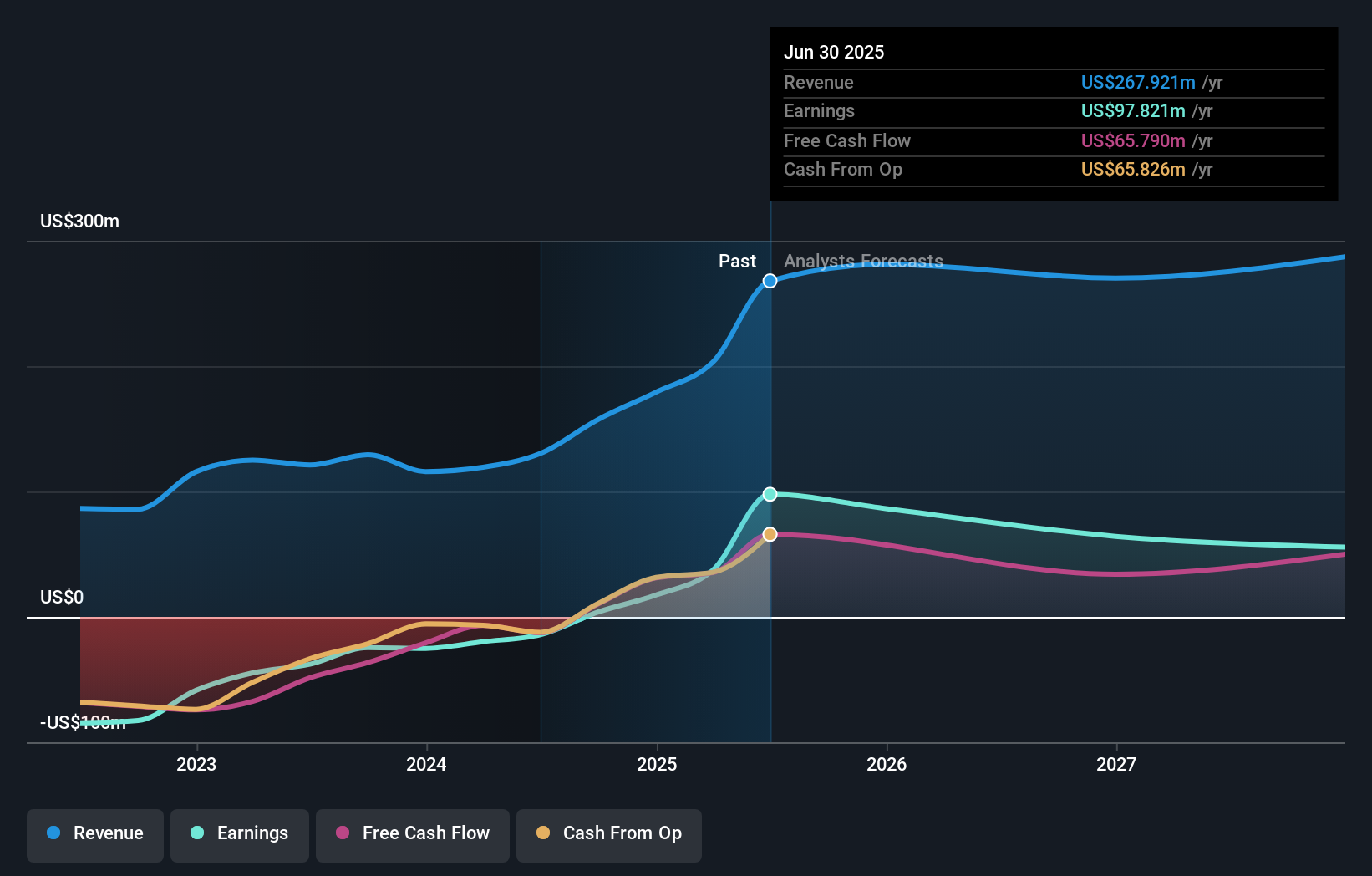

HashiCorp (NasdaqGS:HCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HashiCorp, Inc. provides multi-cloud infrastructure automation solutions globally and has a market capitalization of approximately $7.01 billion.

Operations: HashiCorp generates revenue primarily from its Internet Software & Services segment, amounting to $654.89 million. The company's business focuses on providing automation solutions for multi-cloud infrastructure.

HashiCorp, amid a challenging fiscal landscape, showcases resilience with its recent financial performance. In the third quarter of 2024, revenue surged to $173.39 million from $146.13 million year-over-year, complemented by a significant reduction in net loss to $13.01 million from $39.47 million. This improvement aligns with an industry trend towards robust cloud infrastructure management solutions, where HashiCorp is a critical player due to its innovative toolsets like Terraform and Vault. Despite not engaging in share repurchases recently, the company's strategic focus on enhancing product capabilities and market reach could position it favorably as it moves towards projected profitability and an expected annual profit growth of 51.3%. This trajectory suggests potential for substantial impact within the tech sector, particularly as businesses increasingly rely on sophisticated cloud environments for scalability and security.

- Get an in-depth perspective on HashiCorp's performance by reading our health report here.

Evaluate HashiCorp's historical performance by accessing our past performance report.

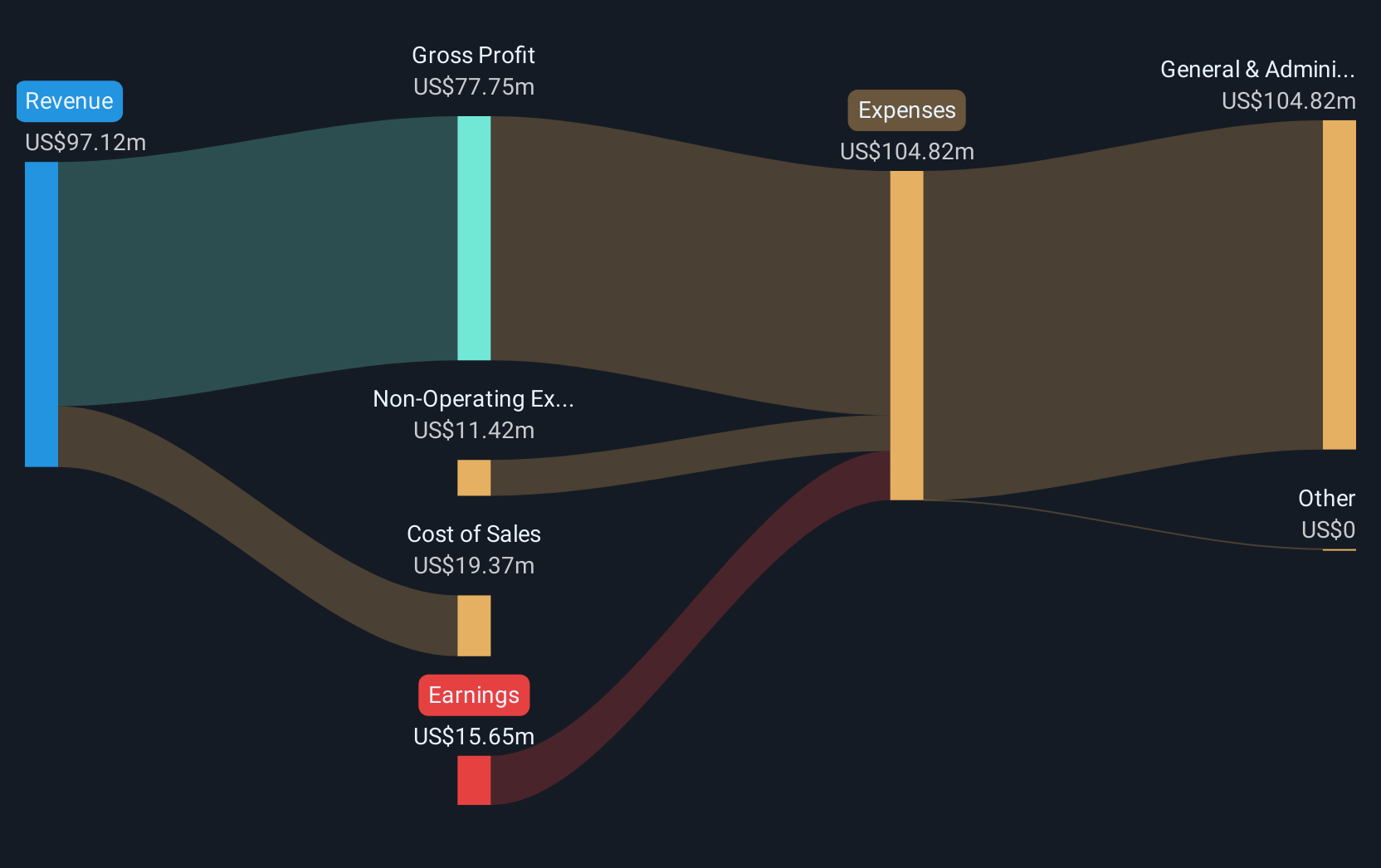

Rigel Pharmaceuticals (NasdaqGS:RIGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigel Pharmaceuticals, Inc. is a biotechnology company focused on discovering, developing, and providing therapies for hematologic disorders and cancer, with a market capitalization of approximately $286.24 million.

Operations: Rigel Pharmaceuticals generates revenue primarily from its biotechnology segment, amounting to $157.37 million. The company is dedicated to developing therapies for hematologic disorders and cancer.

Rigel Pharmaceuticals, recently added to the NASDAQ Biotechnology Index, underscores its growth trajectory with a notable jump in Q3 revenue to $55.31 million from $28.13 million year-over-year and a swing to net income of $12.42 million from a net loss previously. This financial turnaround is mirrored by promising R&D outcomes, particularly with R289 showing potential in treating myelodysplastic syndrome as evidenced at recent medical conferences. With an annual revenue growth forecast at 12.6% and earnings expected to surge by 36.3% per year, Rigel is aligning well within the high-growth biotech landscape, despite facing challenges like highly volatile share prices and under-covered interest payments which could suggest caution for future fiscal stability.

- Unlock comprehensive insights into our analysis of Rigel Pharmaceuticals stock in this health report.

Understand Rigel Pharmaceuticals' track record by examining our Past report.

Make It Happen

- Embark on your investment journey to our 235 US High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HashiCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCP

HashiCorp

Engages in the provision of multi-cloud infrastructure automation solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives