- United States

- /

- Software

- /

- NasdaqGS:AVPT

3 US Growth Stocks With Insider Ownership Up To 37%

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements amid anticipation of key economic reports, investors are closely watching for signals that might influence Federal Reserve decisions on interest rates. In this context, growth companies with high insider ownership can be particularly appealing, as they often reflect management's confidence in their long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.1% | 60.1% |

| Myomo (NYSEAM:MYO) | 13.7% | 56.7% |

Let's uncover some gems from our specialized screener.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of approximately $3.08 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to $315.92 million.

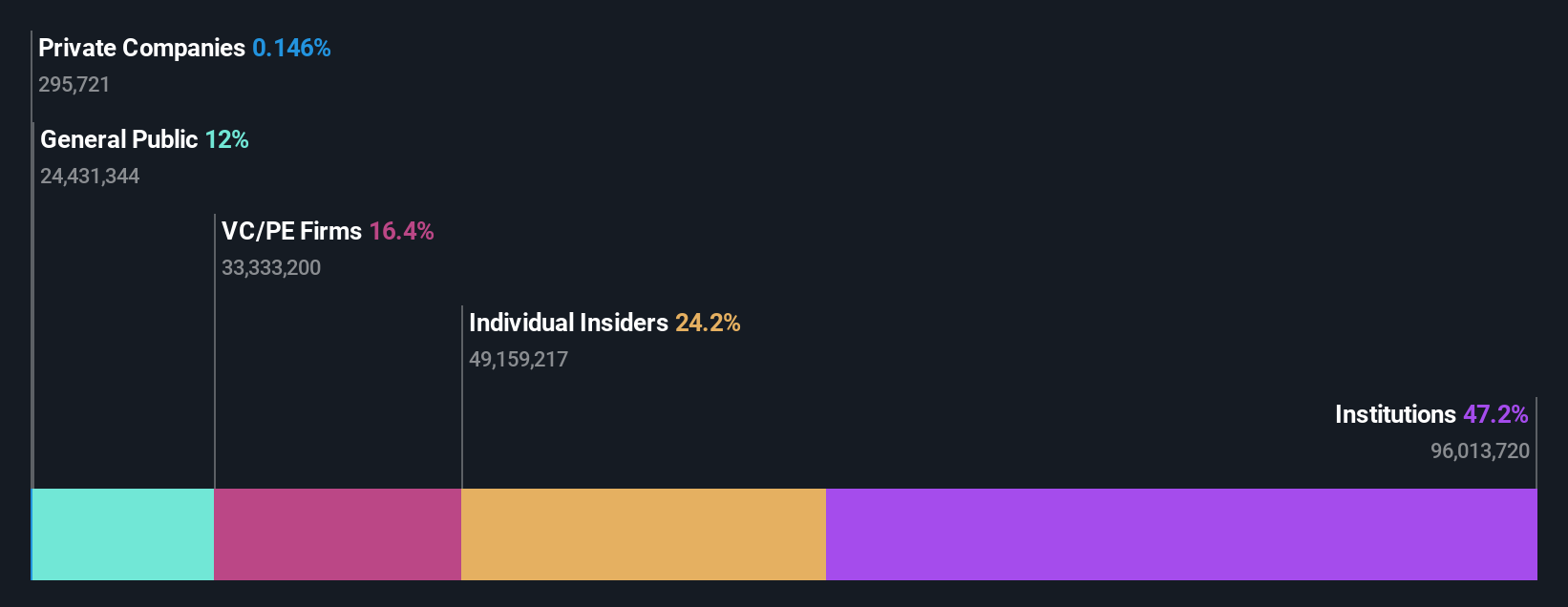

Insider Ownership: 37.1%

AvePoint demonstrates characteristics of a growth company with high insider ownership, as evidenced by its significant earnings growth over the past five years and forecasted revenue increase of 17.9% annually, outpacing the US market. Recent developments include innovative AI capabilities within Microsoft 365 Copilot and an AI Lab to drive global research. Financially, AvePoint reported improved Q3 earnings with US$88.8 million in revenue and net income of US$2.62 million, alongside raising its full-year revenue guidance to approximately US$328 billion.

- Unlock comprehensive insights into our analysis of AvePoint stock in this growth report.

- The analysis detailed in our AvePoint valuation report hints at an inflated share price compared to its estimated value.

HashiCorp (NasdaqGS:HCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HashiCorp, Inc. provides multi-cloud infrastructure automation solutions globally and has a market cap of approximately $7.02 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $654.89 million.

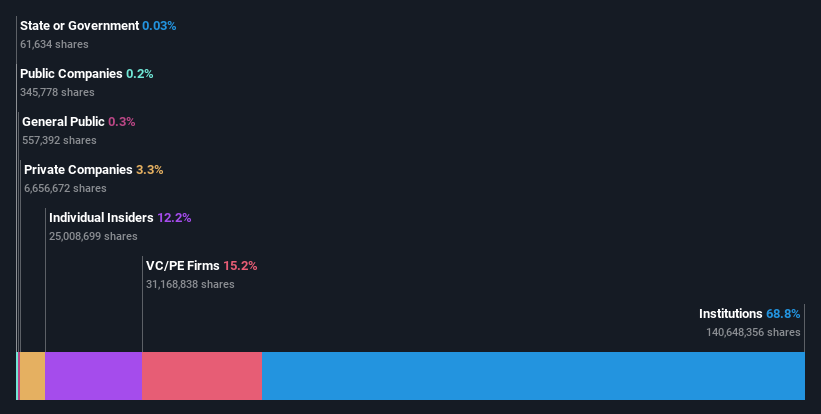

Insider Ownership: 12.2%

HashiCorp is forecasted to become profitable within three years, with earnings anticipated to grow by 51.17% annually, surpassing the US market's growth rate. Recent Q3 results showed revenue of US$173.39 million and a reduced net loss of US$13.01 million compared to last year, indicating financial improvement. Despite trading below estimated fair value and expected slower revenue growth at 14.1% per year, HashiCorp remains on a path toward profitability without substantial insider trading activity recently noted.

- Click here to discover the nuances of HashiCorp with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, HashiCorp's share price might be too optimistic.

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc, along with its subsidiaries, offers technology services across North America, Europe, the United Kingdom, and other international regions, with a market cap of approximately $1.89 billion.

Operations: The company's revenue is primarily derived from its Computer Services segment, which generated £747.39 million.

Insider Ownership: 26.6%

Endava is poised for significant earnings growth, forecasted at 41% annually, outpacing the US market. Despite recent financial challenges with a net income drop to £2.25 million and profit margins decreasing to 0.9%, revenue is projected to grow at 9.5% per year, slightly above the market average. The stock trades close to its fair value without substantial insider trading activity recently. However, shareholders have faced dilution over the past year.

- Navigate through the intricacies of Endava with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Endava's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 202 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific.

Flawless balance sheet with reasonable growth potential.