- United States

- /

- Software

- /

- NasdaqGS:AGYS

High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

As major U.S. stock indexes reach new record highs, buoyed by positive corporate earnings and optimism surrounding international trade talks, the tech sector remains a focal point of investor interest. In this thriving market environment, identifying high-growth tech stocks involves considering companies that demonstrate strong innovation potential and resilience amid evolving economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 10.51% | 20.66% | ★★★★★☆ |

| Palantir Technologies | 25.12% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Zscaler | 15.74% | 40.94% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Gorilla Technology Group (GRRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gorilla Technology Group Inc. operates in Taiwan and the United Kingdom, offering solutions in security, network, business intelligence, and IoT technology with a market capitalization of $483.36 million.

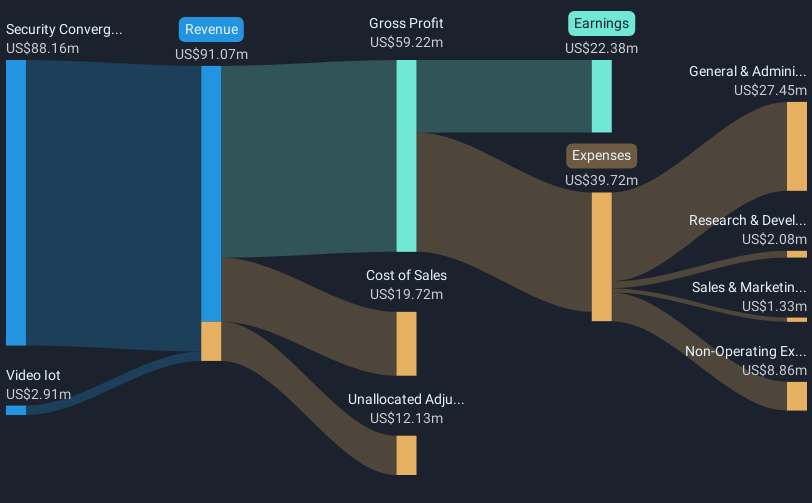

Operations: Gorilla Technology Group Inc. generates revenue primarily from its Security Convergence segment, which accounts for $143.32 million, while its Video IoT segment contributes $3.54 million. The company's operations focus on providing advanced technological solutions in Taiwan and the United Kingdom.

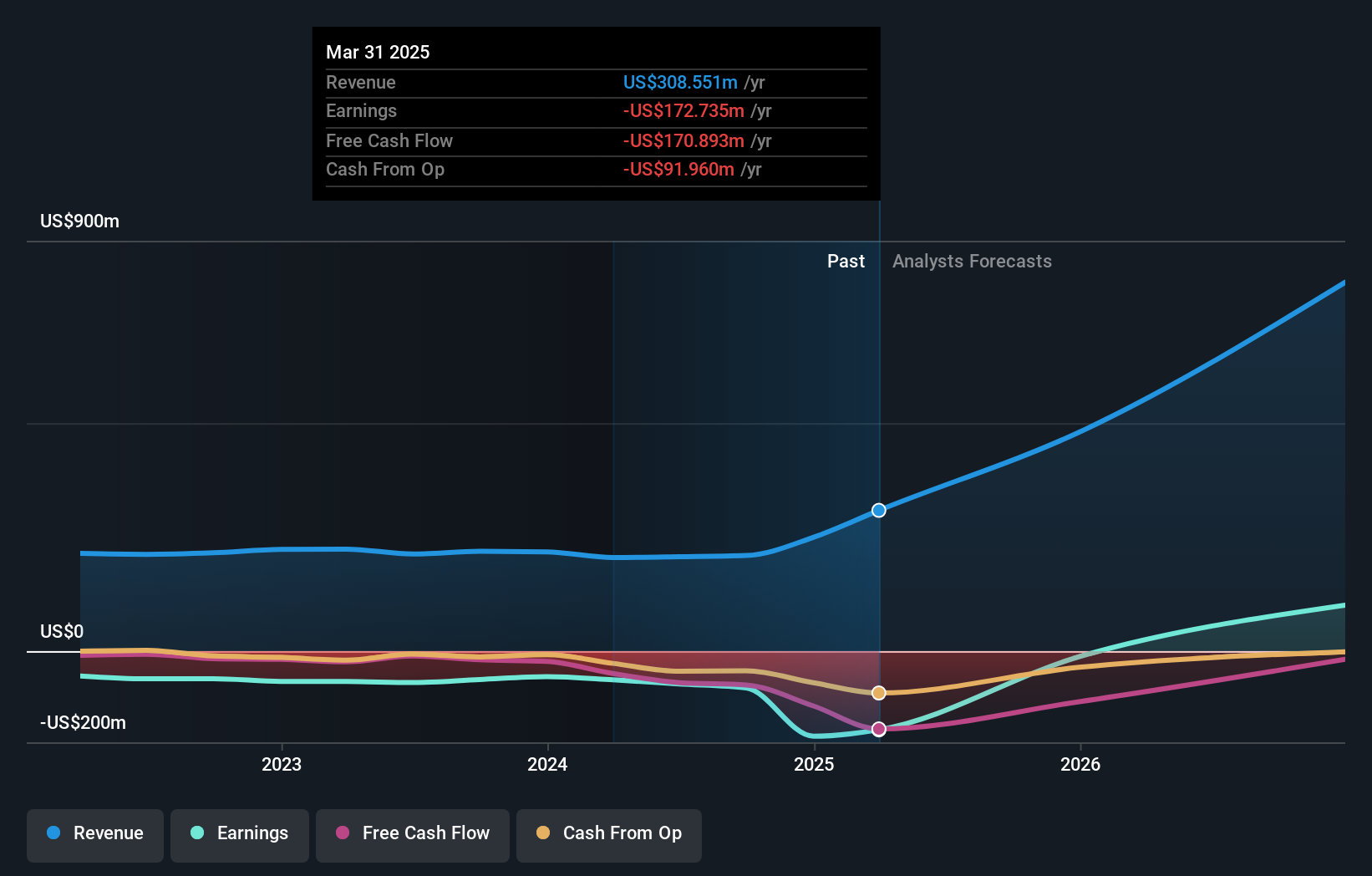

Gorilla Technology Group has recently shown significant growth dynamics, particularly with its strategic move into AI-powered data centers in Southeast Asia through a $1.4 billion deal with Freyr, marking a robust expansion strategy. This initiative starts with a $300 million project set for Q4 2025, reflecting the company's aggressive investment in innovation and regional growth prospects. Despite facing profitability challenges as evidenced by an $8.5 million net loss in H1 2025, Gorilla Technology is optimistic about reaching up to $110 million in revenue this year. The inclusion of Gorilla Technology in the S&P Global BMI Index underscores its emerging market presence and investor recognition amidst financial volatilities.

- Unlock comprehensive insights into our analysis of Gorilla Technology Group stock in this health report.

Understand Gorilla Technology Group's track record by examining our Past report.

Applied Optoelectronics (AAOI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market cap of $2.32 billion.

Operations: The company generates revenue primarily from its optical networking equipment segment, amounting to $368.23 million.

Applied Optoelectronics, a key innovator in optical transceivers for AI data centers, is set to enhance its market presence through a strategic expansion in Sugar Land, Texas. This initiative involves an investment of over $150 million and the creation of 500 jobs, aimed at boosting domestic manufacturing capabilities. Despite recent financial challenges with a net loss of $18.27 million in the first half of 2025, AOI's revenue has impressively grown from $83.94 million to $202.81 million year-over-year. The company's commitment to R&D and innovation is evident as it prepares to launch its new 210,000 square foot facility by summer 2026, positioning itself at the forefront of AI-focused technological advancements in the U.S.

- Get an in-depth perspective on Applied Optoelectronics' performance by reading our health report here.

Gain insights into Applied Optoelectronics' past trends and performance with our Past report.

Agilysys (AGYS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agilysys, Inc. is a company that develops and markets software-enabled solutions and services for the hospitality industry across North America, Europe, the Asia-Pacific, and India, with a market cap of $3.21 billion.

Operations: Agilysys focuses on providing software-enabled solutions and services tailored for the hospitality sector across various regions, including North America, Europe, the Asia-Pacific, and India. The company leverages its expertise in technology to enhance operational efficiencies and customer experiences within the hospitality industry.

Agilysys, a tech firm specializing in hospitality solutions, recently raised its fiscal 2026 earnings guidance, reflecting robust subscription revenue growth expectations of 29% year-over-year. This adjustment follows a significant increase in Q2 revenues to $79.3 million from $68.28 million the previous year and a surge in net income to $11.71 million from $1.36 million. These financial strides underscore Agilysys's effective strategy and innovation in cloud-native technologies, enhancing operational efficiencies across extensive client networks like the Saskatchewan Indian Gaming Authority. The company's focused investment in R&D has propelled these advancements, positioning it well for sustained growth amid evolving digital demands in the hospitality sector.

- Take a closer look at Agilysys' potential here in our health report.

Examine Agilysys' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Delve into our full catalog of 72 US High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)