- United States

- /

- Software

- /

- NasdaqGS:FTNT

Has The Pullback In Fortinet (FTNT) Opened A New Valuation Opportunity?

- If you are looking at Fortinet and wondering whether the current share price really reflects its underlying value, this article is designed to walk you through that question step by step.

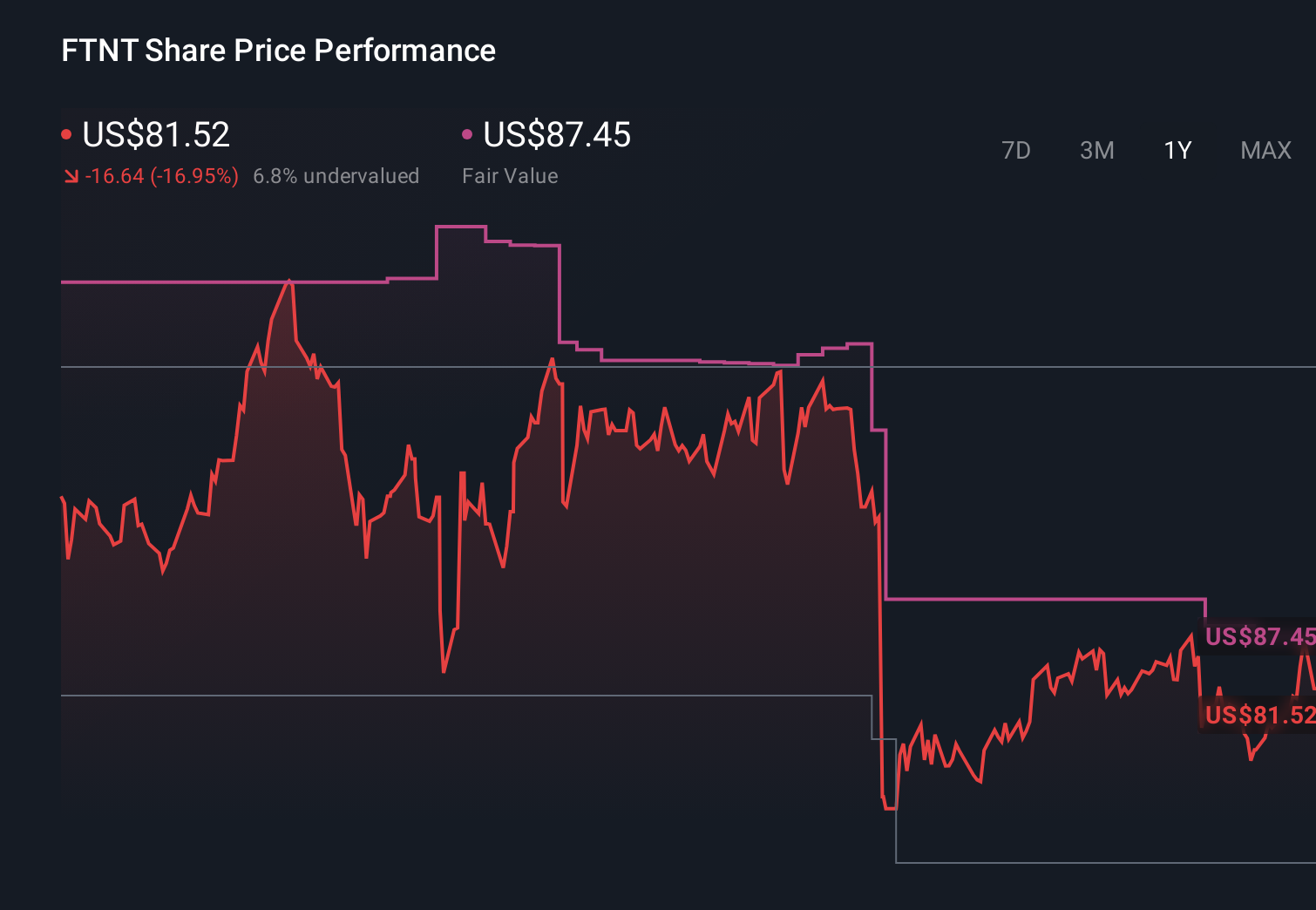

- The stock closed at US$76.32, with returns of a 2.2% decline over 7 days, 7.5% decline over 30 days, 2.0% decline year to date, 18.9% decline over 1 year, 57.6% over 3 years and 154.8% over 5 years, which can change how investors think about both risk and upside.

- Recent news coverage around Fortinet has largely focused on its position in cybersecurity and how investors are reacting to that story over different timeframes. This mix of shorter term pullbacks and stronger multi year returns is an important backdrop when you are trying to decide whether the current price still makes sense.

- Simply Wall St currently gives Fortinet a valuation score of 5 out of 6, which we will unpack using different valuation approaches before circling back at the end of the article to a more practical way you can keep on top of its valuation over time.

Find out why Fortinet's -18.9% return over the last year is lagging behind its peers.

Approach 1: Fortinet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes projected future cash flows and discounts them back to today, so you can compare that stream of cash to the current share price in a consistent way.

For Fortinet, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month Free Cash Flow is about $2.10b. Analyst estimates and Simply Wall St extrapolations project Free Cash Flow rising to around $4.10b by 2030, with interim annual figures between 2026 and 2035 discounted back to today to reflect risk and the time value of money.

When all those projected cash flows are added up and discounted, the model arrives at an estimated intrinsic value of about $101.44 per share. Compared with the recent share price of $76.32, this indicates Fortinet is 24.8% undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fortinet is undervalued by 24.8%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Fortinet Price vs Earnings

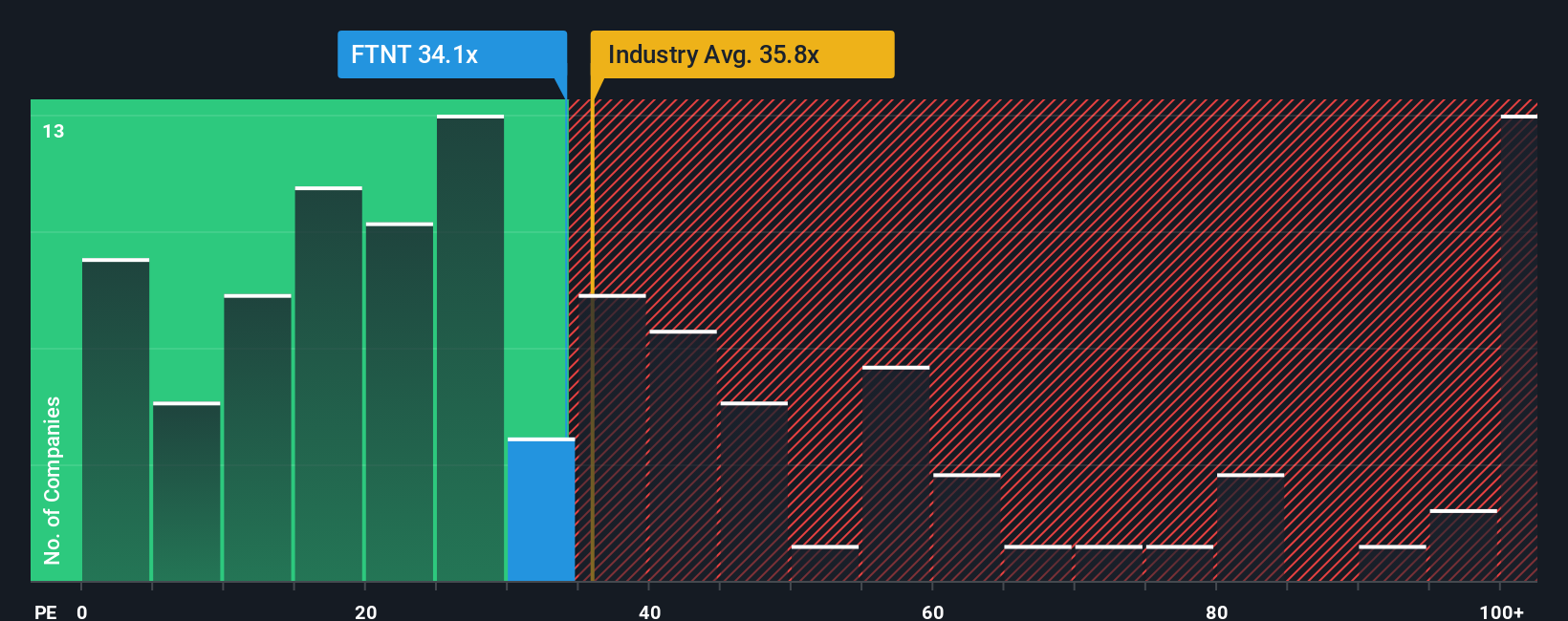

For a profitable company like Fortinet, the P/E ratio is a useful yardstick because it links what you pay per share to the earnings the business is currently generating. It is a simple way to see how much the market is paying for each dollar of profit.

What counts as a “normal” P/E depends on what investors expect for growth and how much risk they see in those earnings. Higher expected growth or lower perceived risk can support a higher P/E, while slower growth or higher risk tends to justify a lower one.

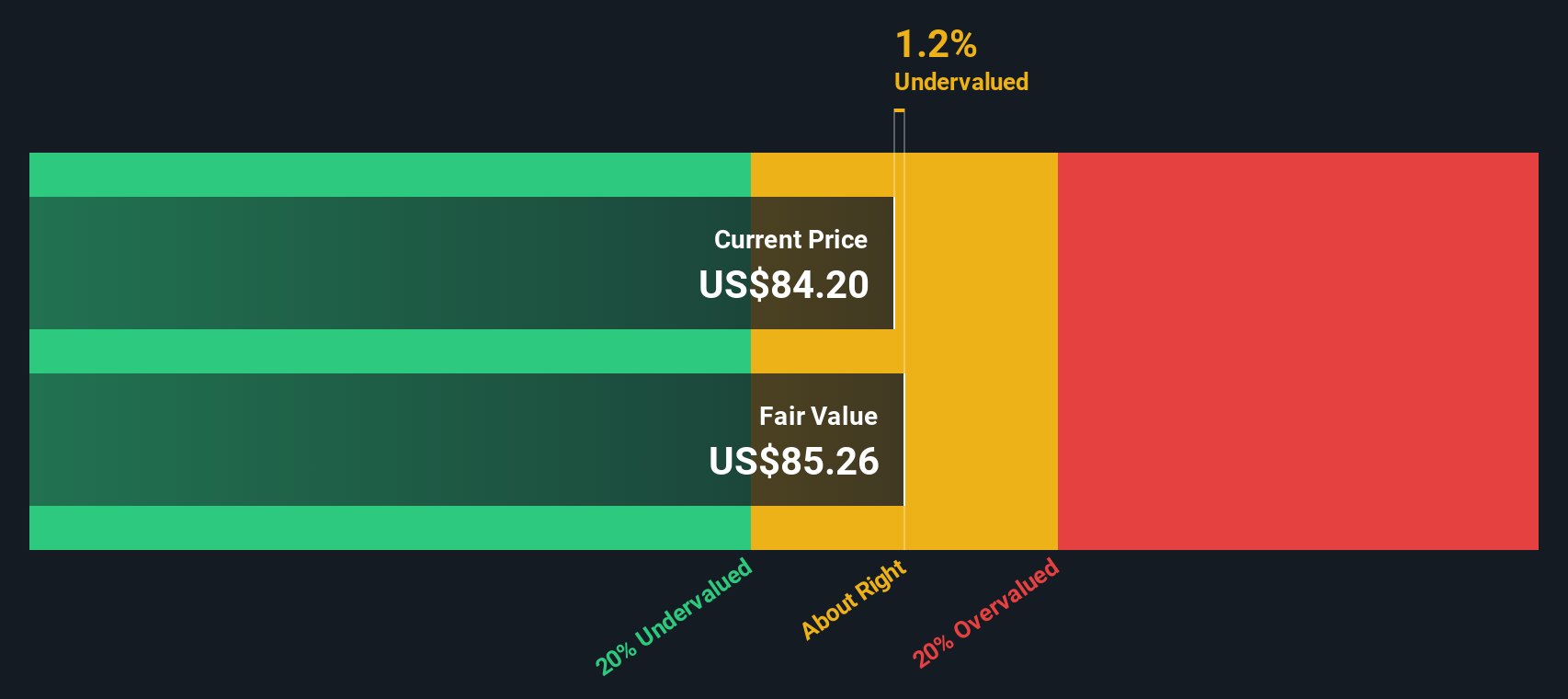

Fortinet trades on a P/E of 30.29x. That is close to the broader Software industry average of 31.77x and below the peer average of 61.09x. Simply Wall St also calculates a proprietary “Fair Ratio” of 34.64x for Fortinet, which is the P/E level it estimates would be reasonable given factors like earnings growth, margins, industry, market cap and company specific risks.

This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for Fortinet’s own characteristics rather than assuming all software stocks deserve the same multiple. Comparing 30.29x to the Fair Ratio of 34.64x suggests the shares look undervalued on this P/E based view.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortinet Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simple stories that you and other investors create to link Fortinet’s business outlook to a financial forecast and then to a fair value, all within Simply Wall St’s Community page that is used by millions of investors.

Each Narrative combines your view on Fortinet’s revenue, earnings and margins with your own fair value estimate, then sets that against the current share price so you can quickly see whether you think the stock looks cheap or expensive and decide if it might be a time to add, trim or wait.

Narratives update automatically as new information comes in. When fresh earnings, guidance or news about areas like AI data center security or hardware risks are added, your forecast and fair value are refreshed without you needing to rebuild a model from scratch.

For example, one Fortinet Narrative on Simply Wall St currently anchors on a fair value of about US$99.03 per share, while another sits closer to US$87.04. This shows how two well informed investors can look at the same company, plug in different assumptions and arrive at different but transparent views on what Fortinet is worth today.

Do you think there's more to the story for Fortinet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!