- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet, Inc. (NASDAQ:FTNT) Just Reported And Analysts Have Been Lifting Their Price Targets

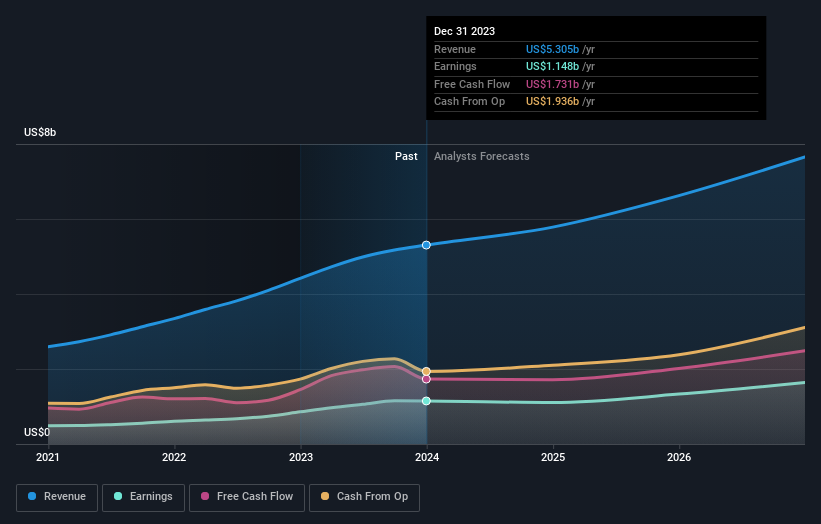

It's been a good week for Fortinet, Inc. (NASDAQ:FTNT) shareholders, because the company has just released its latest yearly results, and the shares gained 5.4% to US$70.03. It was a credible result overall, with revenues of US$5.3b and statutory earnings per share of US$1.46 both in line with analyst estimates, showing that Fortinet is executing in line with expectations. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Fortinet after the latest results.

View our latest analysis for Fortinet

Taking into account the latest results, the current consensus from Fortinet's 40 analysts is for revenues of US$5.78b in 2024. This would reflect a decent 9.0% increase on its revenue over the past 12 months. Statutory earnings per share are expected to shrink 5.7% to US$1.41 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$5.94b and earnings per share (EPS) of US$1.46 in 2024. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the minor downgrade to earnings per share expectations.

What's most unexpected is that the consensus price target rose 21% to US$75.46, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Fortinet at US$90.00 per share, while the most bearish prices it at US$55.11. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Fortinet's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 9.0% growth on an annualised basis. This is compared to a historical growth rate of 23% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 12% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Fortinet.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Fortinet. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Fortinet analysts - going out to 2026, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Fortinet (1 is a bit unpleasant!) that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives