- United States

- /

- Software

- /

- NasdaqGS:PLTR

High Growth Tech Stocks In The US Market With Potential

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a surge, with major indices like the S&P 500 and the small-cap Russell 2000 reaching near-record highs following the Federal Reserve's decision to cut interest rates. This favorable monetary policy environment can create opportunities for high-growth tech stocks, which often thrive in conditions of lower borrowing costs and increased investor optimism. When considering these stocks, it's important to look for companies with strong innovation capabilities and potential to capitalize on emerging technologies within this dynamic economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 27.16% | 29.97% | ★★★★★★ |

| Workday | 11.18% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Viridian Therapeutics | 56.24% | 54.18% | ★★★★★☆ |

| Zscaler | 15.85% | 46.09% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.76% | 116.48% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Protagonist Therapeutics (PTGX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company focused on developing peptide therapeutics for hematology, blood disorders, and inflammatory and immunomodulatory diseases, with a market cap of $5.54 billion.

Operations: Protagonist Therapeutics generates revenue primarily through its biotechnology segment, specifically focusing on startups, with a reported revenue of $209.22 million. The company is engaged in developing peptide therapeutics targeting hematology, blood disorders, and various inflammatory and immunomodulatory diseases.

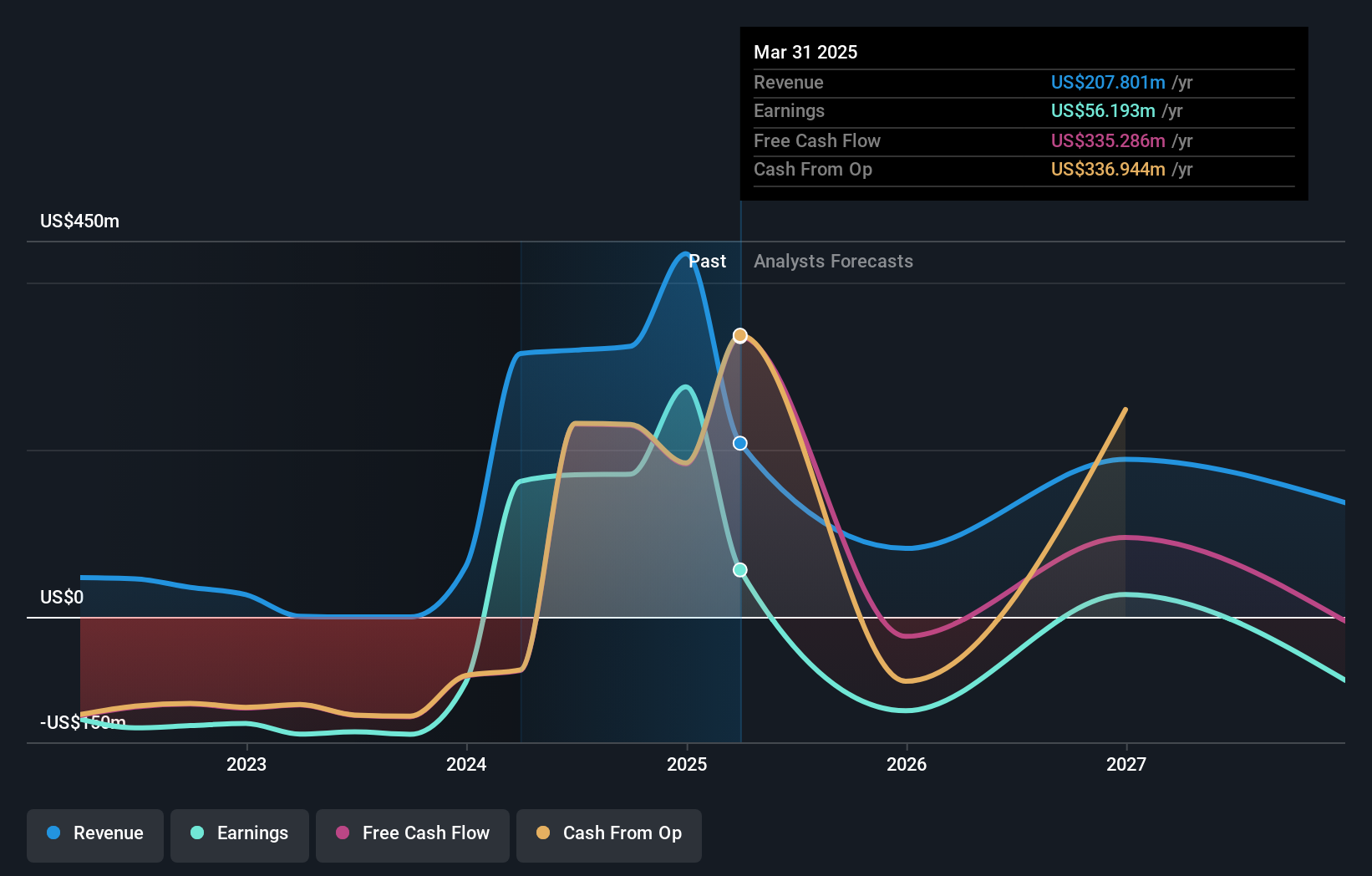

Despite recent setbacks, Protagonist Therapeutics shows promise with an expected annual revenue growth of 24.8% and earnings growth of 44.1%, outpacing the US market averages significantly. The company's recent Phase 3 results for rusfertide in treating polycythemia vera, presented at the ASH Annual Meeting, underscore its potential in hematologic treatments, supported by FDA designations that could expedite its market entry. However, financial challenges persist as evidenced by a net loss increase to $85.77 million from a profit last year in the same period, reflecting ongoing investment into its pipeline amid high R&D expenditures which are crucial for its future success in biotech innovation.

Freshworks (FRSH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Freshworks Inc. is a software development company that offers software-as-a-service products globally, with a market cap of approximately $3.68 billion.

Operations: The company generates revenue primarily from its software and programming segment, which amounted to $810.64 million.

Freshworks, amid a competitive tech landscape, demonstrates robust growth prospects with its revenue forecast to increase by 12.7% annually, outpacing the US market's average of 10.7%. Despite currently being unprofitable, the company is expected to shift towards profitability within three years, reflecting an aggressive growth trajectory underscored by a significant earnings growth projection of 60.35% per year. Recent enhancements in its Freshservice platform leverage AI to streamline IT management—a move that not only addresses efficiency but also positions Freshworks at the forefront of innovation in enterprise software solutions. This strategic focus on integrating advanced technology with user-centric services could significantly influence its market standing and financial health moving forward.

- Navigate through the intricacies of Freshworks with our comprehensive health report here.

Assess Freshworks' past performance with our detailed historical performance reports.

Palantir Technologies (PLTR)

Simply Wall St Growth Rating: ★★★★★★

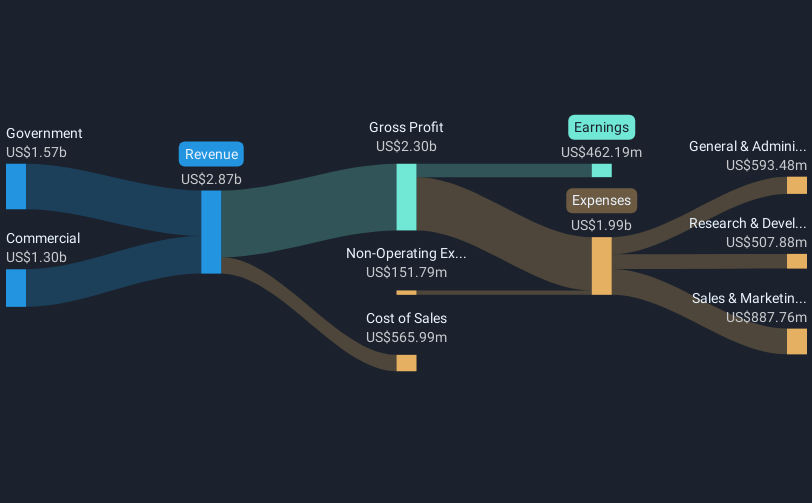

Overview: Palantir Technologies Inc. develops and implements software platforms for intelligence agencies to support counterterrorism efforts globally, with a market cap of $447.87 billion.

Operations: With a market cap of $447.87 billion, Palantir Technologies generates revenue primarily from its Government and Commercial segments, contributing approximately $2.13 billion and $1.77 billion respectively.

Palantir Technologies demonstrates a robust trajectory in the high-growth tech sector, particularly with its recent U.S. Navy partnership to deploy AI across maritime operations, signaling strong government trust and expanding utility in critical national infrastructures. This collaboration underlines Palantir's strategic alignment with significant federal initiatives, potentially enhancing long-term revenue streams and reinforcing its position in tech innovation. Additionally, the company's R&D expenses have been pivotal, amounting to $1.5 billion over the past fiscal year, representing approximately 28% of its total revenue—this substantial investment underscores Palantir’s commitment to advancing AI capabilities and maintaining technological leadership.

- Click here to discover the nuances of Palantir Technologies with our detailed analytical health report.

Gain insights into Palantir Technologies' past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 75 US High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)