- United States

- /

- Software

- /

- NasdaqGM:FIVN

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.2%, yet it remains up by 18% over the past year with earnings expected to grow by 14% per annum in the coming years. In this context, identifying high growth tech stocks involves looking for companies that can leverage technological advancements and maintain robust performance despite short-term market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.79% | 27.57% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Travere Therapeutics | 28.17% | 65.23% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Bitdeer Technologies Group | 51.86% | 122.49% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Five9 (NasdaqGM:FIVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five9, Inc. offers intelligent cloud software solutions for contact centers across the United States, India, and internationally, with a market capitalization of approximately $3.19 billion.

Operations: Five9 generates revenue primarily from its Internet Software & Services segment, amounting to $1.04 billion. The company focuses on providing cloud-based solutions for contact centers globally.

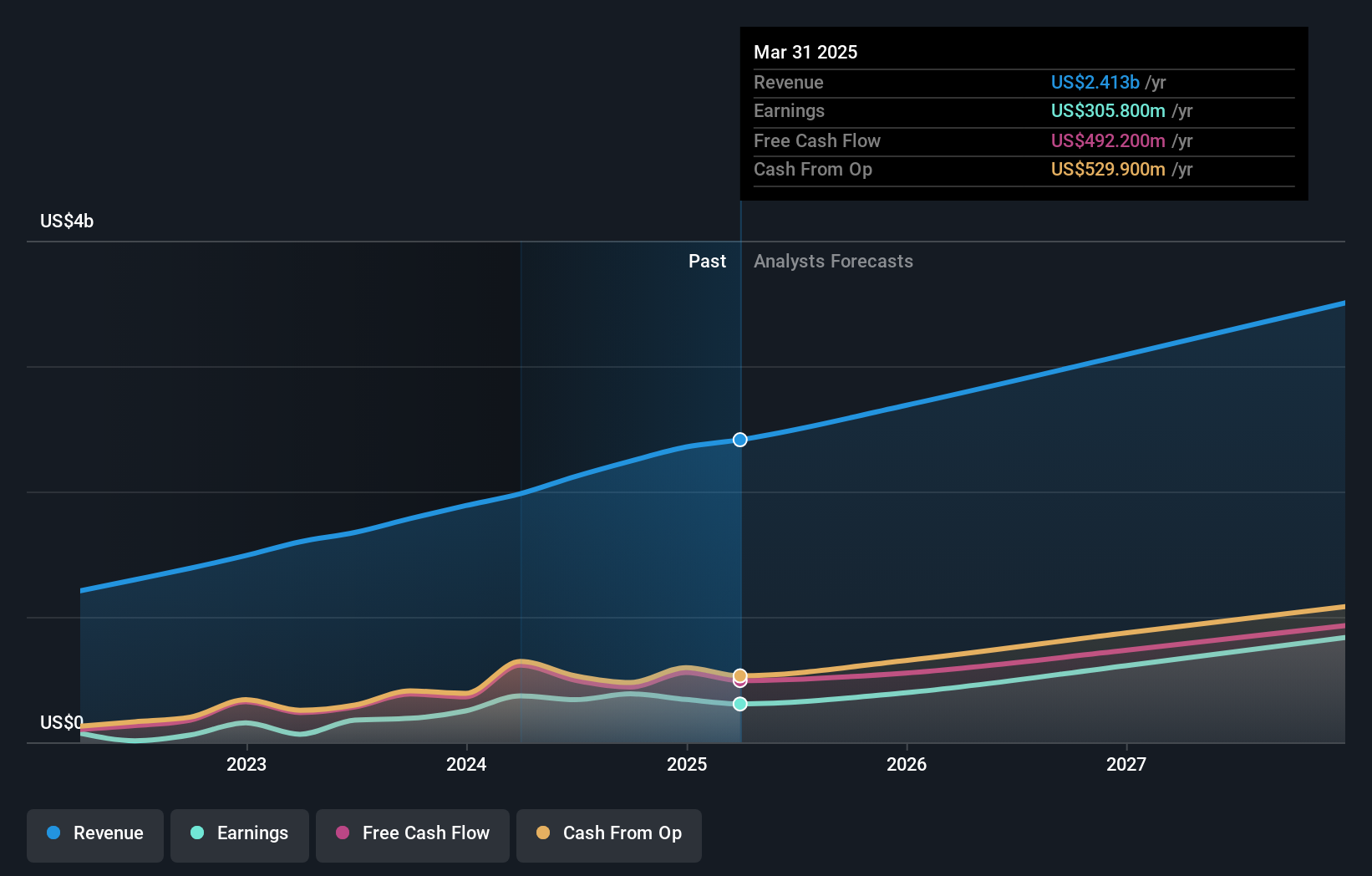

Amid executive transitions, Five9 has shown resilience with a robust forecast, projecting Q1 revenues between $271.5 million and $272.5 million and full-year revenues reaching up to $1.144 billion. The appointment of Bryan Lee as Interim CFO could bring fresh perspectives from his extensive background in finance and technology, potentially enhancing strategic financial planning aligned with Five9's growth objectives. This leadership change follows a solid performance in 2024, where Q4 sales surged to $278.66 million from the previous year's $239.06 million, reflecting a strong market demand for their cloud-based contact solutions integrated with advanced AI capabilities like those recently unveiled on Google Cloud Marketplace—a move that underscores their commitment to expanding innovative customer experience solutions globally.

- Click here and access our complete health analysis report to understand the dynamics of Five9.

Explore historical data to track Five9's performance over time in our Past section.

Neurocrine Biosciences (NasdaqGS:NBIX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Neurocrine Biosciences, Inc. is a company focused on the discovery, development, and marketing of pharmaceuticals targeting neurological, neuroendocrine, and neuropsychiatric disorders globally, with a market cap of $12.03 billion.

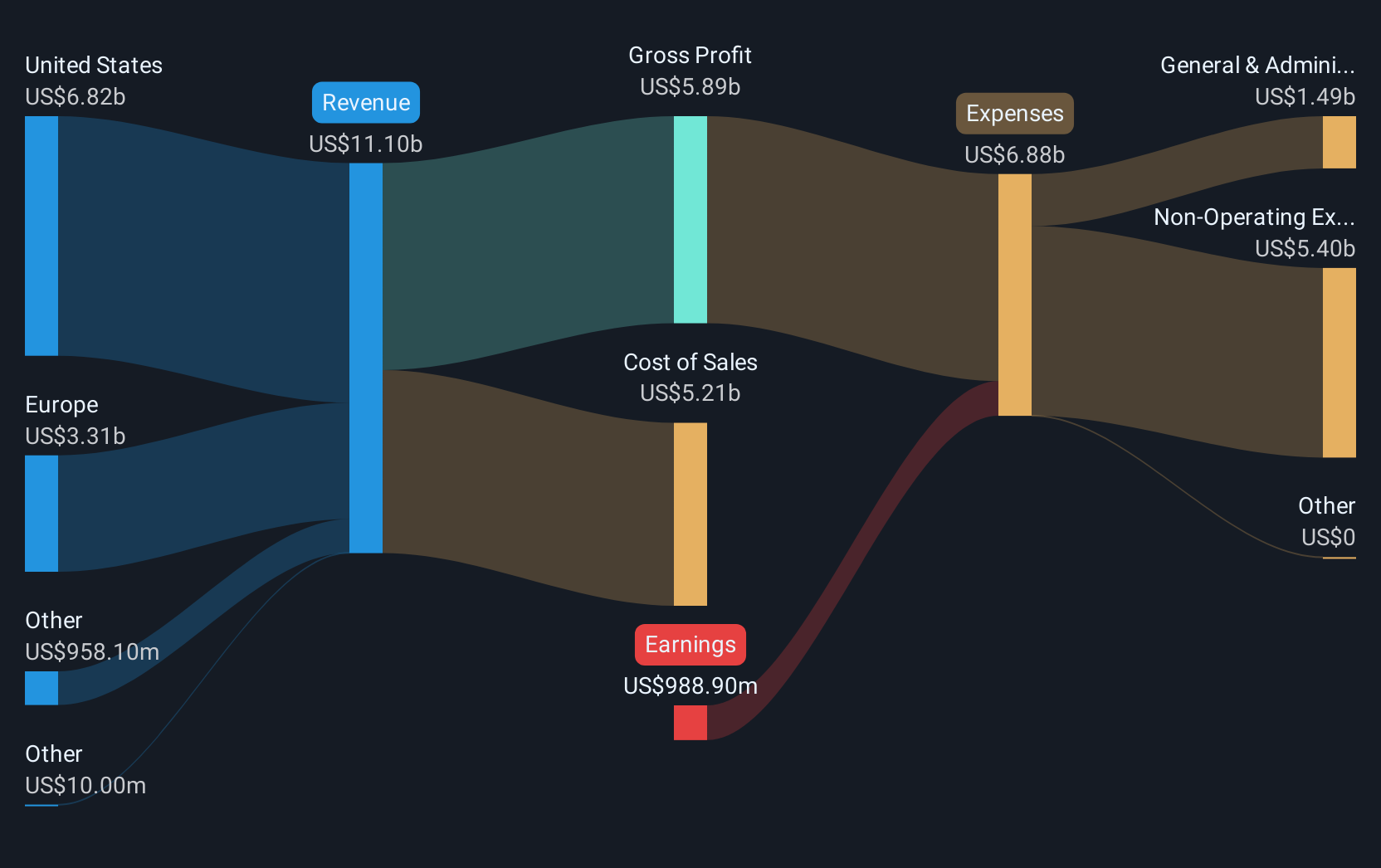

Operations: Neurocrine Biosciences generates revenue primarily from the research, development, and commercialization of pharmaceuticals, amounting to $2.36 billion. The company operates in both domestic and international markets within the pharmaceutical sector.

Neurocrine Biosciences has demonstrated a robust trajectory in its financial and operational performance, notably with a 27.2% projected annual earnings growth and a significant 12.2% expected revenue increase per year. Recently, the company has strategically repurchased shares worth $300 million, enhancing shareholder value amid positive earnings results for 2024 with revenue reaching $2.36 billion, up from $1.89 billion the previous year. This growth is underpinned by promising developments in their R&D pipeline, including advancements in treatments for major depressive disorder and congenital adrenal hyperplasia—areas showing substantial unmet medical needs and potential for market leadership.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $124.35 billion.

Operations: Vertex Pharmaceuticals focuses on developing and commercializing therapies specifically for cystic fibrosis, generating $11.02 billion in revenue from its pharmaceuticals segment.

Vertex Pharmaceuticals has been navigating a challenging landscape with a net loss of $535.6 million in 2024, contrasting sharply with the prior year's profit of $3.62 billion. Despite this setback, the company is poised for recovery, forecasting revenue between $11.75 billion and $12 billion for 2025, buoyed by new product launches like ALYFTREK in cystic fibrosis treatment markets. Recent R&D successes include FDA approval of JOURNAVX for acute pain management, showcasing Vertex's commitment to innovation with potential market leadership in non-opioid pain relief solutions. Additionally, strategic share repurchases totaling $1.62 billion underscore confidence in long-term value creation amidst evolving executive roles aimed at bolstering operational leadership.

Seize The Opportunity

- Dive into all 227 of the US High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives