- United States

- /

- Media

- /

- NYSE:MNTN

Discover Datadog And Two Other Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 14% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $14.91 | $29.21 | 49% |

| Robert Half (RHI) | $42.15 | $82.67 | 49% |

| Rapid7 (RPD) | $22.33 | $43.63 | 48.8% |

| Definitive Healthcare (DH) | $4.02 | $7.84 | 48.7% |

| Carter Bankshares (CARE) | $18.22 | $35.50 | 48.7% |

| Camden National (CAC) | $42.43 | $83.98 | 49.5% |

| BioLife Solutions (BLFS) | $21.42 | $42.44 | 49.5% |

| Atlantic Union Bankshares (AUB) | $33.40 | $65.45 | 49% |

| ACNB (ACNB) | $43.47 | $85.43 | 49.1% |

| Acadia Realty Trust (AKR) | $18.80 | $36.84 | 49% |

Here's a peek at a few of the choices from the screener.

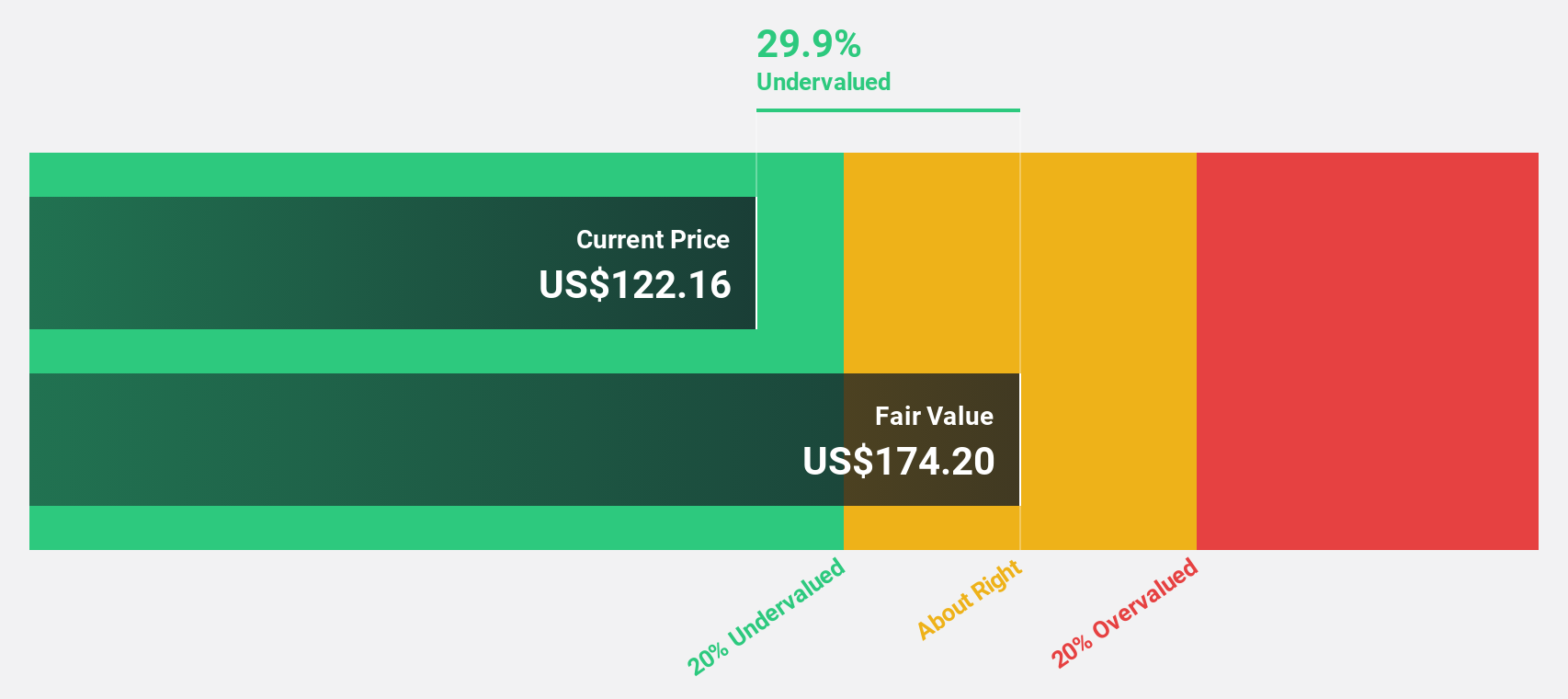

Datadog (DDOG)

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally and has a market cap of approximately $48.13 billion.

Operations: The company's revenue is primarily derived from its IT Infrastructure segment, which generated $2.83 billion.

Estimated Discount To Fair Value: 23.9%

Datadog is trading at US$143.15, significantly below its estimated fair value of US$188.16, suggesting it may be undervalued based on cash flows. Despite recent insider selling, its earnings are projected to grow 24.8% annually, outpacing the broader market's growth rate of 14.9%. Recent index additions and a new integration with Reflectiz enhance Datadog's market visibility and security offerings, potentially supporting future revenue growth above the US market average.

- Our expertly prepared growth report on Datadog implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Datadog with our comprehensive financial health report here.

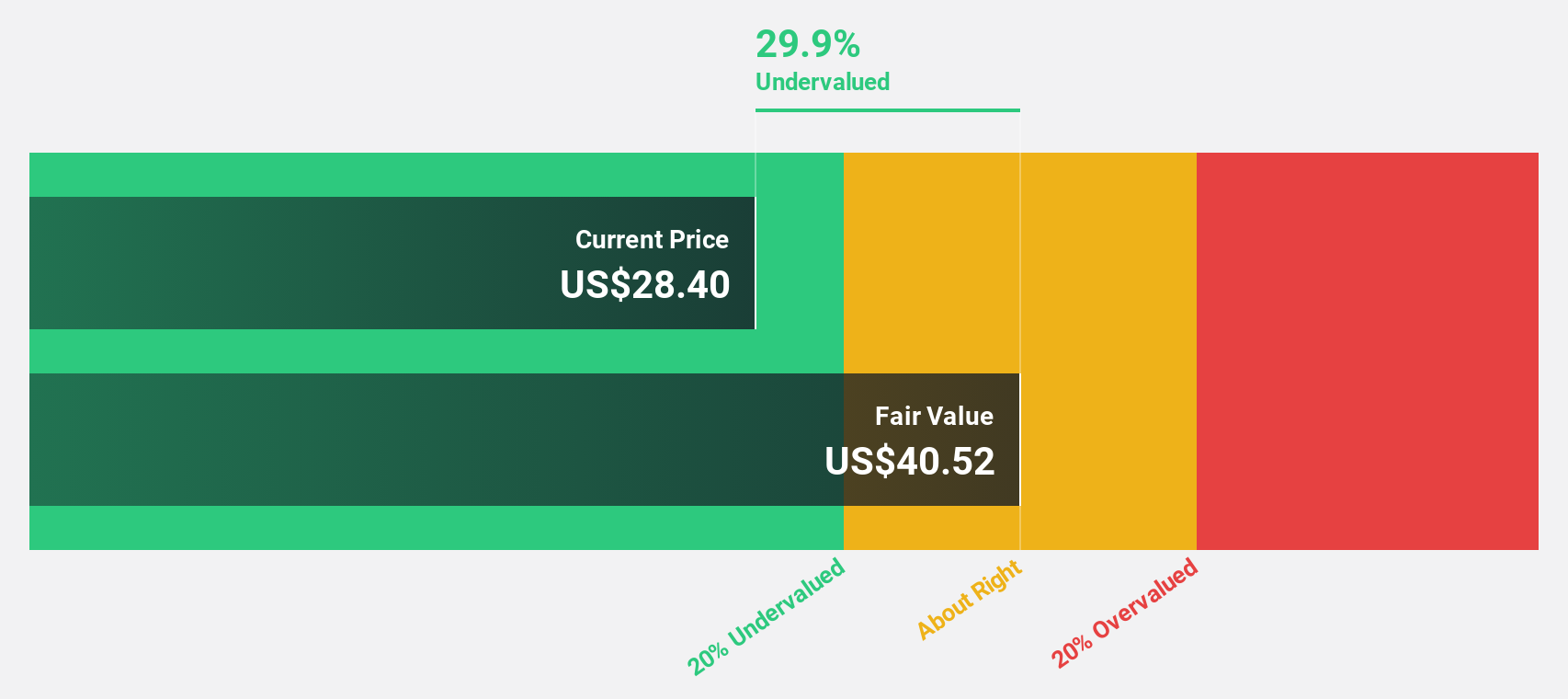

Coupang (CPNG)

Overview: Coupang, Inc. operates a retail business through mobile applications and internet websites in South Korea and internationally, with a market cap of $56.68 billion.

Operations: The company's revenue segments include Product Commerce, generating $27.08 billion, and Developing Offerings, contributing $3.99 billion.

Estimated Discount To Fair Value: 28.3%

Coupang, trading at US$31.15, is undervalued with an estimated fair value of US$43.45, based on cash flows. Earnings are expected to grow significantly at 39.3% annually, surpassing the market rate of 14.9%. Despite insider selling and a decline in profit margins from last year, Coupang's recent US$1 billion share buyback plan and a new US$1.5 billion revolving credit facility enhance its financial flexibility for future growth initiatives.

- Insights from our recent growth report point to a promising forecast for Coupang's business outlook.

- Dive into the specifics of Coupang here with our thorough financial health report.

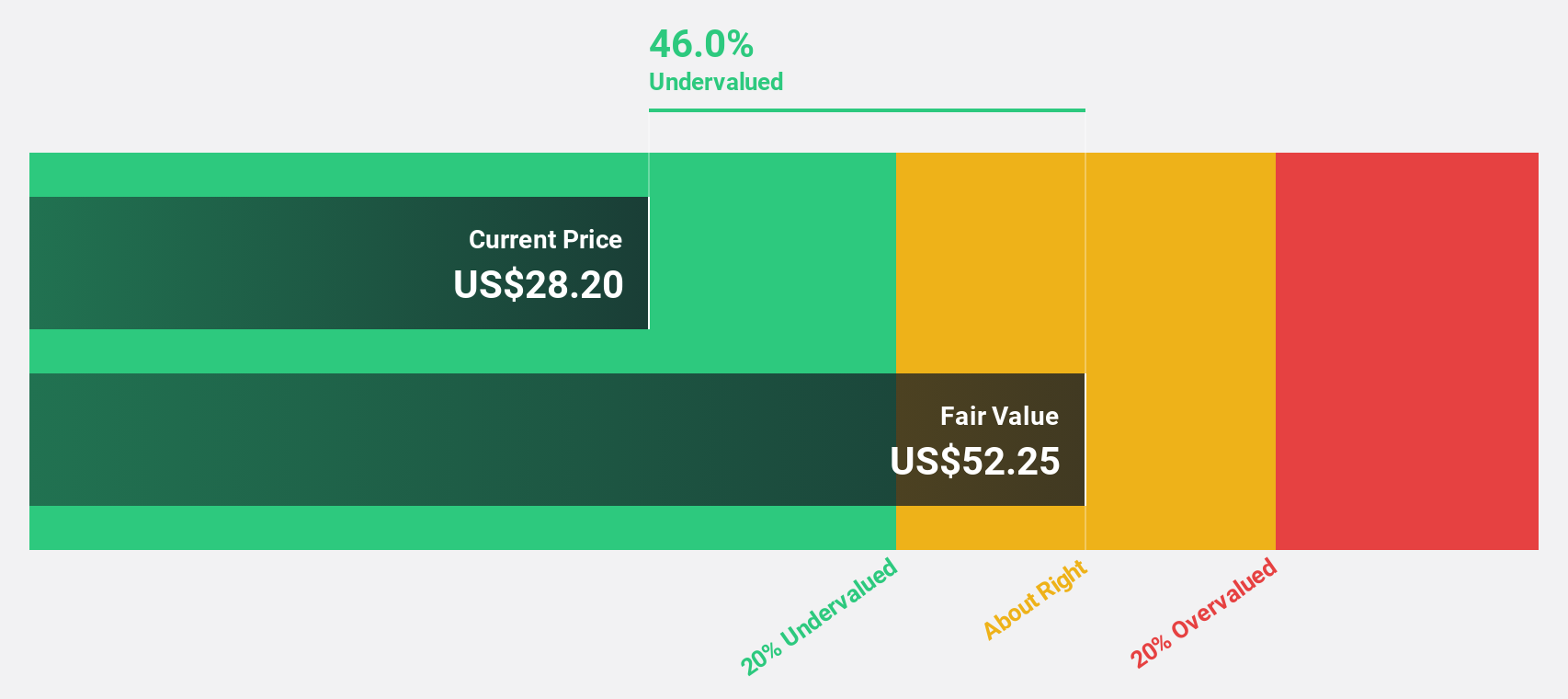

MNTN (MNTN)

Overview: MNTN, Inc. is a performance TV software company offering advertising services in the United States with a market cap of approximately $1.95 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $246.27 million.

Estimated Discount To Fair Value: 46.6%

MNTN, trading at US$27.84, is significantly undervalued with a fair value estimate of US$52.13 based on discounted cash flows. Despite recent insider selling and high share price volatility, MNTN's strategic partnership with ZoomInfo opens access to a lucrative $39 billion advertising market. The company is expected to achieve profitability within three years, with forecasted earnings growth of 74.53% annually and a very high projected return on equity in three years' time (62.3%).

- Our comprehensive growth report raises the possibility that MNTN is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of MNTN.

Turning Ideas Into Actions

- Reveal the 170 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNTN

MNTN

Operates a technology platform that brings performance marketing to Connected TV.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)