- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox (DBX) Valuation in Focus as Wall Street Flags Growth and Efficiency Concerns

Reviewed by Simply Wall St

Dropbox (DBX) is back in the spotlight after fresh commentary from Wall Street pointed to concerns over slowing sales growth and questions around the company’s efficiency. These discussions are shaping investor sentiment and putting Dropbox’s strategy under closer scrutiny.

See our latest analysis for Dropbox.

Dropbox’s share price has drifted modestly this year, recently closing at $29.27. However, the 12-month total shareholder return of 13.5% indicates there is still solid momentum for long-term holders. Sentiment remains in flux as investors weigh Wall Street’s recent doubts against Dropbox’s longer-term gains, which remain well ahead of the S&P 500 over three and five years.

If you’re exploring beyond the usual tech names, now is the perfect moment to discover fast growing stocks with high insider ownership and see which other stocks are catching investor interest right now.

With shares trading just below the average analyst price target and growth concerns driving recent headlines, investors must ask themselves if Dropbox is undervalued at these levels or if the market has already factored in its prospects for the future.

Most Popular Narrative: 4% Overvalued

Dropbox's last close at $29.27 sits just above the fair value of $28.12 projected in the most followed narrative, highlighting a narrow gap that puts future assumptions under the microscope.

Ongoing investments in onboarding improvements, streamlined product experiences, and personalized retention (e.g., cancellation flow redesign, Simple plan targeting mobile-first consumers) are already reducing churn and increasing user engagement. This sets the stage for greater user retention and potential user base growth, positively impacting revenue stability and reducing customer acquisition costs.

Earnings projections, margin trajectory, and even share count changes are the secret ingredients behind the narrative’s fair value. What bold moves, hidden trends, or future shocks do analysts believe will make Dropbox worth this price in a changing tech landscape? Unpack the numbers that keep the narrative valuation just out of reach.

Result: Fair Value of $28.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in revenue and increased pressure from competitors could challenge Dropbox’s growth story and shift sentiment for investors as time progresses.

Find out about the key risks to this Dropbox narrative.

Another View: Stepping Back from the Price Tag

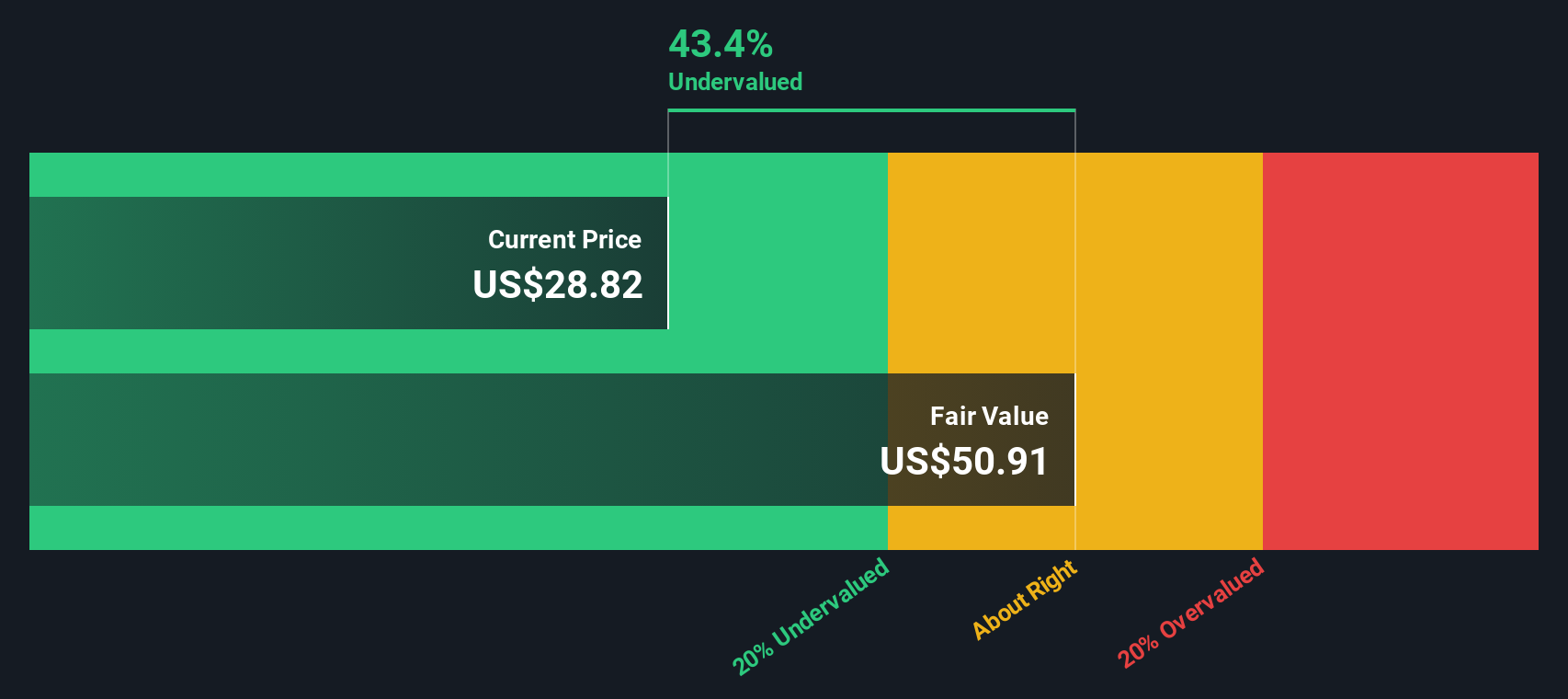

Looking at Dropbox through our SWS DCF model, a different picture emerges. The DCF valuation puts fair value at $51.50, which suggests Dropbox is significantly undervalued at current prices. When two methods see things so differently, which one should you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dropbox Narrative

If the numbers or prevailing opinions don't quite fit your view, it takes less than three minutes to dive in and shape your own perspective. Do it your way.

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next great opportunity slip by. With the right tools, you can target hidden gems and themes shaping tomorrow’s markets. Let’s get you ahead of the curve.

- Capture potential high yields by reviewing these 17 dividend stocks with yields > 3% with strong payouts above 3%, setting your portfolio up for reliable passive income.

- Capitalize on emerging artificial intelligence trends by backing your conviction with these 26 AI penny stocks at the forefront of machine learning and automation breakthroughs.

- Uncover undervalued contenders by reviewing these 875 undervalued stocks based on cash flows and give yourself an edge finding companies trading below their intrinsic worth today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)