- United States

- /

- IT

- /

- NasdaqGS:CTSH

Cognizant Technology Solutions (NasdaqGS:CTSH) Launches AI-Driven Contact Center With Google Cloud

Reviewed by Simply Wall St

Cognizant Technology Solutions (NasdaqGS:CTSH) recently partnered with Google Cloud to release the Cognizant® Autonomous Customer Engagement solution, an AI-driven platform aimed at transforming customer interactions. Although the company's stock price saw minimal change over the last quarter, several key events could have influenced its stability. These include Cognizant's open-sourcing of its Neuro AI Multi-Agent Accelerator and expanded collaboration with Pegasystems, potentially underscoring its commitment to AI and cloud innovations. The market exhibited volatility due to geopolitical tensions and interest rate anticipations, yet index trends suggest a generally stable environment.

The recent collaboration between Cognizant Technology Solutions and Google Cloud could significantly influence its ongoing focus on AI-driven innovations and customer engagement solutions. Alongside its open-sourcing initiative and expanded partnership with Pegasystems, these developments could enhance the company's capacity to optimize operations and potentially support revenue growth by attracting high-value, innovation-led deals. Such strategic moves are aimed at bolstering Cognizant's competitive positioning and may offer added value in terms of cost optimization and talent development.

Examining Cognizant's longer-term performance, the company's total return, encompassing both share price appreciation and dividends, was 55.61% over a five-year span from 18 June 2020 to today. While this highlights a substantial gain, Cognizant's performance over the past year showed a different trajectory, underperforming the US IT industry which returned 38.8%. However, over the same one-year period, the company surpassed the US market's 10.9% return.

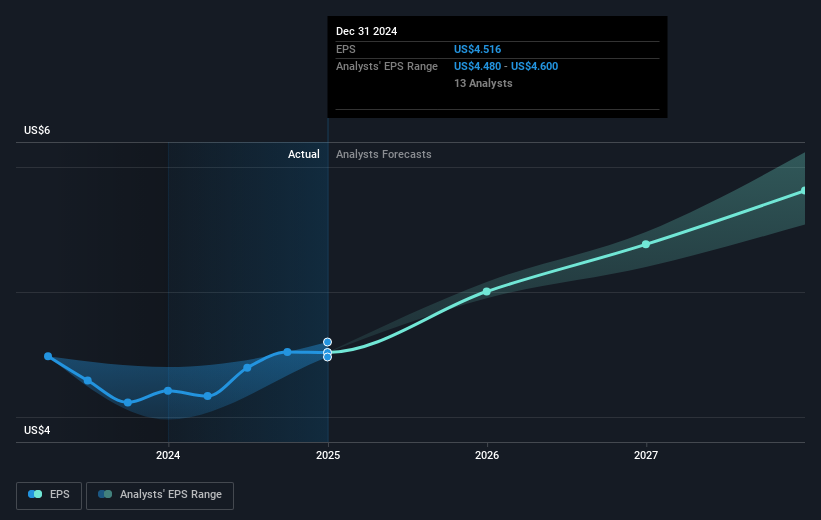

The news of Cognizant’s technological advancements and partnerships could exert a positive impact on future revenue and earnings forecasts, provided that these initiatives translate into successful customer engagements and contracts. Analysts currently hold a consensus price target of US$86.55, indicating a potential upside of 10.3% from the current share price of US$77.64. This illustrates market anticipation of value in Cognizant's forward trajectory, driven by its continued investments in AI and strategic collaborations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)