- United States

- /

- Software

- /

- NasdaqGS:CRWD

Does CrowdStrike Still Have Room to Grow After Its 54% Price Surge in 2025?

Reviewed by Simply Wall St

If you own shares of CrowdStrike Holdings or are weighing whether now is the time to jump in, you’re in good company. After all, this stock has been riding an impressive wave, with the price recently closing at $414.06 and notching a remarkable 54.7% return over the last year. That is not even counting its notable longer-term performance, where returns reach 104% over three years and 253.5% since its public debut five years ago.

So, what is fueling all this momentum? For starters, CrowdStrike’s leadership in cybersecurity has kept it at the forefront as demand for cloud-based protection increases, especially as businesses become more focused on digital threats. Recent market developments and high-profile attacks have further highlighted the need for robust security solutions, and investors have taken note of this trend.

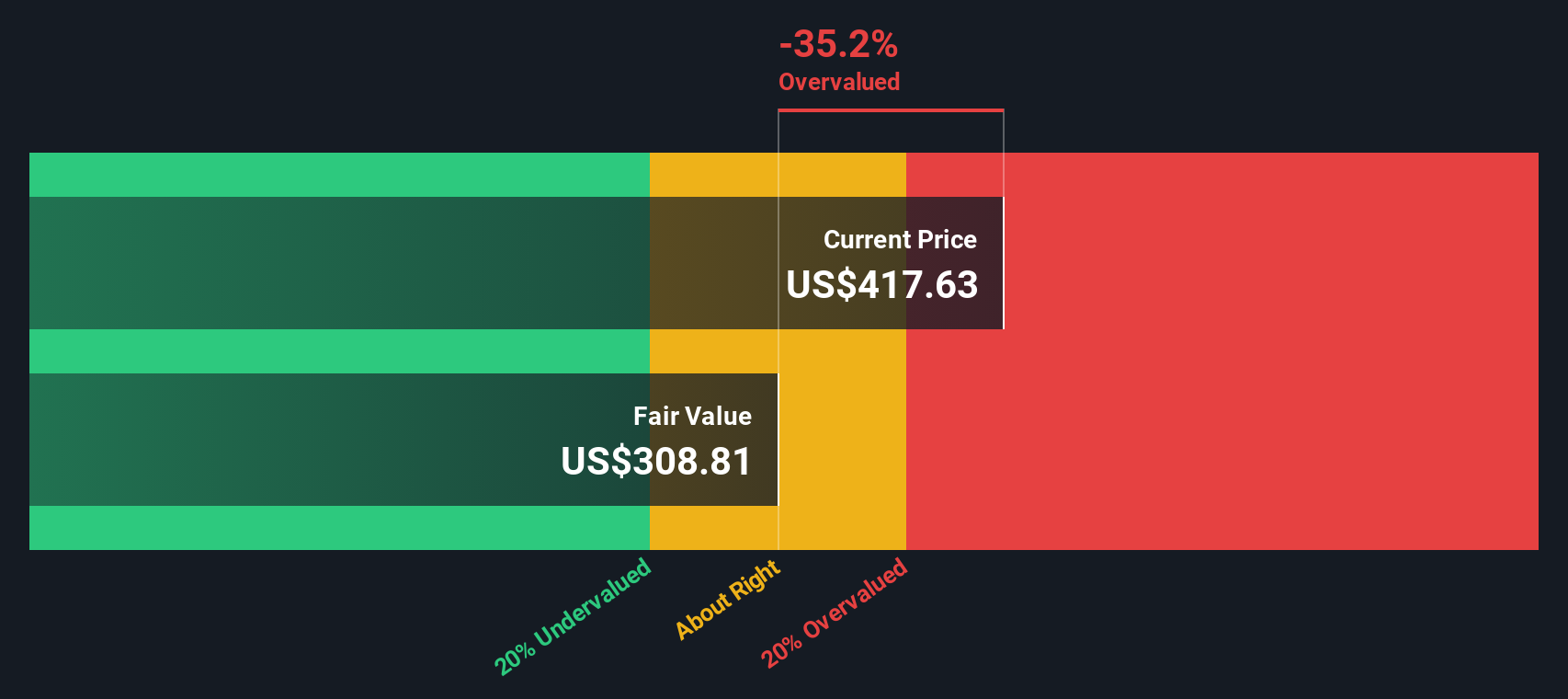

Of course, the question now is whether these price gains still leave any room for further growth, or if the stock is becoming overvalued. According to standard valuation checks, CrowdStrike currently scores a 0 out of 6 when it comes to undervaluation signals. In other words, not a single major metric currently indicates that CRWD is undervalued.

Before you make your next move, let’s break down those valuation approaches and what they really mean. There is more nuance here than you might think. Keep reading, as at the end, you will find an approach to analyzing CrowdStrike’s value that goes beyond the usual numbers.

Approach 1: CrowdStrike Holdings Cash Flows

A Discounted Cash Flow (DCF) model tries to estimate a company's intrinsic value by projecting its future free cash flows and then discounting those amounts back to today’s dollars. This process essentially tells us what those future profits are worth in present terms.

CrowdStrike Holdings currently generates Free Cash Flow of about $1.0 billion, with analysts projecting it could grow rapidly to reach roughly $4.0 billion by 2030. These projections are based on a range of analyst forecasts and longer-term estimates, reflecting steady growth over the next 10 years.

Based on this approach, the model arrives at an estimated fair value for CrowdStrike shares of $341.46. However, the DCF calculation shows the stock is currently approximately 22.8% overvalued compared to this intrinsic value. This means the market price is notably higher than what future cash flows alone might justify, according to this specific estimate.

Result: OVERVALUED

Our DCF analysis suggests CrowdStrike Holdings may be overvalued by 22.8%. Find undervalued stocks based on DCF analysis or create your own screener to find better value opportunities.

Approach 2: CrowdStrike Holdings Price vs Sales

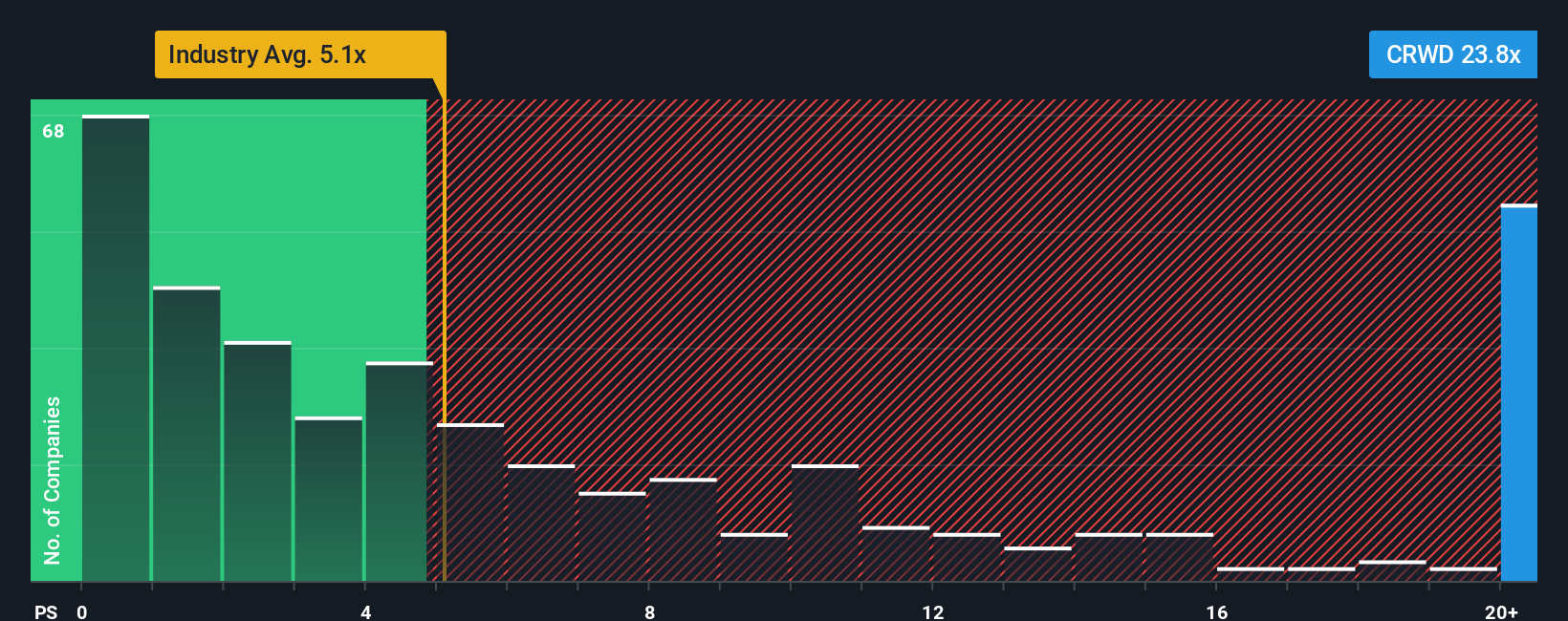

The Price-to-Sales (P/S) ratio is a popular metric for valuing growth companies like CrowdStrike Holdings, especially when they are investing aggressively in expansion and may have inconsistent profitability. The P/S multiple is particularly relevant for companies with strong revenue growth but limited earnings, as it offers a way to compare their valuation to peers and the broader industry based on current sales rather than net profit.

An appropriate P/S ratio is not fixed; it shifts based on how quickly a company is growing and how much risk investors are willing to accept for future results. Higher expected sales growth or a more dominant market position can often justify a higher multiple, while increased risk or competitive pressures might lower it.

CrowdStrike trades at a Price-to-Sales ratio of 25.26x, which is considerably higher than both the Software industry average of 4.84x and the peer group average of 13.76x. According to Simply Wall St’s proprietary Fair Ratio calculation, which considers factors like CrowdStrike’s revenue growth rate, profit margins, industry trends, and risk profile, a more appropriate P/S multiple would be 17.00x. This indicates that CrowdStrike is currently trading above what its fundamentals and market context justify, suggesting investors may be paying a substantial growth premium.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

Beyond the traditional numbers, investors are increasingly using Narratives , which offer a clear, story-driven view that links their expectations about CrowdStrike Holdings’ future prospects to financial forecasts and ultimately to a fair value.

A Narrative is your way of expressing the story you see unfolding for a company. It combines your assumptions on future revenue, earnings, margins, and risks into a single, understandable perspective. This approach helps you connect what is happening in the business and the wider industry to a projected financial outcome, making your investment decisions both personal and informed.

On platforms like Simply Wall St, Narratives are accessible and dynamic. They are updated automatically as new news or earnings arrive, and you can compare your story to those of millions of other investors. Narratives provide a practical decision-making tool, allowing you to immediately see when the Fair Value from your outlook is above or below today’s price, making it easier to choose when to buy, hold, or sell.

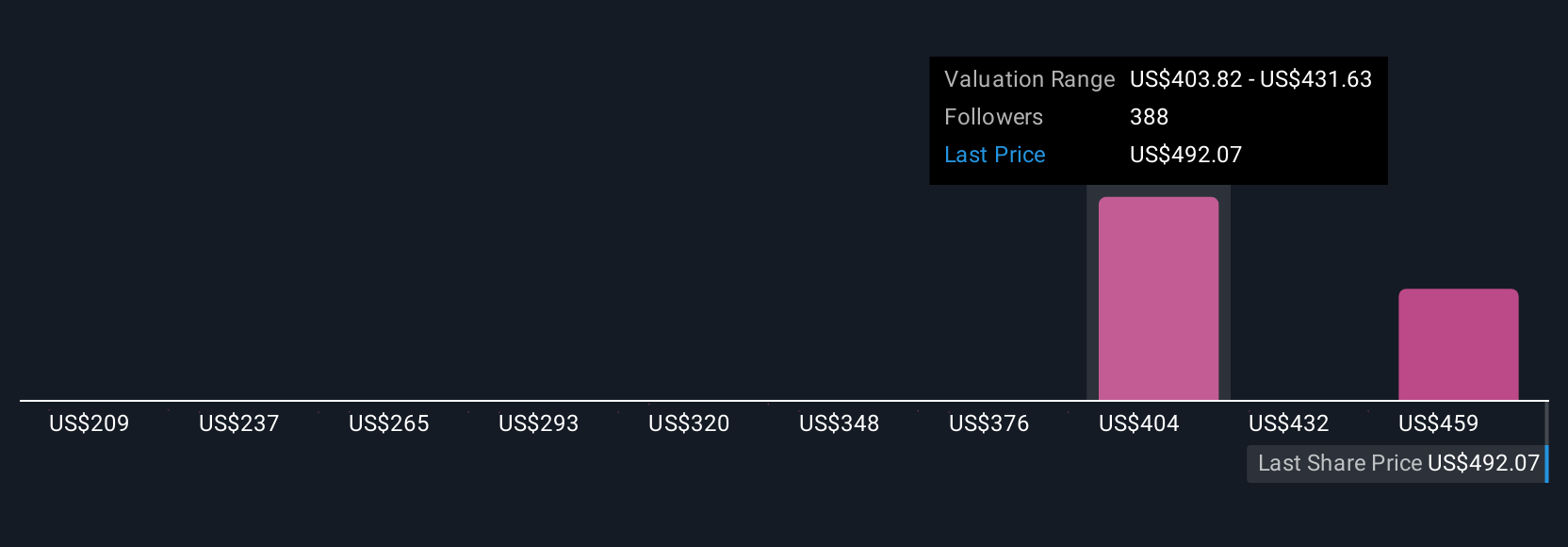

For example, some investors currently see CrowdStrike’s fair value as low as $113, emphasizing competitive risks and conservative growth. Others estimate it as high as $610, reflecting rapid innovation and growing demand. Your Narrative can help you determine where you stand along this spectrum.

For CrowdStrike Holdings, we’ll make it really easy for you with previews of two leading CrowdStrike Holdings Narratives:

🐂 CrowdStrike Holdings Bull Case

Fair Value: $431.24

23% undervalued (based on current price of $419.17)

Projected Revenue Growth Rate: 18%

- Highlights a flexible, cloud-based platform (Falcon) with a diverse and expanding suite of interconnected modules. This is driving strong customer adoption and recurring revenue.

- Emphasizes healthy financials, including more equity than debt, rising ROE, and ambitious targets for ARR growth to $10B by 2031.

- Argues that recent operational setbacks have not dented growth prospects and projects a 10% annual return at current prices based on robust free cash flow projections.

🐻 CrowdStrike Holdings Bear Case

Fair Value: $324.30

29% overvalued (based on current price of $419.17)

Projected Revenue Growth Rate: 25.01%

- Sees strong topline expansion and sector tailwinds but flags a high valuation multiple and intense competition from both incumbents and new entrants.

- Warns that market saturation, execution risks, and dependency on ongoing cloud adoption could threaten future growth and margins.

- Notes that current and projected P/E ratios are extremely elevated, suggesting the share price may be running ahead of realistic long-term expectations.

Do you think there's more to the story for CrowdStrike Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives