- United States

- /

- Software

- /

- NasdaqGS:CRNC

Shareholders in Cerence (NASDAQ:CRNC) have lost 90%, as stock drops 18% this past week

Cerence Inc. (NASDAQ:CRNC) shareholders will doubtless be very grateful to see the share price up 202% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 90% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Cerence has shed US$68m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Cerence

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

We know that Cerence has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

We think that the revenue decline over three years, at a rate of 4.9% per year, probably had some shareholders looking to sell. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

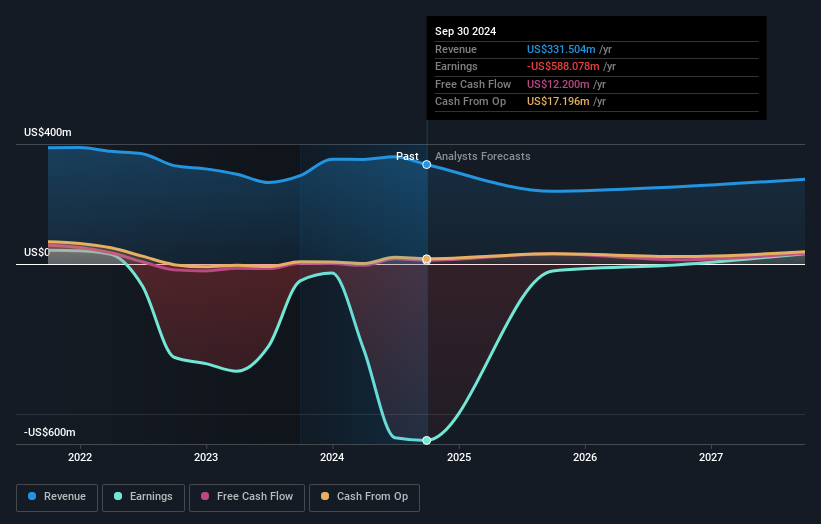

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 30% in the last year, Cerence shareholders lost 58%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Cerence better, we need to consider many other factors. Take risks, for example - Cerence has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNC

Cerence

Provides AI powered virtual assistants for the mobility/transportation market in the United States, rest of the Americas, Germany, rest of Europe, the Middle East, Africa, Japan, and rest of the Asia-Pacific.

Undervalued with moderate growth potential.