- United States

- /

- Software

- /

- NasdaqGS:CRNC

Cerence (NasdaqGS:CRNC) Stock Soars 44% Despite Disappointing Q1 Earnings

Reviewed by Simply Wall St

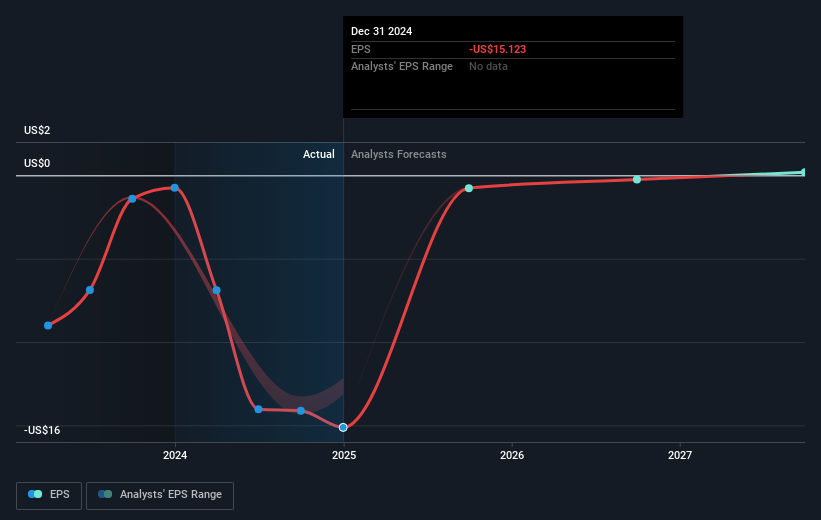

Cerence (NasdaqGS:CRNC) reported disappointing earnings for Q1 2025, revealing declines in both revenue and net income. Despite this, the company's stock rose 44% over the last quarter. Key events, such as the strategic partnership with Mapbox and an enhanced collaboration with NVIDIA, may have bolstered investor confidence regarding future growth prospects. Cerence's Q2 guidance, predicting a revenue increase to $74-77 million, could also have positively influenced market sentiment. Amid a broader market slump where major indices and stocks, like Tesla and Nvidia, experienced declining performance due to concerns about tariffs and economic uncertainty, Cerence’s position and guidance contrastingly suggested resilience and optimism about its innovative technology offerings. Combined with the ongoing amendments to its corporate governance structure to mitigate liability, these factors likely contributed to a significant positive movement in Cerence's stock amidst a volatile economic landscape.

Unlock comprehensive insights into our analysis of Cerence stock here.

Despite more recent positive news for Cerence Inc. (NasdaqGS: CRNC), over the past year, the company's total shareholder return has been a decline of 29.44%. This performance lags behind the broader US market, which returned 15.3% and the US Software industry with a return of 4.4% over the same period. Cerence's financial challenges have been evident, with significant declines in revenue and increasing net losses, as reflected in its Q1 2025 earnings report, showing revenue at US$50.9 million and a net loss of US$24.29 million.

Amidst these challenges, the company has pursued growth through key partnerships, including alliances with Jaguar Land Rover and Audi announced in 2024, using Cerence's AI capabilities. Leadership changes, such as appointing Brian Krzanich as CEO and the launch of new AI products, underscore efforts to pivot towards innovation in the automotive sector while managing unprofitability and volatile share performance.

- See whether Cerence's current market price aligns with its intrinsic value in our detailed report

- Assess the downside scenarios for Cerence with our risk evaluation.

- Are you invested in Cerence already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNC

Cerence

Provides AI powered virtual assistants for the mobility/transportation market in the United States, rest of the Americas, Germany, rest of Europe, the Middle East, Africa, Japan, and rest of the Asia-Pacific.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives