- United States

- /

- IT

- /

- NYSE:DAVA

Top US Growth Companies With High Insider Ownership November 2024

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs fueled by a post-election rally, investor optimism is buoyed by recent political developments and favorable monetary policy. In such an environment, growth companies with high insider ownership are of particular interest, as they often signal strong confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| New Fortress Energy (NasdaqGS:NFE) | 32.6% | 83% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

We're going to check out a few of the best picks from our screener tool.

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc. develops and operates industrial-scale bitcoin mining data centers in the United States, with a market cap of $2.49 billion.

Operations: The company's revenue is derived from data processing, totaling $152.47 million.

Insider Ownership: 16.9%

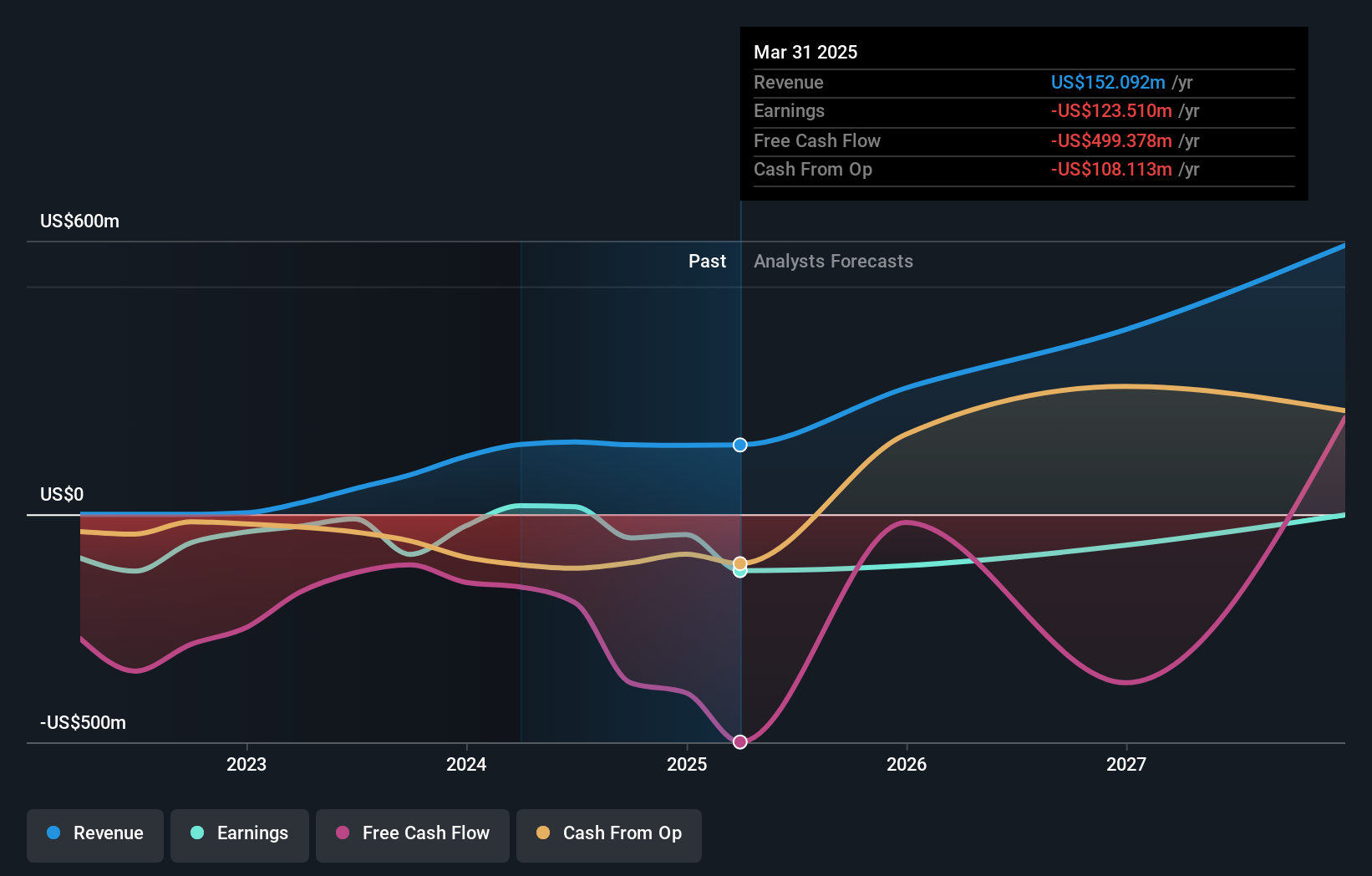

Cipher Mining is experiencing substantial revenue growth, forecasted at 56% annually, outpacing the US market. Despite a volatile share price and past shareholder dilution, the company is expected to become profitable within three years with earnings projected to grow significantly. Recent expansions include strategic acquisitions of sites totaling 2.5 GW capacity for future development. However, it faces financial challenges with less than one year of cash runway and reported significant net losses in recent quarters.

- Navigate through the intricacies of Cipher Mining with our comprehensive analyst estimates report here.

- Our valuation report here indicates Cipher Mining may be undervalued.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally with a market cap of $7.97 billion.

Operations: The company generates revenue from its semiconductors segment, amounting to $217.59 million.

Insider Ownership: 13.9%

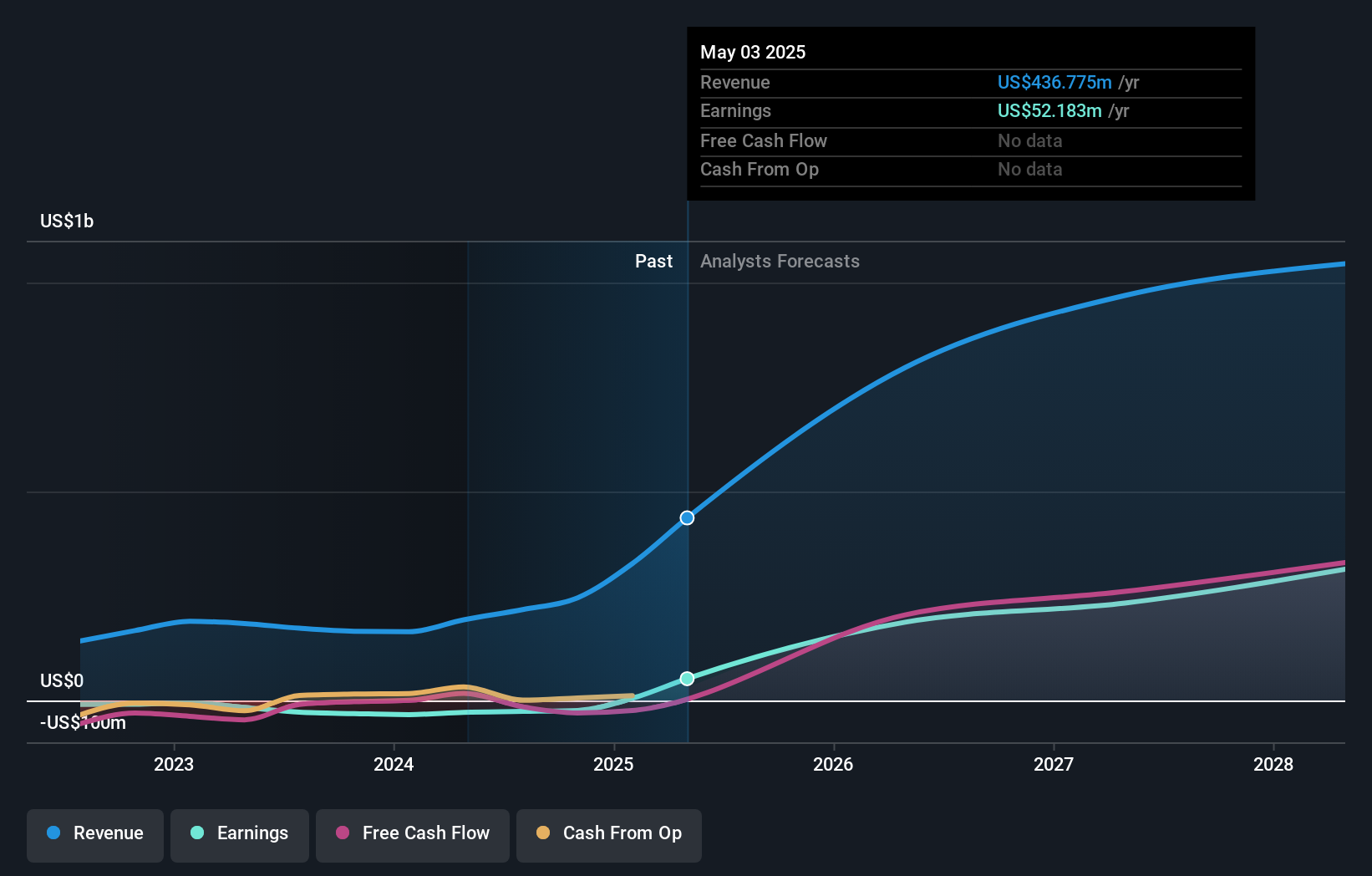

Credo Technology Group Holding is projected to achieve significant revenue growth of 32.8% annually, surpassing the US market average. Despite high share price volatility and recent shareholder dilution, the company is expected to become profitable within three years, with earnings forecasted to grow by 95% annually. Recent product announcements include advanced retimers and cables for AI networks, showcasing innovation in their offerings. However, substantial insider selling has been reported over the past quarter.

- Take a closer look at Credo Technology Group Holding's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Credo Technology Group Holding is priced higher than what may be justified by its financials.

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc, along with its subsidiaries, offers technology services across North America, Europe, the United Kingdom, and internationally with a market cap of approximately $1.56 billion.

Operations: The company's revenue is primarily derived from its Computer Services segment, which generated £740.76 million.

Insider Ownership: 22.1%

Endava is forecasted to achieve significant earnings growth of 34.9% annually, outpacing the US market. However, recent financial results show a decline in net income from £94.16 million to £17.12 million year-over-year, with profit margins dropping from 11.8% to 2.3%. Despite trading below estimated fair value and expecting revenue growth of up to 11.5%, legal challenges could impact investor sentiment due to an ongoing securities class action lawsuit.

- Click to explore a detailed breakdown of our findings in Endava's earnings growth report.

- Our valuation report unveils the possibility Endava's shares may be trading at a premium.

Summing It All Up

- Reveal the 201 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Endava might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAVA

Endava

Provides technology services in North America, Europe, the United Kingdom, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)