Stock Analysis

- United States

- /

- Auto

- /

- NYSE:XPEV

Exploring Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the S&P 500 continues to set records, reflecting a robust appetite for equities amid fluctuating global markets, investors are increasingly focused on the fundamentals that drive long-term value. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially leading to more sustainable company performance in these volatile times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 26% | 21% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.4% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

| Li Auto (NasdaqGS:LI) | 29.3% | 23% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| EHang Holdings (NasdaqGM:EH) | 33% | 104.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| ZKH Group (NYSE:ZKH) | 17.7% | 98.2% |

| BBB Foods (NYSE:TBBB) | 23.6% | 77.5% |

Here we highlight a subset of our preferred stocks from the screener.

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc. operates industrial-scale bitcoin mining data centers in the United States and has a market capitalization of approximately $1.24 billion.

Operations: The company generates its revenue primarily from software and programming, amounting to $153.08 million.

Insider Ownership: 18.5%

Cipher Mining has shown a robust turnaround, reporting a first-quarter net income of US$39.9 million in 2024, a significant improvement from a net loss the previous year. Sales more than doubled to US$48.14 million. Despite high revenue growth forecasts and earnings expected to outpace the market, the stock trades well below its estimated fair value. However, shareholder dilution occurred over the past year and share price volatility remains high, posing risks alongside its growth trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Cipher Mining.

- The analysis detailed in our Cipher Mining valuation report hints at an deflated share price compared to its estimated value.

Waterdrop (NYSE:WDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in the People’s Republic of China, connecting users with insurance products provided by various insurers, and has a market capitalization of approximately $468.55 million.

Operations: The company generates revenue primarily from insurance brokerage services, totaling CN¥2.34 billion, and also from crowdfunding activities amounting to CN¥162.68 million.

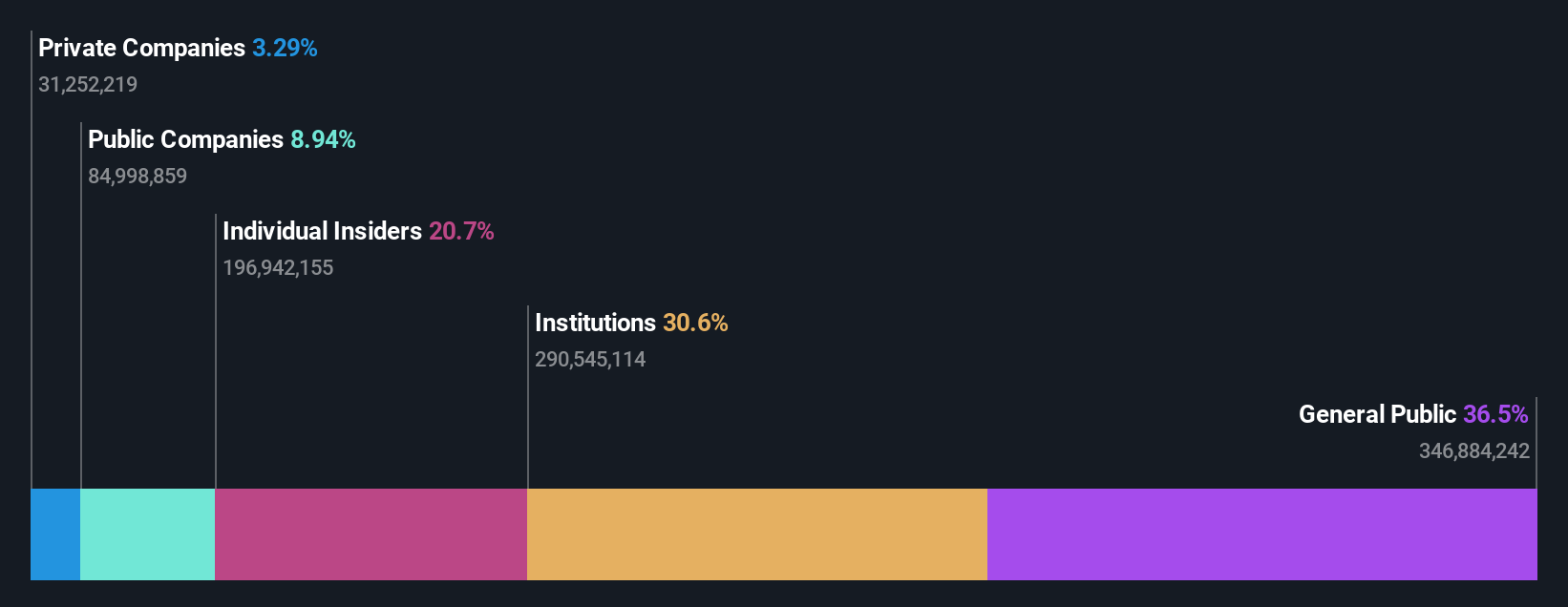

Insider Ownership: 21.7%

Waterdrop is poised for significant earnings growth, with projections indicating an annual increase of 37.7%, substantially outpacing the US market average. Despite this, its return on equity is expected to remain low at 6.8%. Recent events include the resignation of a key executive and a special dividend announcement, alongside a decrease in net profit margins from last year, reflecting potential challenges in maintaining profitability levels amidst its growth trajectory.

- Get an in-depth perspective on Waterdrop's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Waterdrop is trading beyond its estimated value.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company based in the People's Republic of China that designs, develops, manufactures, and markets smart electric vehicles (EVs), with a market capitalization of approximately $8.27 billion.

Operations: The company generates its revenue primarily through the design, development, manufacturing, and marketing of smart electric vehicles in China.

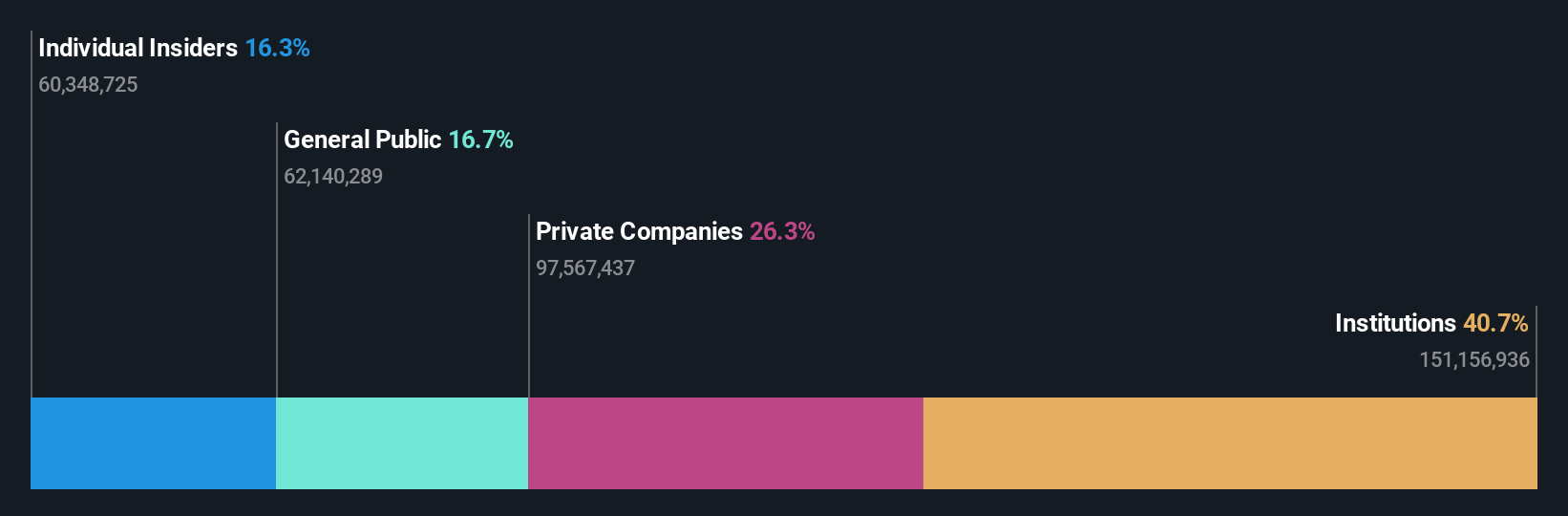

Insider Ownership: 23.4%

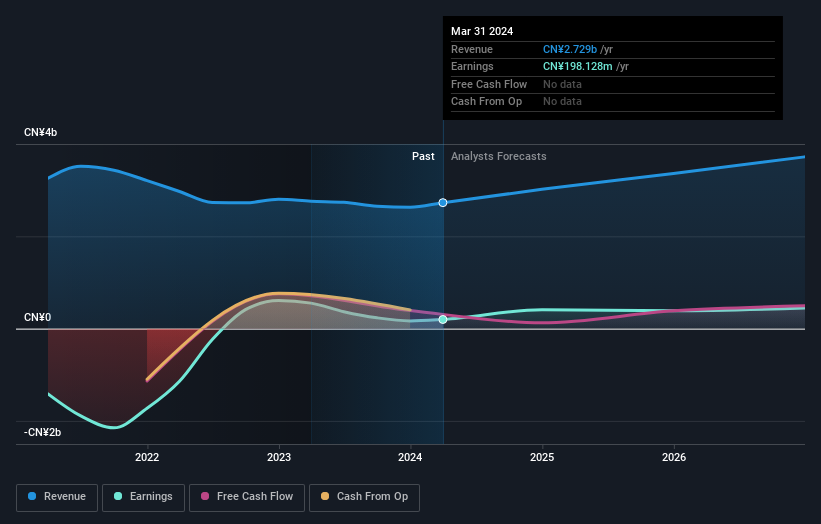

XPeng, a growth-focused electric vehicle company with substantial insider ownership, reported a narrowed net loss of CNY 1.37 billion in Q1 2024 from CNY 2.34 billion the previous year, on revenues of CNY 6.55 billion. The firm is enhancing its market position through technological advancements such as the rollout of its AI-driven Tianji in-car OS across all models, aiming to significantly boost smart driving capabilities and user experience. Despite these innovations and revenue growth, XPeng faces challenges like high volatility in share price and recent shareholder dilution which could affect investor confidence.

- Take a closer look at XPeng's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of XPeng shares in the market.

Turning Ideas Into Actions

- Unlock our comprehensive list of 181 Fast Growing US Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether XPeng is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential and good value.