Quote of the Week: “We’ve got an overall test, which is greater confidence that inflation is moving down to 2% on a sustainable basis. That’s our overall test. Or alternatively, we see unexpected weakening in the labor market. So those are two different tests.” - Jerome Powell

Last week, we looked at some of the reasons the healthcare sector has underperformed over the last few years.

This week we’re taking a look at the industries within the sector to see how they differ,what investors should look at when analyzing these different types of companies, and some existing narratives on some of the biggest names.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🇺🇸 US Fed says just one rate cut coming this year ( CNBC )

- Our Take: Jerome Powell acknowledged that there has been progress in the fight against inflation, but said the committee would need to see more ‘good data’ before cutting rates. The market still seems to be betting on two cuts by 2025, and that view received a boost when CPI data showed consumer prices flat between April and May.

-

🤖 OpenAI coming to Apple Devices and Siri ( Reuters )

- Our Take: This announcement wasn’t a surprise but could turn out to be a big deal for the company. Many of the new AI features will run on the Apple devices, rather than in the cloud - and they will only run on new devices. There hasn’t been much excitement around new iPhone models for a while, so the company really needed a new catalyst to drive upgrades. Speaking of excitement, Apple also added the calculator app to the iPad after 14 years of not having it. Now that’s a positive catalyst. Check out this 3 minute summary of 18 things from WWDC24 .

-

💳 New features are coming to Apple Pay too ( CNBC )

- Our Take: Apple Pay users will now be able to access ‘buy now, pay later’ loans from Affirm when paying with their devices. They will also be able to transfer cash to other users by simply tapping phones. These developments were seen as good news for Affirm and bad news for competing payment platforms like PayPal and Block . This illustrates the power that big tech companies like Apple derive from their customer base - and it's also something regulators aren’t too keen on. These kinds of value-added features help explain why Apple’s service revenue now represents 26% of their total revenue, up from 13% in 2017, and are eating other people’s lunch.

-

🔌 Bill Gates backed TerraPower Breaks ground on nuclear plant ( AP )

- Our Take: TerraPower was founded in 2005 and has been developing a reactor that uses depleted uranium. Its first project in China was abandoned in 2019 due to technology transfer limitations. It’s now building a 500 MW reactor in Wyoming, but work on the reactor itself won’t begin in 2026. Things move slowly in this industry! You can read more about the project here .

-

🇯🇵 Share buybacks on track to hit a record high in Japan ( NikkeiAsia )

- Our take: Structural reforms in Japan have prompted companies to focus on shareholder returns. Share buybacks are one of the ways companies can improve those returns, and repurchase programs worth $57 billion have already been announced in 2024. As a result, global investors, including private equity funds, are paying a lot more attention to the country. US PE giants Blackstone and Carlyle Group are raising multi-billion dollar funds for corporate buyouts in the country - implying they still see value in the market.

-

🇪🇺 EU announces new tariffs on China EV imports ( Reuters )

- Our take: The EU is imposing tariffs ranging from 17 to 38%, in addition to the current 10% duty on all imported vehicles. BYD cooperated with the EU investigation and is therefore being charged the lowest rate of 17%. The company’s EVs will still reportedly be very competitive with the tariff, and will now have a price advantage over Chinese rival firms too.

⚕️ Checking the Vital Signs of Healthcare Companies

We mentioned last week that there are a few reasons to be optimistic about the healthcare sector.

If earnings growth recovers as it is expected to over the next 18 months, valuations will begin to look attractive compared to other sectors. Dividend yields will also look more attractive if interest rates decline.

Sentiment around the sector has also been weak, which means companies with strong fundamentals may have been overlooked.

✨ There are also obvious long term tailwinds behind the sector. People are living longer, and the percentage of populations in developed economies over the age of 65 is rising. The sector benefits from a virtuous cycle where better healthcare means you can live longer, which means you're likely to need more healthcare.

In addition, recent advances in genomic medicine and research, robotics and AI suggest several major medical breakthroughs could be on the horizon.

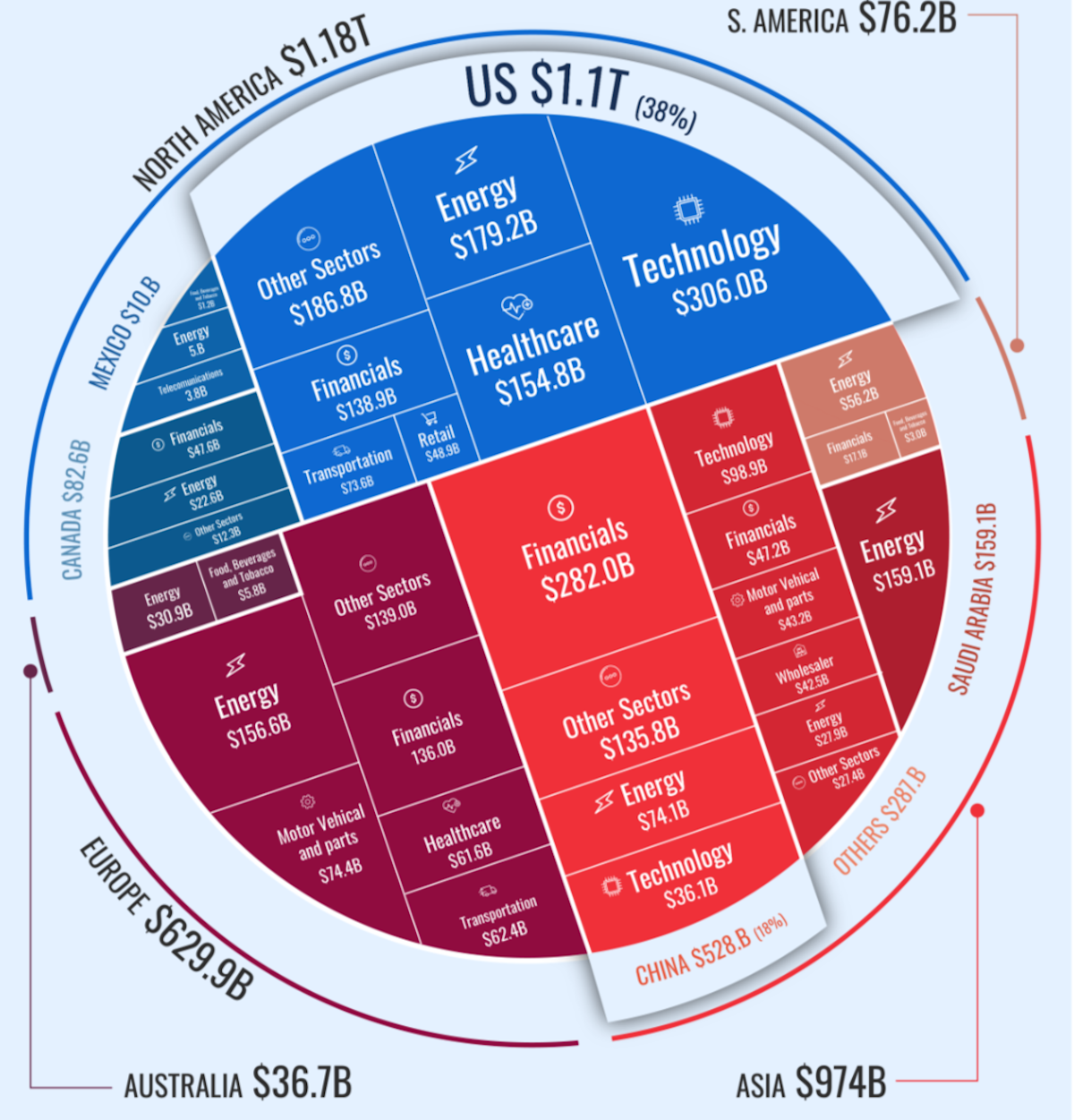

Healthcare is also a very profitable sector - but as we’ll discuss later, the industries within healthcare differ widely in their margins. As the graphic below illustrates, for Fortune 500 companies, healthcare is the fourth most profitable sector globally.

Most of those profits are earned in the US, where it was ranked third in 2023, which was a year when profits actually fell. It was also the fifth most profitable sector in Europe last year.

There are a few reasons that the sector stands out in the US and Europe compared to other parts of the world. Most of the largest pharmaceutical companies are located in the US and Europe, and the populations are older, so it makes sense.

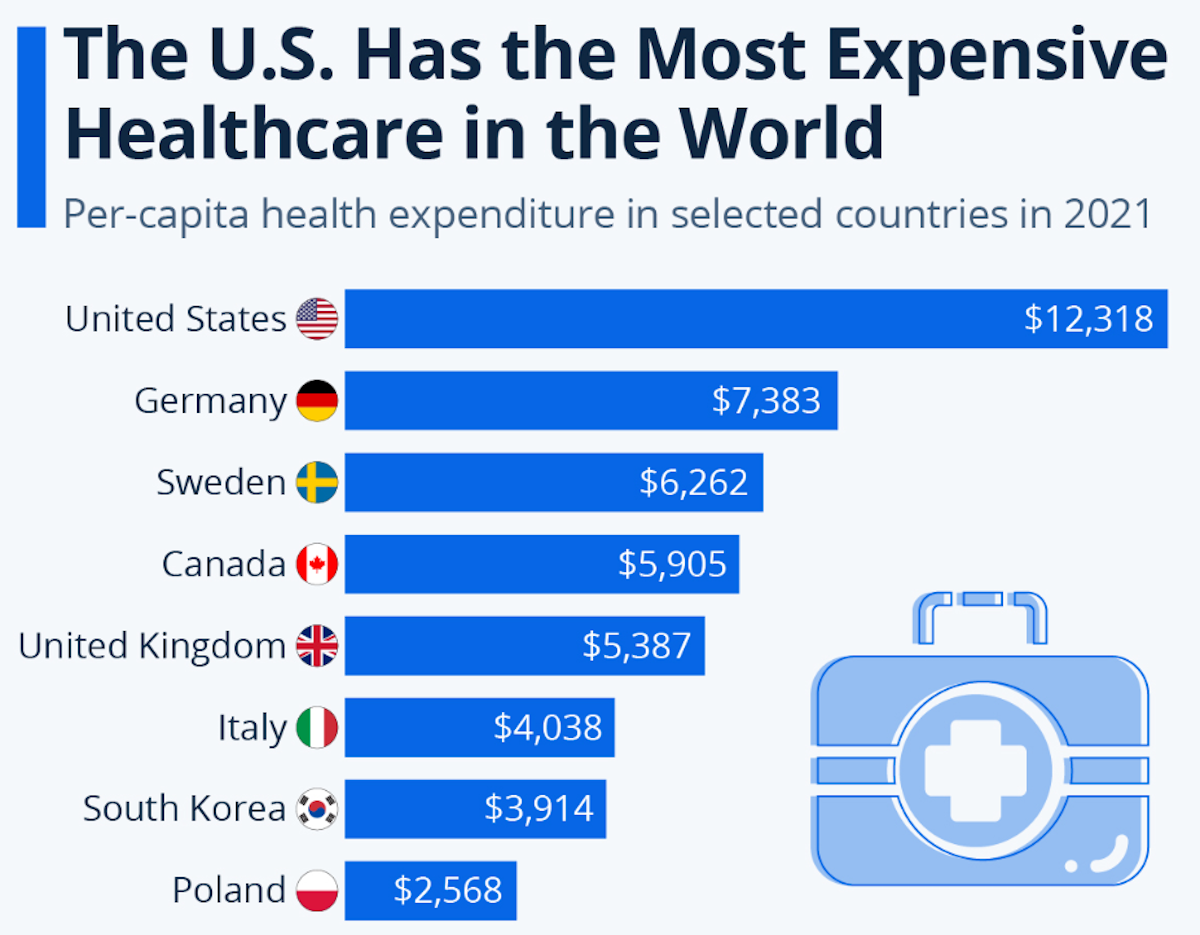

✨ The US also spends far more on healthcare per capita than any other country. This is partly due to structural factors, but also to the availability of new, more expensive treatments, higher income levels and a rapidly growing population over the age of 65. Regardless, if more is spent on healthcare, healthcare companies are going to be more profitable.

Does this mean it's only worth investing in the healthcare sectors in the US and Europe?

Definitely not. There are opportunities in most countries, just not as many. In developing economies, the healthcare sector is likely to grow as incomes rise and average ages rise.

At the same time, in developed economies, the focus is turning to improving efficiency and reducing costs, to keep the sector on a sustainable path.

🏥 Investing in Key Healthcare Industries

As mentioned, income statements for various types of healthcare companies look very different.

While some of the pharmaceutical and biotech giants have profit margins that compare favorably to the top tech companies, the likes of health insurers and medical distribution companies typically struggle to maintain low single digit margins.

Some parts of the industry have predictable cash flows, while others look more like gold miners.

Adding to this is the complexity that comes with regulatory approval for new treatments, and companies trying to disrupt the industry with technology.

🩺 Medical Equipment and Devices

This industry provides some of the most basic supplies to the sector, as well as leading edge surgical equipment, implants and prosthetic devices. There is also a lot of overlap with the life sciences industry, which covers equipment used for diagnosis and research.

The largest companies include Abbott Labs, Intuitive Surgical, Stryker, and Boston Scientific in the US and Siemens Healthineers in Europe. Life sciences companies include Thermo Fisher, Danaher and Agilent Technologies.

The medical equipment and devices industry is actually one of the most profitable in the sector, and revenues are relatively stable. The challenge for investors is estimating realistic growth rates for the future.

The market tends to get overly optimistic about potential growth from time to time. After all, this is an innovative sector - but it doesn’t have the same growth rates as software, and realistic valuations need to reflect that.

You can get an initial idea of a company’s valuations by checking the historical P/E ratio on the company report under section 1.4. Below, we can see that Intuitive Surgical’s P/E is at the upper end of the range.

That’s not necessarily a problem if EPS increases enough in the next year or two, or if expectations for future earnings continue to rise.

🧑⚕️ Managed Healthcare

The managed healthcare industry provides health insurance and healthcare services, typically via a network of healthcare professionals and facilities.

Managed healthcare is unique to certain countries, including the US, that don’t have single payer health systems. The big companies in this industry are UnitedHealth, Elevance Health, and Humana.

✨ Revenues for the managed healthcare industry are fairly stable, with steady growth - but margins are tight. Scale is a key factor for managed healthcare providers, and margins are closely correlated to size.

The key ratios for healthcare insurers are the medical cost ratio and the medical loss ratio. These should improve as the company grows - otherwise there’s a problem.

Managed healthcare providers do face regulatory risks in the countries where they operate - although changes to healthcare systems tend to take a lot longer than anticipated.

🏥 Healthcare Facilities

This industry includes companies that own hospitals, clinics and other healthcare facilities, with the most well known stock being HCA Healthcare.

The industry has reasonable margins, but it’s subject to changing market conditions. As the industry shifts to outpatient and even remote treatment, companies need to adapt. You’ll typically find that companies with diverse portfolios of facilities are better positioned to navigate the marketplace.

😷 Healthcare Services and Distributors

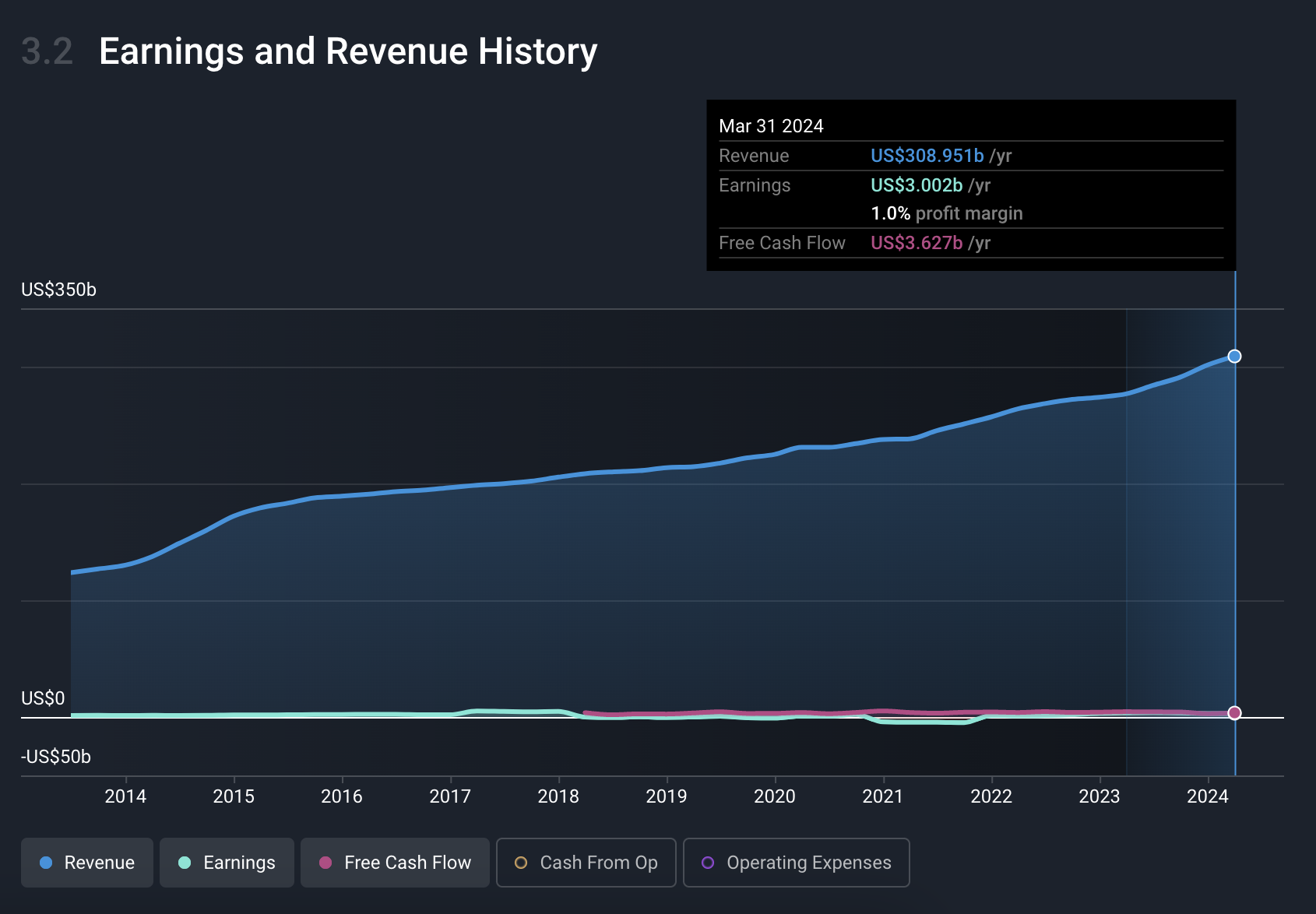

Healthcare distributors like McKesson Corporation are an integral part of the healthcare system. But they are essentially wholesalers with very tight margins.

The chart below shows how low those margins are. They haven’t been above 3% in the last 10 years.

🧑💻 Healthtech

Last year we covered the Healthtech industry which includes companies like Veeva Systems , GoodRX, and Teladoc. These companies are using software, data, and AI to improve efficiencies in the industry.

Like many innovation and growth companies, valuations in this industry reached astronomical levels in 2020 and 2021, and then came crashing down in 2022.

These companies do have the potential to disrupt the industry in time - but investors need to be realistic about likely growth rates and valuations, and make sure to avoid investing when expectations are unreasonably high.

💊 Pharmaceuticals and Biotech

Technically, pharmaceutical companies develop and manufacture drugs from chemicals, while biotech companies create medicine using living organisms. In practice, there’s a lot of overlap and some companies operate in both spaces.

The term biotech is often used to describe companies with a narrower focus, while pharmaceutical companies have large portfolios of drugs in various stages of development and distribution.

The leading companies in both industries are the most profitable in the healthcare sector. But the majority are either not profitable or pre-revenue and entirely focussed on research.

Only around 5% of US-listed biotech companies are profitable, and more than 50% are pre-revenue.

✨ The pharmaceutical sector is one of high risk and high reward, particularly when investing in the pre-revenue companies. A company may develop the next miracle cure and see their valuation skyrocket, but there’s also a significant likelihood that the company spends millions trying to get products through the clinical trial stage to no avail.

💡 The Insight: You Don’t Need To Be A Doctor To Begin Investing In Healthcare

Companies working on breakthrough treatments do offer the potential for astronomical returns - but the success rate is low. Investing in biotech startups requires a massive amount of research and/or domain knowledge.

For the average investor, the larger companies with a portfolio of drugs or treatments, or positive cash flow are the more realistic option. For these companies, investors need to be aware of:

- 📅 The current portfolio of patented drugs , when the patents expire, and any competing substitutes on the horizon.

- 💊 How dependent the company is on its best-selling products . If a company has all its eggs in one basket, the risk is higher.

- 💸 The pipeline of drugs in development , and particularly in second and third phase clinical trials. New drugs take years and upwards of $1 billion to develop, gain approval, and market.

- Only around 10% make it through all phases of clinical trials, so those in early stage development have low odds of making it to market.

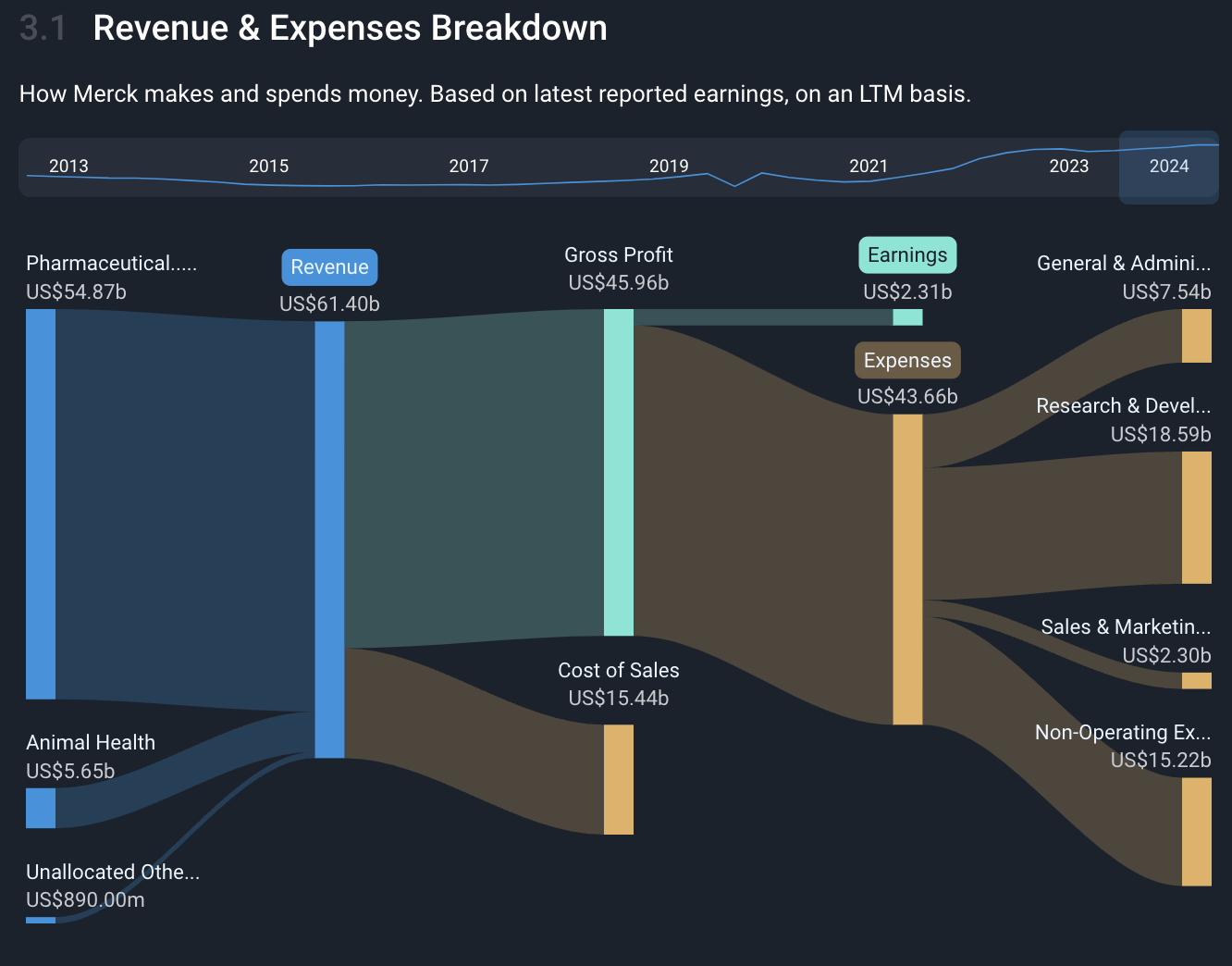

To ensure a strong pipeline of new drugs, companies need to invest in R&D.

Merck has spent $18.5 billion (30% of revenue) on R&D (see below) in the last 12 months - which should hopefully deliver returns down the road.

These two narratives for Johnson & Johnson cover the company’s product pipeline, and how that factors into the fair value estimate for the company:

- Rich Drug Pipeline Will Push Revenues and Earnings Higher

- Industry Tailwinds, Company Headwinds And New Products Will Lead To Stable Revenue Growth

Pharmaceutical companies also produce generic and licensed drugs, which can be very profitable at scale. So manufacturing and distribution capabilities are also important to their outlook.

As for analysts' narratives on some other healthcare stocks, checkout these on Eli Lilly , UnitedHealth , AbbVie , Fiserv , CVS Health, and Boston Scientific .

In summary, no matter whether you’re investing in pharmaceuticals, healthtech, biotech, service providers, managed healthcare, or equipment makers, make sure you’re confident that you understand the underlying business.

There’s a lot more nuance to the healthcare industry than just hospitals and selling drugs, so make sure you know your way around these business models before allocating your capital.

Key Events During the Next Week

Tuesday

- 🇦🇺 The Reserve Bank of Australia will set the benchmark interest rate, which it is expected to keep at 4.35%.

- 🇺🇸 US retail sales are forecast to be up 0.1% month-on-month after being flat in April.

Wednesday

- 🇯🇵 Trade data will be released in Japan. The trade deficit was previously reported at ¥462.5 billion.

- 🇬🇧 The UK’s consumer inflation rate is forecast to fall to 1.9% from 2.3% when the May figures are reported.

Thursday

- 🇬🇧 The Bank of England will announce the benchmarked rate. Economists expect the BOE to keep rates at 5.25%, and make the first cut in August, followed by one more later in the year.

- 🇺🇸 US building permits are forecast to show a slight uptick in activity, rising from 1.44 million to 1.47 million.

Friday

- 🇯🇵 Japan’s official inflation rate (currently 2.5%) will be released.

- 🇬🇧 UK retail sales are due to be published. The month-on-month change is forecast to be 1.9% after a 2.7% drop in April.

First quarter earnings season is all but over, though there are quite a few smaller companies still reporting. The few remaining larger companies reporting this week are:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.