- United States

- /

- Consumer Durables

- /

- NYSE:LEG

June 2024 Insight On Undervalued Small Caps With Insider Transactions

Reviewed by Simply Wall St

Amid a robust surge in the U.S. stock market, with major indices like the S&P 500 and Nasdaq 100 reaching new highs largely due to mega-cap tech companies, smaller cap stocks often present unique opportunities for discerning investors. Given the current economic climate and insider transactions, understanding what makes a small-cap stock potentially undervalued could be particularly timely.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ramaco Resources | 11.6x | 0.9x | 25.88% | ★★★★★★ |

| Hanover Bancorp | 8.4x | 1.9x | 49.12% | ★★★★★☆ |

| PCB Bancorp | 8.6x | 2.3x | 46.24% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 28.74% | ★★★★★☆ |

| AtriCure | NA | 2.8x | 40.56% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 17.04% | ★★★★☆☆ |

| Franklin Financial Services | 9.2x | 1.9x | 37.30% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -170.98% | ★★★☆☆☆ |

| Lindblad Expeditions Holdings | NA | 0.7x | -93.03% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

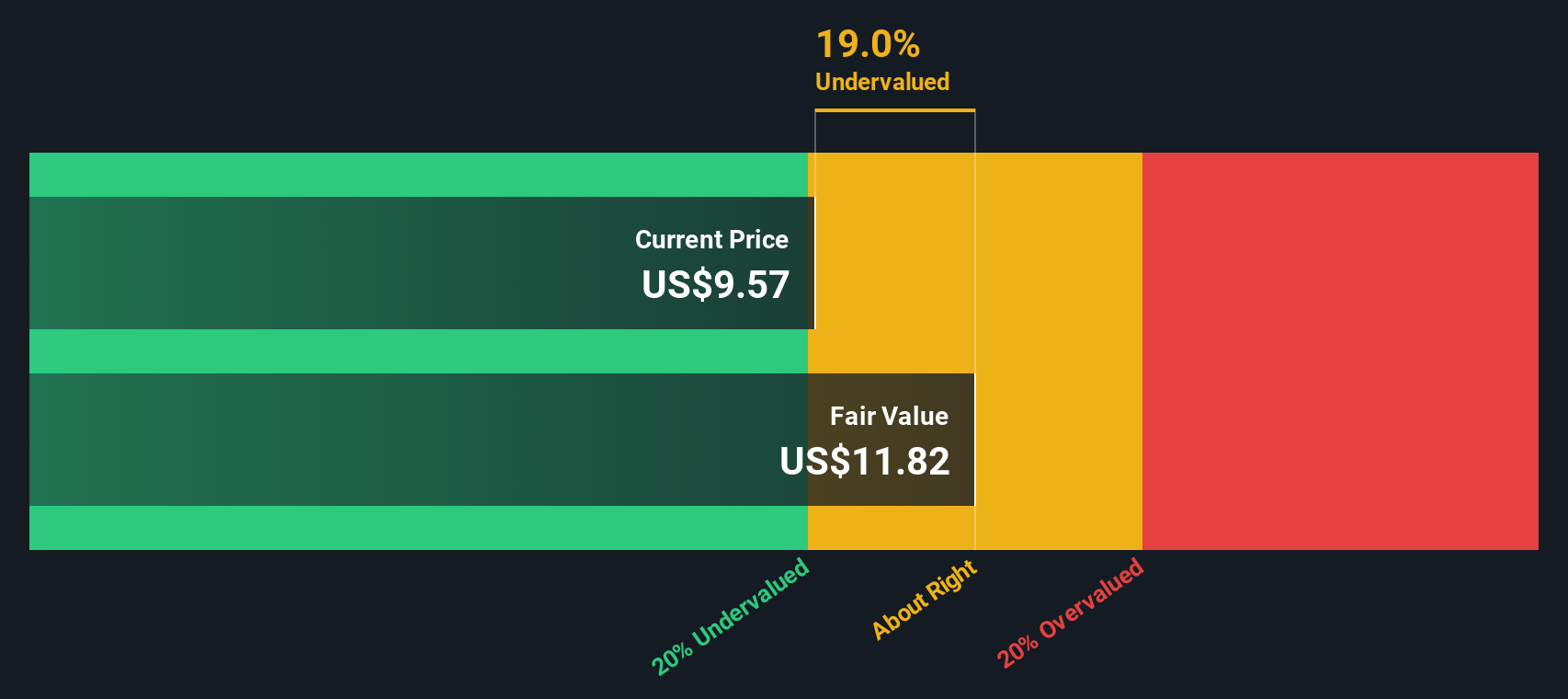

AtriCure (NasdaqGM:ATRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.47 billion.

Operations: Surgical & Medical Equipment generated $414.60 million in revenue, with a gross profit margin of 75.26%. The company's operating expenses for the period were $348.26 million.

PE: -30.9x

AtriCure, despite its unprofitability forecast for the next three years, has shown robust revenue growth with a recent 15% to 17% increase projected for 2024. The company's innovative cryoSPHERE+ device, enhancing operative efficiency by reducing freeze times, underscores their commitment to advancing medical technology. Recently purchased shares by insiders signal confidence in the firm’s trajectory. This strategic insider activity coupled with substantial revenue forecasts positions AtriCure as a compelling entity in the healthcare sector.

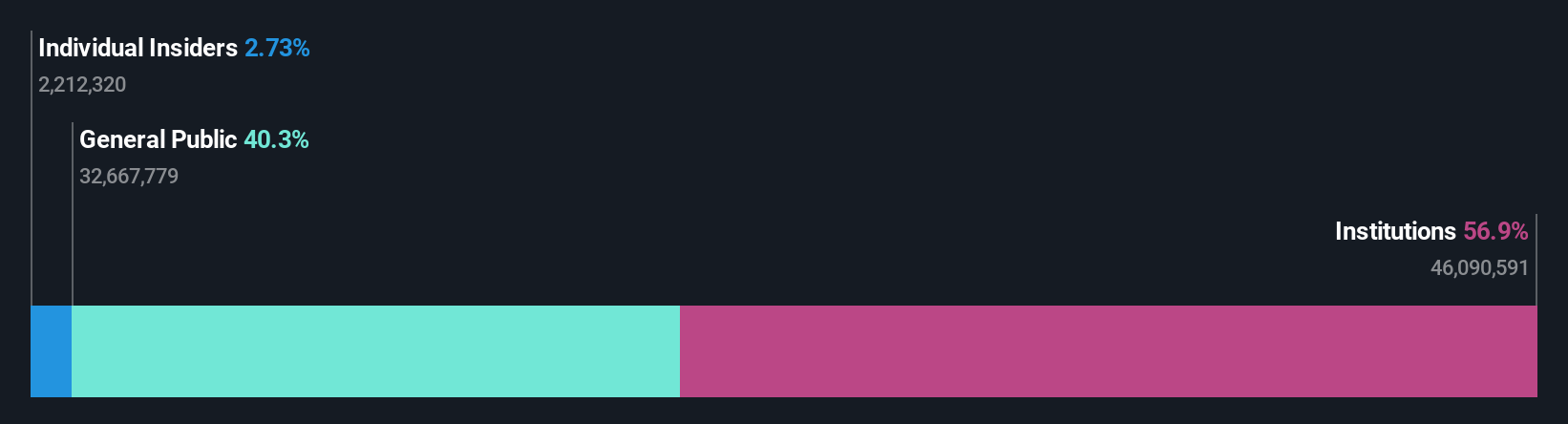

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing, on a leveraged basis, in a diversified portfolio of mortgage assets.

Operations: The business generates revenue primarily through investments in mortgage assets, achieving a gross profit margin of 0.89 and net income margin of approximately 0.43% as of the latest reporting period in 2024. General and administrative expenses for this period were $54.35 million, reflecting operational costs associated with managing its investment portfolio.

PE: 8.8x

Chimera Investment recently increased its quarterly dividend to $0.35 per share, signaling financial confidence despite a reverse stock split aimed at consolidating shares and enhancing value. With a notable $65 million fixed-income offering completed in May 2024, they're bolstering their capital structure for future endeavors. Insider confidence is evident as they've recently purchased shares, affirming belief in the company's prospects amidst external borrowings that pose higher risks. This blend of strategic financial maneuvers and insider activity paints a picture of a firm poised for recalibration and potential growth.

- Navigate through the intricacies of Chimera Investment with our comprehensive valuation report here.

Examine Chimera Investment's past performance report to understand how it has performed in the past.

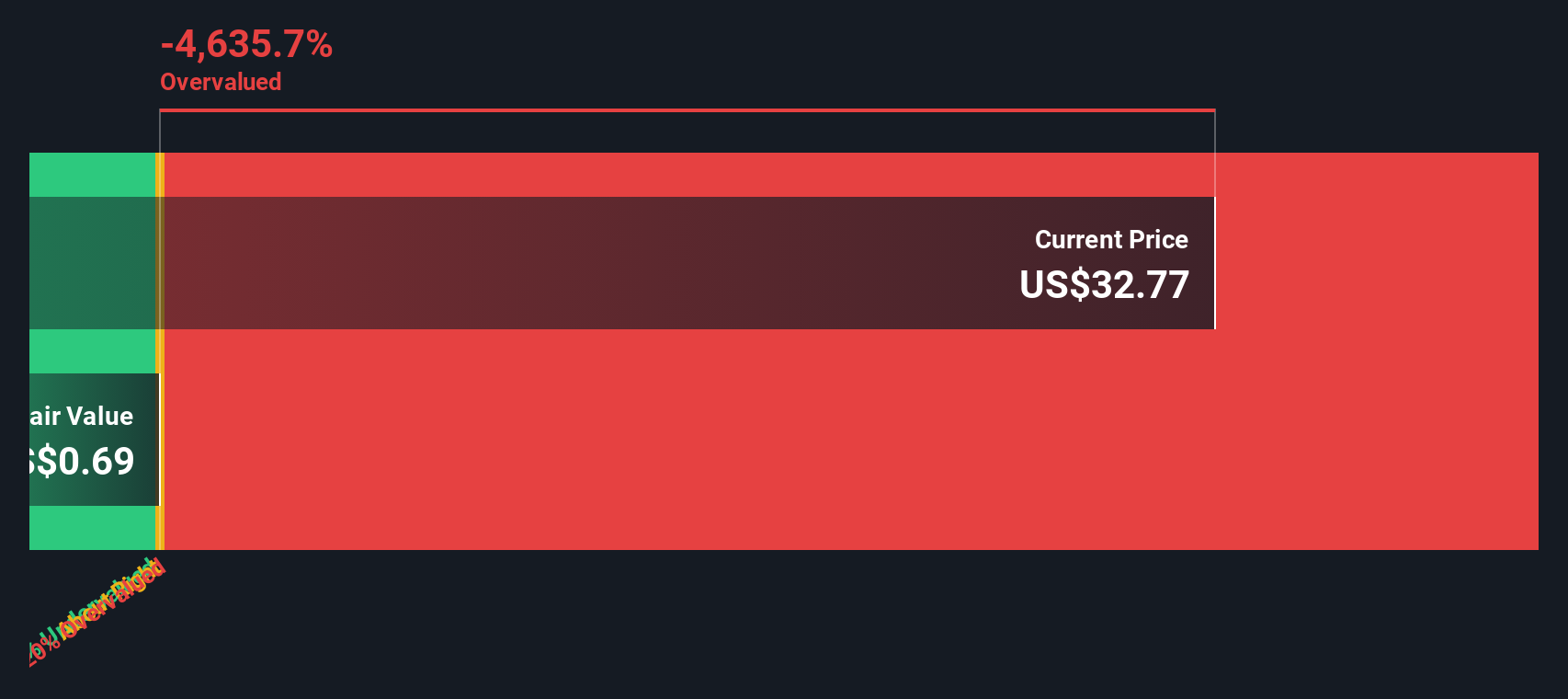

Leggett & Platt (NYSE:LEG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer that designs and produces various engineered components and products, including bedding, specialized products, and furniture, flooring & textile items, with a market capitalization of approximately $4.65 billion.

Operations: In the latest financial period, the company generated $4.61 billion in revenue with a net income of -$158.70 million, reflecting a gross profit margin of 17.83%. The primary revenue contributors were Bedding Products ($1.91 billion), Specialized Products ($1.28 billion), and Furniture, Flooring & Textile Products ($1.46 billion).

PE: -10.0x

Recently, Leggett & Platt has demonstrated strategic financial maneuvers, notably a shift in leadership with Karl G. Glassman reassuming executive roles to steer the company through current market dynamics. With earnings forecasted to grow by 40% annually and insider confidence underscored by recent acquisitions of shares, the firm is actively seeking growth through acquisitions while managing debt prudently. Despite a dividend cut, their reaffirmed guidance and sales figures suggest cautious optimism for their fiscal health and expansion prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Leggett & Platt.

Evaluate Leggett & Platt's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 65 Undervalued Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEG

Leggett & Platt

Designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives