Quote of the Week: “Healing is a matter of time, but it is sometimes also a matter of opportunity” - Hippocrates

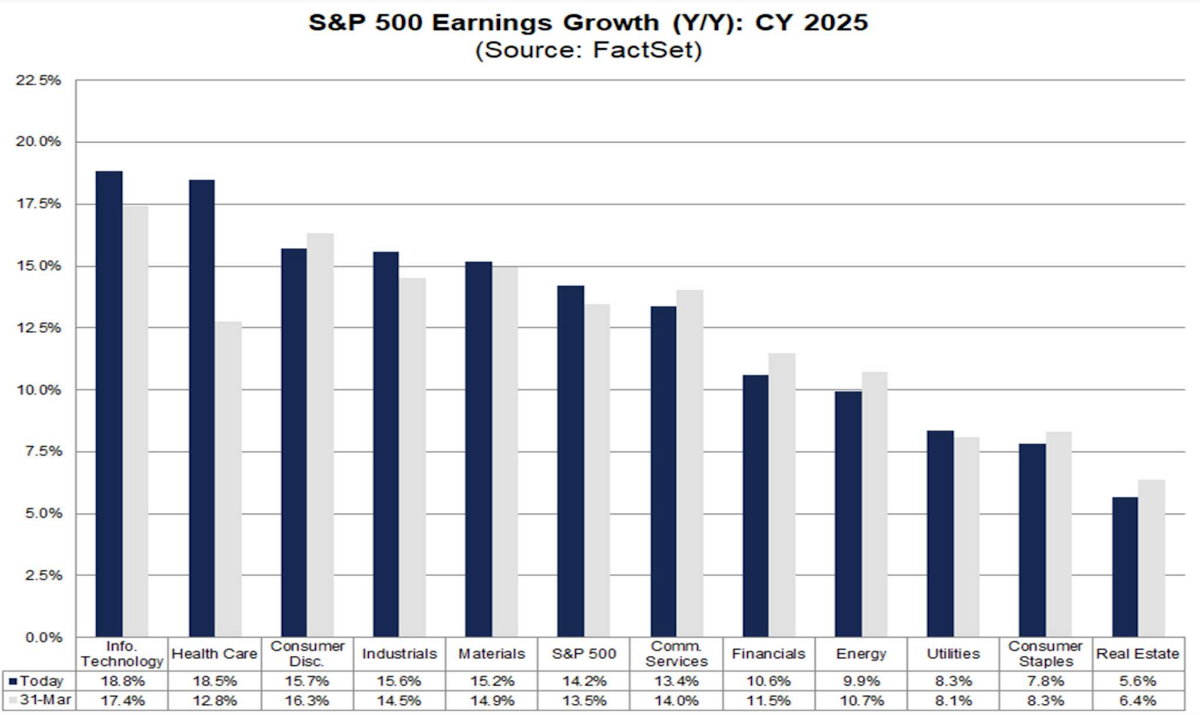

Last week, we looked at the themes playing out in global equity markets. The healthcare sector emerged as a bit of an anomaly. While the sector has lagged in quite a few markets, it also appears to be more expensive than other sectors, despite optimistic forecasts from analysts.

This week, we are taking a closer look at the sector in a few key markets to see why it’s been lagging and whether it really is expensive.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🇪🇺 🇨🇦 EU and Canada central banks cut rates ( Reuters )

- Our take: The ECB and BOC both cut their benchmark rates by 0.25% as expected. The ECB did point out that domestic price pressure remains elevated, so further cuts could be some time away. Canada’s inflation rate has remained below 3% for four months, which allowed the central bank to reduce the benchmark rate to 4.75%.

- The BOE’s next meeting is on 20th June, and while rates are currently expected to remain at 5.25%, the odds of a cut appear to be increasing.

-

🇺🇸 US employment data points to cooling labor market ( Reuters )

- Our take: Three separate employment reports pointed to a softer job market. The JOLTs job openings report showed job openings falling more than expected. The ADP employment report showed private sector employment increasing by a lower than expected 152k in May. Jobless claims also increased by slightly more than expected.

- These data points have tended to contradict one another recently, so the fact that they are now lining up is notable and bodes well for interest rates.

-

🌏 Elections in India, Mexico and South Africa lead to market volatility ( WSJ )

- Our take: The three countries are all members of the G20 and key emerging economies:

- In India, the ruling coalition’s majority narrowed, suggesting Prime Minister Modi’s policy agenda is losing support.

- Mexico’s Morena Party won a convincing majority, leading to fears of anti-business reforms.

- South Africa’s ruling ANC lost its majority, pushing the country into an era of coalition governments.

- Our take: The three countries are all members of the G20 and key emerging economies:

In all three cases, the uncertainty is more of an issue for investors than actual policy changes. This may well be repeated later in the year when US voters head to the polls.

-

💻 Dell selling more servers, but margins are down ( CNBC )

- Our take: Dell’s stock price fell ~25% on the back of results that included earnings and revenue beats and improved full year guidance. The problem was that while the ISG segment which sells servers for data centers (including AI servers) reported revenue growth of 42%, there was no improvement in operating profit. Dell is sacrificing profits to win market share. Investors will need to decide whether those sacrifices will be worthwhile in the long run.

-

💾 Musk diverts Tesla GPUs to other companies ( Fortune )

- Our take: Musk justified the rerouting by saying the chips weren’t actually needed by Tesla at the time. That may be true, but this still points to a bigger issue facing Tesla shareholders. There is considerable overlap between the use of resources amongst Musk’s various companies - including his own time and focus.

-

📺 Meta tests out unskippable ads on Instagram ( Business insider )

- Our take: This isn’t a new idea, and has been in place on YouTube for some time. The difference is that YouTube offers the option of a premium, ad free subscription. Meta will also need to decide whether profitability or beating TikTok on engagement is the priority.

-

🔍Google Scales back AI overview in search results ( The Washington Post )

- Our take: Alphabet’s Google has once again embarrassed itself by rushing to launch an AI product that wasn’t ready for prime time. The new AI search overviews have been reported to contain incorrect and ‘bizarre’ results.

- Google will probably be able to fix these issues - but is likely to face bigger problems on the copyright front. If AI overviews give users all the information they need, there is no reason to visit the websites Google is using to source that data.

🏥 Is Healthcare Positioned To Outperform?

From 2010 to 2020 the US Healthcare sector outperformed the S&P 500 index (216% to 199%). Investors benefited from this as the sector is regarded as defensive, and it allowed for diversification away from growth sectors.

Since then, it has underperformed, despite very strong performance from a handful of companies. In 2020 and 2021 it was companies like Moderna and Pfizer that earned windfall profits, but traded up to unsustainable valuations. In the last year Eli Lilly and Novo Nordisk have cashed in on their GLP-1 weight loss and diabetes drugs, but it remains to be seen whether their valuations are sustainable as competition in the space increases.

The sector has lagged the broader market by 14% over the last 12 months, and by 27% over the last five years. Despite this underperformance, the current P/E ratio of 96x appears very high when earnings are expected to increase by 21% per year over the next few years.

The pharmaceutical industry’s 135x P/E is an outsize factor, as it accounts for nearly a third of the sector. But the other industries apart from health services are also trading on much higher multiples than the broader market.

So, why has the sector underperformed, and is it as expensive as it appears?

Some healthcare companies performed well during the pandemic, while others benefited from delayed demand when it ended. This meant that earnings rose and valuations appeared reasonable through the end of 2021. Since then, revenues across the sector have increased, but costs have increased at a much faster rate. While revenue has increased by ~16% since the beginning of 2022, earnings have fallen more than 55%.

So the high P/E ratios are really a result of falling earnings rather than share prices rising. In fact, share prices have on balance been flat since the start of 2022.

Analysts have been expecting a turnaround for the last 18 months, but have had to continually revise their near-term estimates lower. In the last two months, Q2 EPS growth estimates have been cut by another 1.5%.

Once again. Most of these revisions have been due to lower profit margins. While the profit margin for the S&P 500 index as a whole rose from 11.6% to 11.7% in the last year, for the healthcare sector it fell from 9.3% to 6.5% . Adding to the pressure on earnings, two index heavyweights Bristol-Myers and Gilead Sciences , reported earnings that were 314% and 196% lower than they were in the first quarter of 2023.

Analysts are still expecting a turnaround during the second half of 2024 and in 2025 when earnings are expected to increase by 18.5%.

🌍 Other Markets

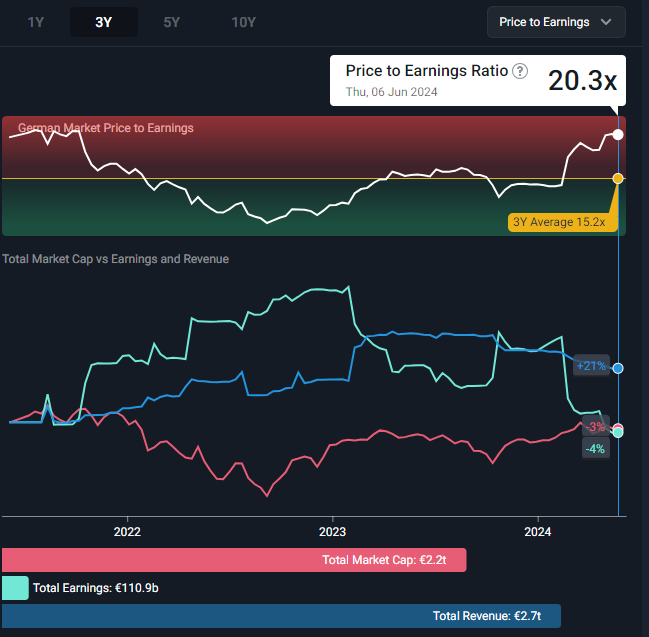

A similar pattern is playing out in quite a few other markets - but not all of them. In Germany, the healthcare sector’s revenue is up 21% over three years, while earnings have fallen 4%. Merck (pharmaceuticals) and Bayer (life sciences) have had an outsize impact on the sector.

Germany Healthcare Sector Performance 2021 to 2024 - Simply Wall St

In other markets, strong performance from one or two pharmaceutical giants has contributed to very different outcomes for the sectors overall. In the UK, the healthcare sector has outperformed the broader market, primarily due to strong performance from AstraZeneca and GSK .

Two pharma giants, Sun Pharmaceuticals and Cipla have also contributed to outperformance of the sector in India.

💡 The Insight: Performance Within The Healthcare Sector Is Less Correlated Than It Is In Other Sectors

It’s clear that companies across the healthcare sector have been hammered by rising costs over the last few years. Meanwhile, healthcare spending increases every year across the globe - and it’s also quite resilient to economic downturns. If or when inflationary pressures do subside, earrings should recover. The sector is also likely to come back into focus if momentum slows in the technology and communications sectors.

The other takeaway from the recent performance of the sector is that the pharmaceutical and biotech industries have an outsize influence on the sector. These industries account for some of the largest companies in the sector - and they are also prone to earnings volatility.

In fact, the entire sector consists of industries with very different dynamics, ranging from fast-growing healthtech companies to relatively stable health service providers.

✨ We often mention ETFs as an option when investing in specific sectors. In the case of healthcare, ETFs need to be treated with more caution. They do offer diversification, but that also comes with exposure to quite a few companies with poor fundamentals. This sector may be better suited to picking individual stocks.

Simply Wall St’s Stock Screener is a very useful tool when it comes to looking for stocks in the sector. You’ll find them all within two industries as follows:

Healthcare:

- Medical Equipment

- Healthcare Services

- Healthtech

Pharmaceuticals and Biotech

- Biotech

- Pharmaceuticals

- Life Sciences

You can also check out the Discover Page to find a few collections in the sector, including:

US Big Pharma , Top Healthcare Stocks and Biotech Breakthroughs .

Key Events During the Next Week

The Fed’s interest rate decision and press conference on Wednesday will be the main event this week.

Tuesday

- 🇬🇧 UK employment data will be published. Economists expect the unemployment rate to remain at 4.3%.

- 🇬🇧 UK manufacturing production data is also due to be released, providing further insight into the strength of the economy ahead of the next BOE meeting.

Wednesday

- 🇺🇸 US consumer inflation data will be published. The inflation rate is forecast to remain at 3.4%, while the core inflation rate is expected to remain at 3.6%.

- 🇺🇸 The US Fed is expected to keep the fed funds target range at 5.25% to 5.5%. The odds of a rate cut have increased slightly, but futures markets still imply a 75% chance that rates will remain unchanged. Investors will nevertheless be keen to hear how committee members are reacting to recent data.

Thursday

- 🇦🇺 Australia’s Westpac Consumer Confidence index is forecast to show a 0.3% decline in sentiment.

- 🇺🇸 US producer price inflation data is due. Annual PPI is expected to rise from 2.2% to 2.3%.

Friday

- 🇯🇵 The Bank of Japan is expected to keep the benchmark lending rate at 0.1%.

- 🇺🇸 The US University of Michigan Consumer Sentiment Index is forecast to show another uptick in sentiment, from 69.1 to 70.

Just a handful of companies are due to report this week. Notable companies include:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.