- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR) Valuation After Fed’s Third Rate Cut and Renewed Crypto-Sector Optimism

Reviewed by Simply Wall St

The Federal Reserve's third consecutive rate cut, trimming the funds rate to a 3.5% to 3.75% range, immediately put Cipher Mining (CIFR) on traders' radar as crypto linked names caught a bid.

See our latest analysis for Cipher Mining.

Even after today’s pullback, with the share price at $17.05, Cipher’s roughly 57% 3 month share price return and powerful 1 year total shareholder return of 178% suggest momentum is cooling, not broken, after a huge run.

If this kind of volatility has your attention, it could be worth scanning other high growth tech and AI names using our high growth tech and AI stocks for fresh ideas beyond crypto mining.

With analysts still seeing nearly 60% upside to their price targets and crypto exposed names back in favor, is Cipher Mining trading at a discount to its next leg of growth, or has the market already priced it in?

Most Popular Narrative Narrative: 37.4% Undervalued

With Cipher Mining closing at $17.05 versus a narrative fair value of $27.25, the gap implies investors are still discounting the new AI powered business mix.

Industry wide demand for large scale, flexible, and energy rich data center sites driven by accelerating institutional and mainstream adoption of digital assets and AI aligns with Cipher's strategy to develop infrastructure that can quickly pivot between Bitcoin mining and high performance computing (HPC), creating upside potential for both revenue diversification and earnings stability.

Want to see why this story leans on breakneck revenue expansion, a margin makeover, and a future earnings multiple usually reserved for elite software platforms? Dive into the full narrative to uncover the specific growth path, profitability shift, and valuation math that together support this striking upside case.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Bitcoin price weakness or delays converting AI and HPC capacity into signed, revenue generating contracts could quickly undermine this upbeat growth story.

Find out about the key risks to this Cipher Mining narrative.

Another Take on Valuation

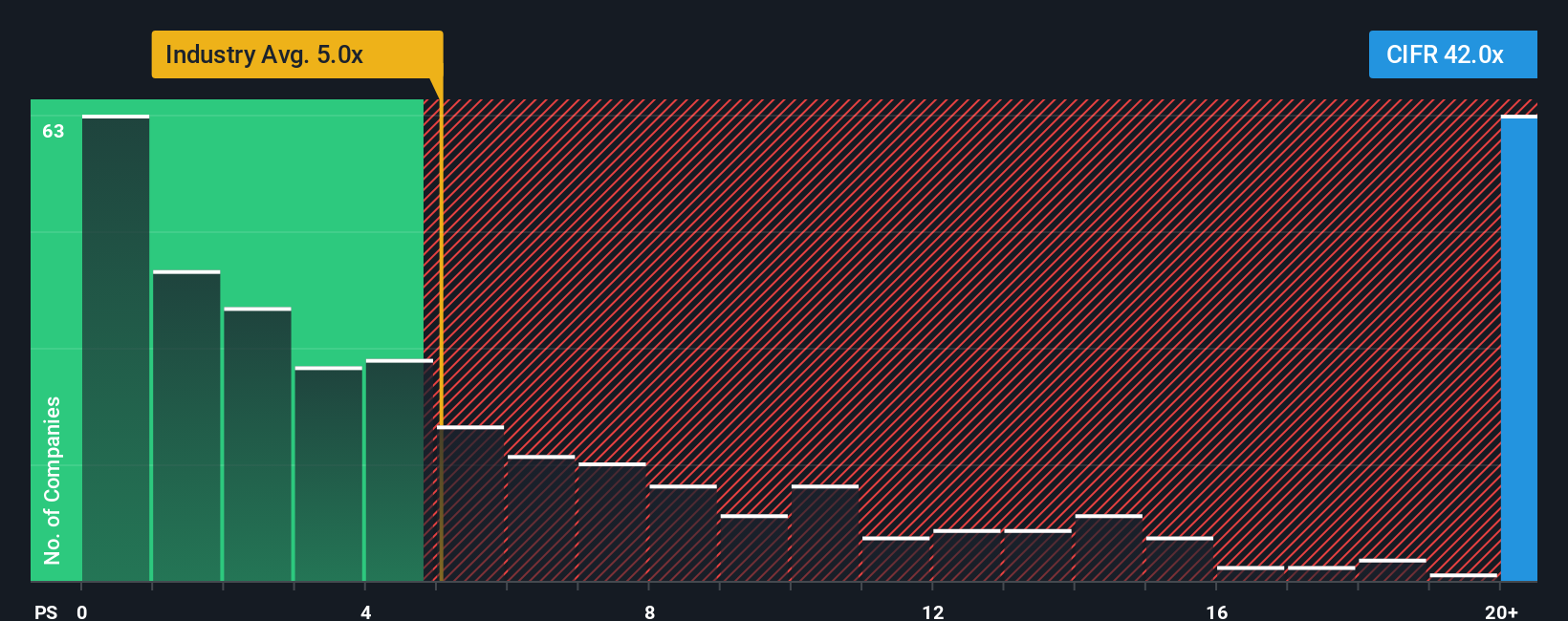

That upbeat narrative fair value clashes with what the current sales based valuation is signaling. At 32.6 times sales versus a fair ratio of 8.4 times, the US Software sector at 4.9 times, and peers at 19.8 times, the stock screens as aggressively priced on today’s fundamentals. This raises the question of how much future execution is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized narrative in just minutes with Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the next wave of opportunities, use the Simply Wall St Screener now so you do not miss what is coming.

- Tap into potential market mispricing by scanning these 903 undervalued stocks based on cash flows that combine solid cash flow support with attractive entry points.

- Ride structural growth trends in automation and data by filtering for these 26 AI penny stocks poised to benefit from accelerating adoption.

- Target income and stability by focusing on these 13 dividend stocks with yields > 3% that may strengthen your portfolio with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)