- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point (CHKP) Valuation Check After Quantum Firewall R82.10 Product Upgrade and AI Security Push

Reviewed by Simply Wall St

Check Point Software Technologies (CHKP) just rolled out its Quantum Firewall Software R82.10, a substantial upgrade aimed at helping enterprises manage AI related risks while tightening security across sprawling hybrid networks.

See our latest analysis for Check Point Software Technologies.

Despite the buzz around R82.10 and a fresh $1.5 billion zero coupon convertible note issue, Check Point’s 1 month share price return of minus 5.04 percent contrasts with a steadier year to date share price gain and an impressive 3 year total shareholder return of 48.87 percent. This combination suggests that long term momentum remains intact even as near term sentiment cools.

If this kind of AI driven security story has your attention, it is worth scanning other opportunities in high growth tech and AI stocks to see which names are building similar momentum.

With revenue still growing, earnings dipping slightly and the stock trading about 19 percent below analyst targets, is Check Point a quietly undervalued AI security play, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 15.9% Undervalued

With the narrative fair value sitting above Check Point’s last close of $192.12, the implied upside leans on specific growth and margin assumptions.

The analysts have a consensus price target of $223.054 for Check Point Software Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $173.0.

Want to see what is powering this upside case? The story hinges on steady top line expansion, resilient margins and a richer future earnings multiple. Curious which assumptions really move the needle here? Read on to unpack the full narrative behind that fair value.

Result: Fair Value of $228.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unwind if competitive SASE and AI offerings pressure margins, or if tariff and Taiwan related manufacturing risks disrupt hardware supply.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View on Value

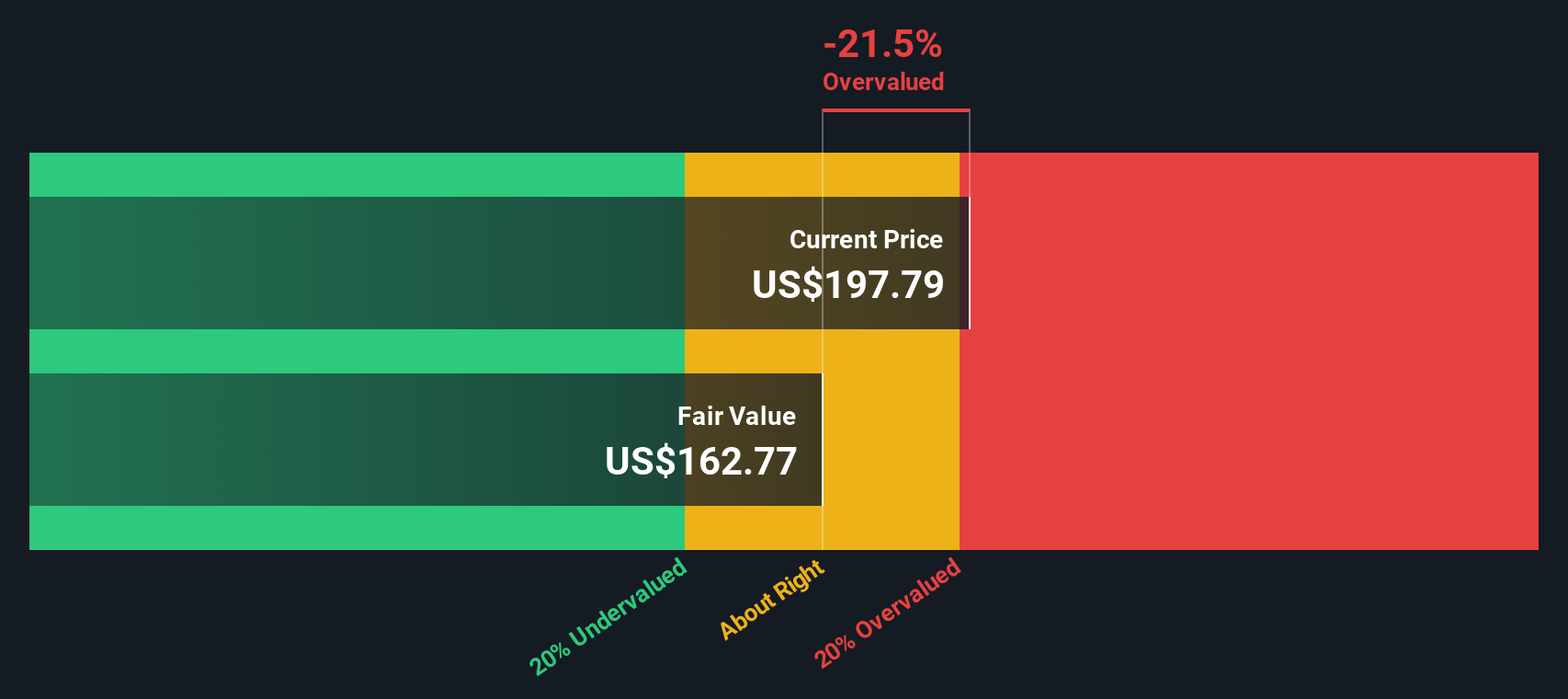

Our SWS DCF model paints a more cautious picture, putting fair value nearer $166.03, which suggests Check Point might actually be overvalued at $192.12. If cash flows do not ramp as fast as the narrative implies, today’s optimism could be running ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way

A great starting point for your Check Point Software Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning fresh opportunities on Simply Wall St, where tailored screeners surface focused ideas aligned with your strategy.

- Explore high potential growth stories early by reviewing these 3610 penny stocks with strong financials that pair low share prices with solid fundamentals.

- Review these 26 AI penny stocks to find companies positioned to participate in demand for intelligent software and infrastructure.

- Assess options in these 13 dividend stocks with yields > 3% to identify companies that may help support a portfolio’s income stream over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)