- United States

- /

- Software

- /

- NasdaqGS:CHKP

A Look At Check Point Software Technologies (CHKP) Valuation After Its New AI Exposure Management Launch

Check Point Software Technologies (CHKP) has drawn fresh attention after launching its Check Point Exposure Management platform, an AI-era security offering that unifies threat intelligence, attack surface visibility, and automated remediation for enterprise customers.

See our latest analysis for Check Point Software Technologies.

While the new Exposure Management launch has sharpened investor focus on Check Point, the recent 7 day and 30 day share price returns of 5.51% and 5.95% declines, alongside a 1 year total shareholder return decline of 9.28%, suggest momentum has cooled after stronger 3 year and 5 year total shareholder returns of 37.65% and 34.75%.

If this kind of AI driven security story has your attention, it could be a good moment to broaden your watchlist with high growth tech and AI stocks.

With Check Point trading at US$178.16 against an average analyst target of US$225.16 and carrying a mid-range value score of 4, you have to ask: is this a genuine opening or is future growth already priced in?

Most Popular Narrative: 21.3% Undervalued

At a last close of $178.16 versus a most followed fair value of about $226.51, the current price sits well below the narrative anchor, which leans heavily on AI security momentum and billings strength.

The Infinity platform continues to gain traction, with strong double digit revenue growth and increased customer adoption, now accounting for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross selling opportunities.

Curious what underpins that fair value gap? The narrative leans on steady top line expansion, firm margins, and a future earnings multiple that assumes solid execution. Want to see how those moving parts fit together in the full model?

Result: Fair Value of $226.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear watchpoints, including competitive pressure in SASE and AI security, as well as manufacturing or tariff issues tied to Taiwan that could squeeze margins.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: Cash Flows Paint a Tighter Picture

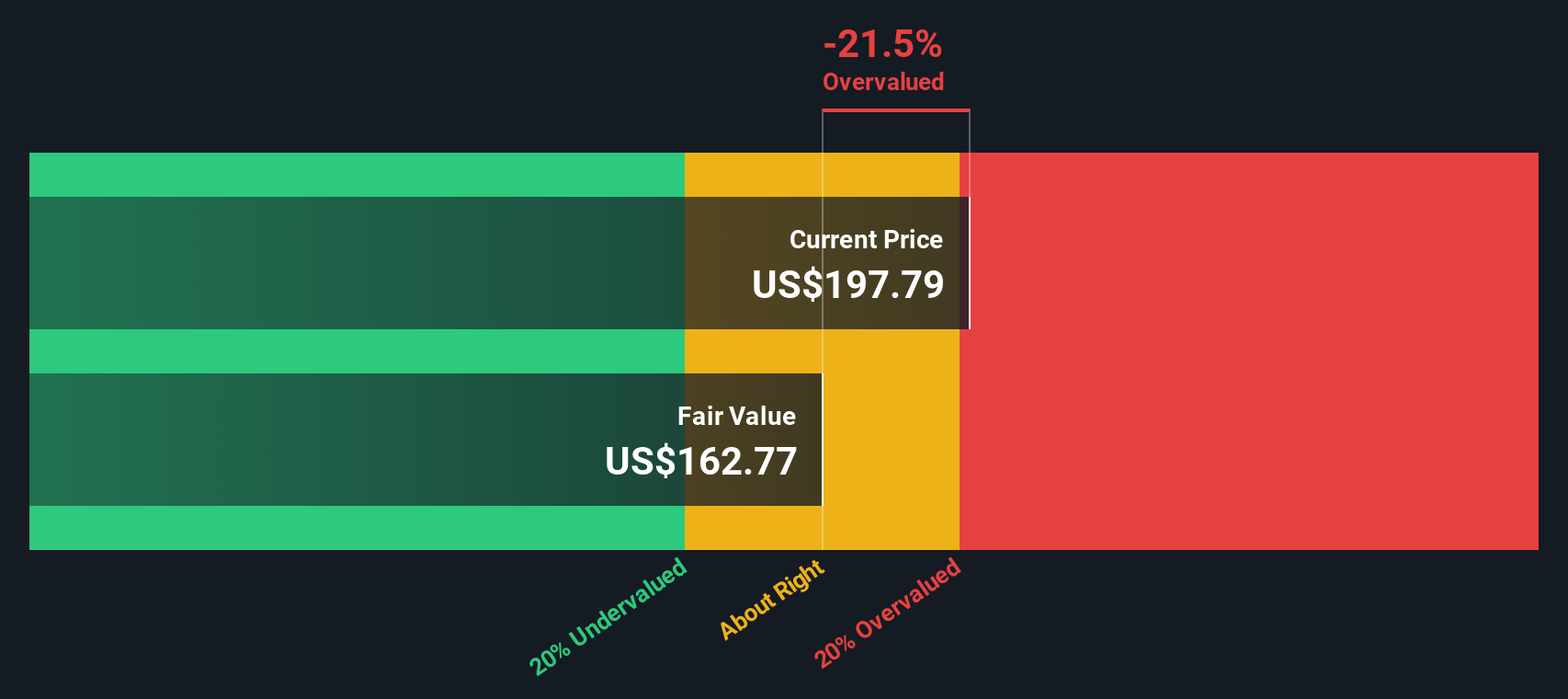

The popular fair value narrative suggests Check Point Software Technologies looks about 21.3% undervalued at $226.51, but our DCF model is less generous. On a future cash flow basis, it points to a value of $166.67, which sits below the current $178.16 price and screens as overvalued. Which lens do you trust more: earnings multiples or hard cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you see the data differently or would rather build your own view from the ground up, you can shape a full narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for more investment ideas?

If Check Point has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to line up your next round of high conviction ideas.

- Spot potential bargains early by running your eye over these 3522 penny stocks with strong financials that already show stronger balance sheets and cash generation than many expect at this size.

- Lean into the AI theme further by scanning these 24 AI penny stocks that are tying machine learning to real products, revenue and clear business models.

- Put value front and center by filtering for these 880 undervalued stocks based on cash flows that our models suggest are trading below their estimated cash flow based worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!