- United States

- /

- Software

- /

- NasdaqGS:CFLT

Subdued Growth No Barrier To Confluent, Inc. (NASDAQ:CFLT) With Shares Advancing 29%

Confluent, Inc. (NASDAQ:CFLT) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 49% in the last year.

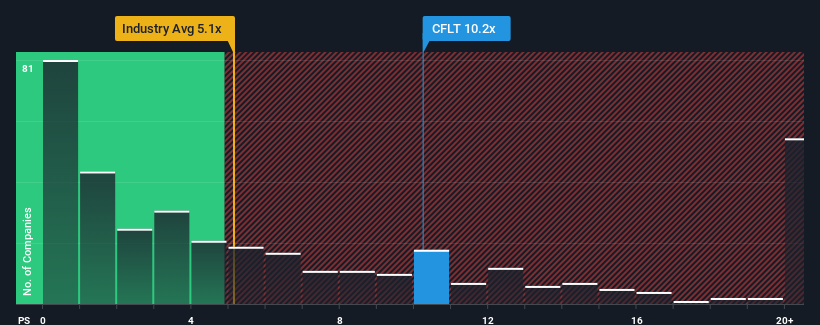

Since its price has surged higher, Confluent may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 10.2x, since almost half of all companies in the Software industry in the United States have P/S ratios under 5.1x and even P/S lower than 1.9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Confluent

What Does Confluent's Recent Performance Look Like?

Recent times have been advantageous for Confluent as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Confluent.Is There Enough Revenue Growth Forecasted For Confluent?

The only time you'd be truly comfortable seeing a P/S as steep as Confluent's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 171% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 21% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Confluent's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

The strong share price surge has lead to Confluent's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Confluent currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Before you settle on your opinion, we've discovered 2 warning signs for Confluent that you should be aware of.

If you're unsure about the strength of Confluent's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives