- United States

- /

- Software

- /

- NasdaqGS:CFLT

How Investors May Respond To Confluent (CFLT) Teaming With Formula 1 for Real-Time Data Solutions

Reviewed by Sasha Jovanovic

- Confluent announced a multi-year partnership with the Visa Cash App Racing Bulls Formula 1 team to deliver real-time data streaming solutions for race performance and decision-making.

- This collaboration brings high-profile visibility to Confluent’s platform in the sports technology arena, underscoring its role in real-time data processing for competitive advantage.

- We'll examine how this Formula 1 alliance highlights Confluent's expanding influence in real-time technology and impacts its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Confluent Investment Narrative Recap

To be a shareholder in Confluent, you typically need to believe in the essential role of real-time data streaming for digital transformation and AI-driven enterprise workloads. The Formula 1 partnership increases Confluent’s visibility in real-time analytics, but is not expected to meaningfully affect the key short-term catalyst of cloud consumption growth or offset the major risk of slower adoption among large clients and ongoing customer optimization, which continue to weigh on Confluent Cloud revenues.

Of the recent announcements, the introduction of Streaming Agents in August stands out for its relevance, illustrating Confluent’s push into AI-powered, real-time applications. While growing its platform capabilities addresses a core growth catalyst, expanding enterprise demand for real-time streaming, the impact of these new product launches remains limited relative to the headwinds from decelerating cloud consumption.

However, in contrast to expanding brand partnerships, there is information investors should be aware of regarding ongoing cloud usage optimization and its impact on recurring revenues...

Read the full narrative on Confluent (it's free!)

Confluent's outlook anticipates $1.7 billion in revenue and $220.6 million in earnings by 2028. This scenario requires revenue to grow at 16.5% annually and reflects a $532.3 million increase in earnings from the current -$311.7 million.

Uncover how Confluent's forecasts yield a $24.69 fair value, a 22% upside to its current price.

Exploring Other Perspectives

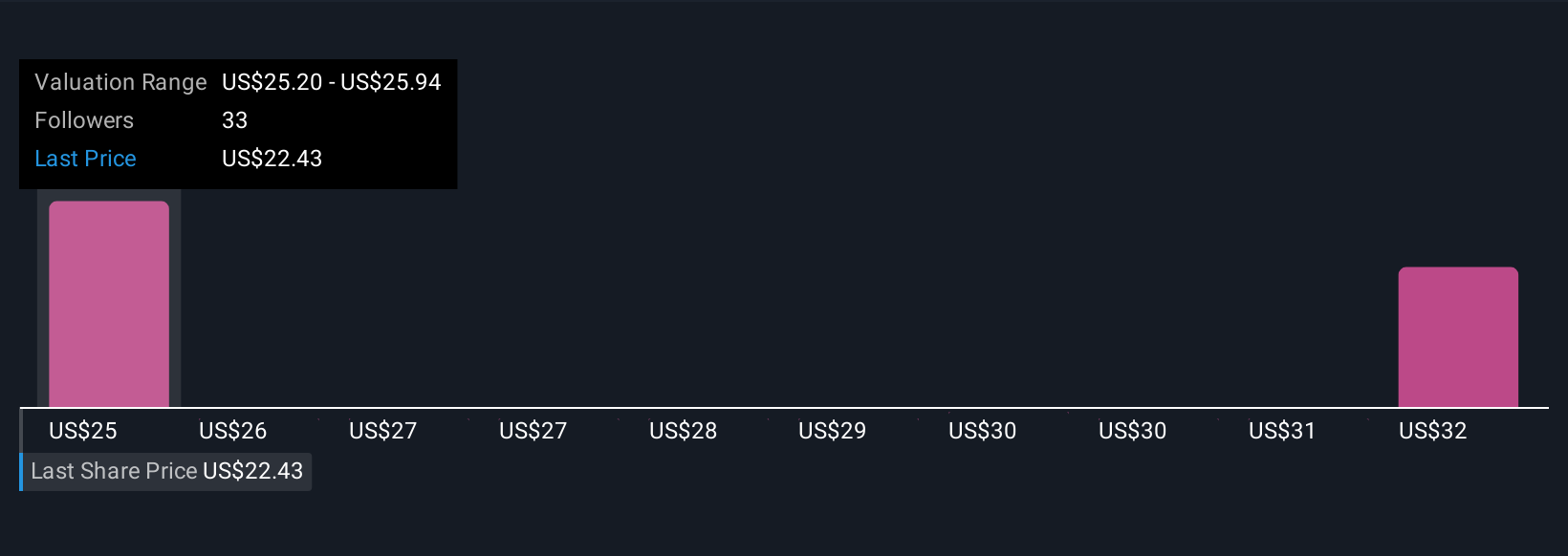

Simply Wall St Community members provided two fair value estimates for Confluent, ranging from US$24.69 to US$32.13 per share. With cloud consumption growth under pressure, opinions on the company's future value differ, reviewing a range of viewpoints can help broaden your understanding.

Explore 2 other fair value estimates on Confluent - why the stock might be worth just $24.69!

Build Your Own Confluent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Confluent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Confluent's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives