- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT): A Fresh Look at Valuation as Investors Reassess Growth Prospects

Reviewed by Kshitija Bhandaru

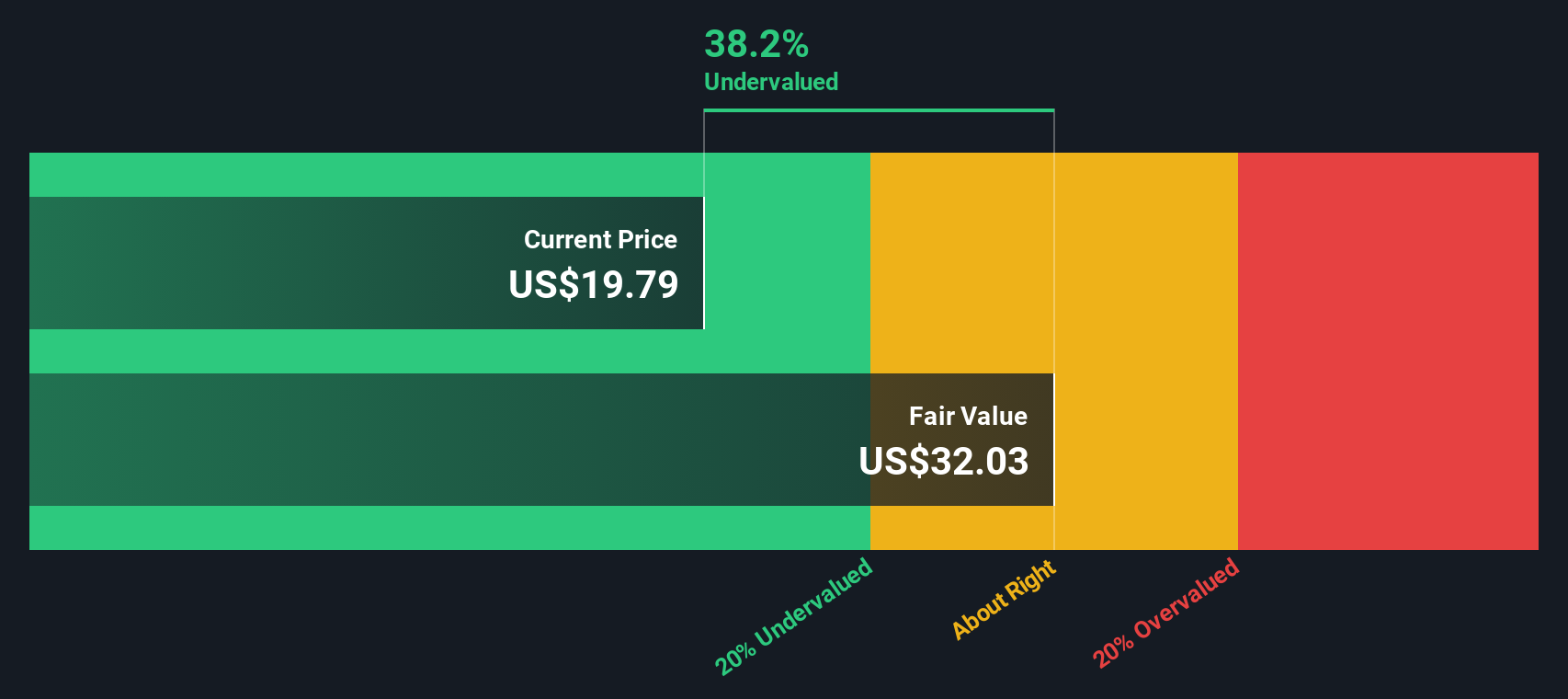

Most Popular Narrative: 18.8% Undervalued

The most closely watched narrative sees Confluent trading notably below its fair value, suggesting the potential for significant upside as expectations shift.

Rapid growth in real-time AI and agentic workloads is driving increased demand for enterprise-grade streaming and processing solutions, with Confluent seeing a projected 10x expansion in production AI use cases across hundreds of customers. This is likely to accelerate subscription and platform revenue over the medium to long term as these use cases mature and proliferate.

How does this narrative justify such a bullish outlook? There is a major financial turning point hidden in the consensus assumptions, one that hinges on sustained growth, maturing profit margins, and a bold future earnings forecast. Want to know what could explain a value gap this size? Dig into the details to see just how aggressive the growth blueprint gets.

Result: Fair Value of $24.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing customer optimization and competitive pressures in cloud services could slow Confluent’s growth. This may challenge the optimistic outlook behind current valuations.

Find out about the key risks to this Confluent narrative.Another View: SWS DCF Model Weighs In

While multiples point to potential value, our DCF model also sees Confluent as undervalued. This approach takes a closer look at expected cash flows and fundamentals, prompting us to consider whether the market is missing something substantial.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Confluent to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Confluent Narrative

If you see things differently or want to dive into the latest numbers, you can pull together your own take in just a few minutes. Do it your way

A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Make your next move count. Expand your watchlist with handpicked opportunities you might otherwise miss using Simply Wall Street’s research tools.

- Unlock rapid growth by targeting companies leading breakthroughs in medical AI with healthcare AI stocks.

- Power up your portfolio with hidden gems trading below their cash flow value by using undervalued stocks based on cash flows.

- Tap into the future of secure payments and digital innovation by scanning cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives