- United States

- /

- Software

- /

- NasdaqGS:BSY

Veracyte And 2 More Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Amid recent market volatility, with major indices like the Dow Jones and Nasdaq experiencing significant declines, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value. In such turbulent times, identifying undervalued stocks can offer potential opportunities as these equities might not fully reflect their companies' fundamental strengths or future prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $27.41 | $54.76 | 49.9% |

| NBT Bancorp (NasdaqGS:NBTB) | $40.45 | $78.70 | 48.6% |

| Semrush Holdings (NYSE:SEMR) | $9.14 | $18.17 | 49.7% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.55 | 49.6% |

| Vericel (NasdaqGM:VCEL) | $44.24 | $86.05 | 48.6% |

| Veracyte (NasdaqGM:VCYT) | $32.62 | $64.53 | 49.4% |

| Elastic (NYSE:ESTC) | $83.35 | $163.03 | 48.9% |

| Zillow Group (NasdaqGS:ZG) | $64.96 | $128.27 | 49.4% |

| BioLife Solutions (NasdaqCM:BLFS) | $22.79 | $44.51 | 48.8% |

| CNX Resources (NYSE:CNX) | $29.35 | $57.33 | 48.8% |

Here's a peek at a few of the choices from the screener.

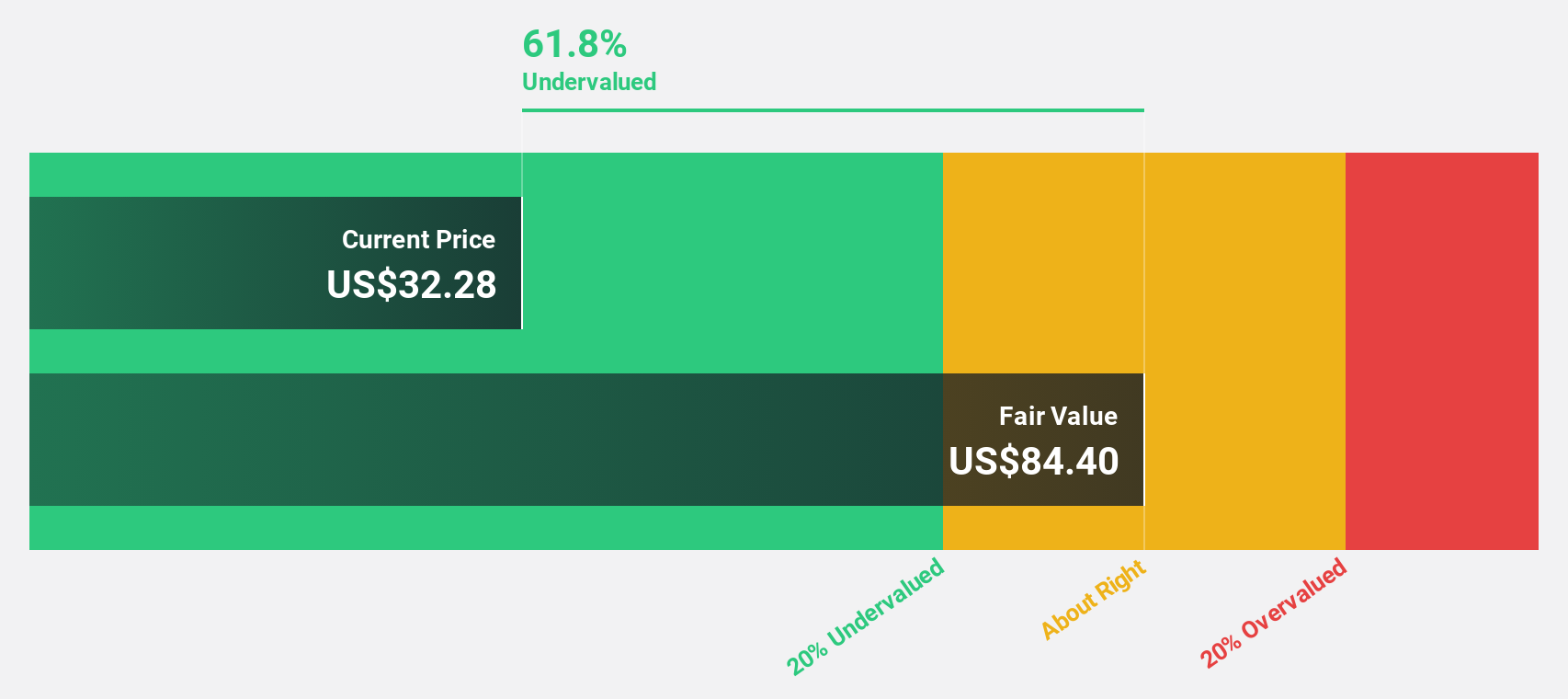

Veracyte (NasdaqGM:VCYT)

Overview: Veracyte, Inc. is a diagnostics company operating in the United States and internationally, with a market cap of approximately $2.25 billion.

Operations: The company generates revenue from its diagnostic products, amounting to $445.76 million.

Estimated Discount To Fair Value: 49.4%

Veracyte, Inc. is trading significantly below its estimated fair value, with a price of US$32.62 against a fair value estimate of US$64.53, indicating potential undervaluation based on cash flows. The company has recently become profitable with net income reaching US$24.14 million in 2024 compared to a loss the previous year. Veracyte's innovative MRD testing platform shows promising clinical performance, potentially enhancing future revenue streams and supporting its growth trajectory in the oncology diagnostics market.

- Insights from our recent growth report point to a promising forecast for Veracyte's business outlook.

- Dive into the specifics of Veracyte here with our thorough financial health report.

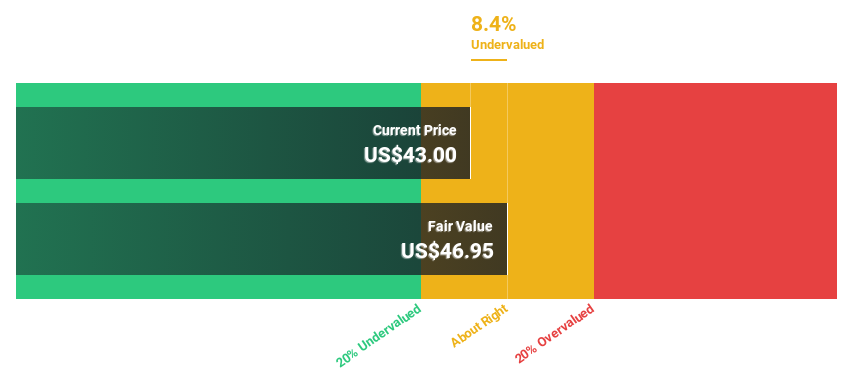

Bentley Systems (NasdaqGS:BSY)

Overview: Bentley Systems, Incorporated develops and provides infrastructure engineering software solutions globally, with a market capitalization of approximately $12.20 billion.

Operations: The company's revenue is primarily derived from its Computer Software and Related Services segment, totaling $1.35 billion.

Estimated Discount To Fair Value: 10.2%

Bentley Systems is trading slightly below its estimated fair value of US$46.96, with a current price of US$42.15, suggesting some undervaluation based on cash flows. Recent earnings show revenue growth to US$1.35 billion in 2024, but net income declined to US$234.79 million from the previous year. The company completed a share buyback worth US$92.57 million and expects revenue growth to outpace the broader U.S. market in 2025 despite high debt levels.

- Our growth report here indicates Bentley Systems may be poised for an improving outlook.

- Click here to discover the nuances of Bentley Systems with our detailed financial health report.

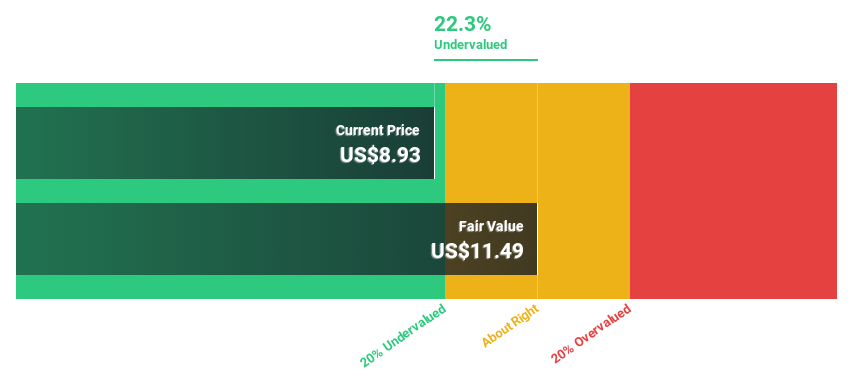

CCC Intelligent Solutions Holdings (NasdaqGS:CCCS)

Overview: CCC Intelligent Solutions Holdings Inc. is a software as a service (SaaS) company serving the property and casualty insurance sectors in the United States and China, with a market cap of approximately $5.44 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $944.80 million.

Estimated Discount To Fair Value: 21.6%

CCC Intelligent Solutions Holdings trades at US$9.02, below its estimated fair value of US$11.51, indicating undervaluation based on cash flows. The company forecasts significant earnings growth of 66.81% annually, outpacing the U.S. market's 13.5%. Recent financials show revenue reaching US$944.8 million in 2024, with a net income turnaround to US$26.15 million from a prior loss. The firm is actively pursuing M&A opportunities to bolster strategic growth and has completed a follow-on equity offering worth US$433.65 million.

- The growth report we've compiled suggests that CCC Intelligent Solutions Holdings' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of CCC Intelligent Solutions Holdings stock in this financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 183 Undervalued US Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives