- United States

- /

- Software

- /

- NasdaqGS:AVPT

3 Growth Companies With High Insider Ownership Seeing Up To 16% Revenue Growth

Reviewed by Simply Wall St

As major U.S. stock indices like the S&P 500 and Nasdaq recently hit fresh records, investors are keeping a close eye on companies that demonstrate strong growth potential amid fluctuating market conditions. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business and may offer robust revenue expansion opportunities, such as the ones experiencing up to 16% revenue growth discussed in this article.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| Hesai Group (HSAI) | 14.9% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.2% | 29.4% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

We're going to check out a few of the best picks from our screener tool.

Futu Holdings (FUTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Futu Holdings Limited operates as a digitalized securities brokerage and wealth management product distributor in Hong Kong and internationally, with a market cap of approximately $23.80 billion.

Operations: The company generates revenue from its online brokerage services and margin financing services, amounting to HK$16.10 billion.

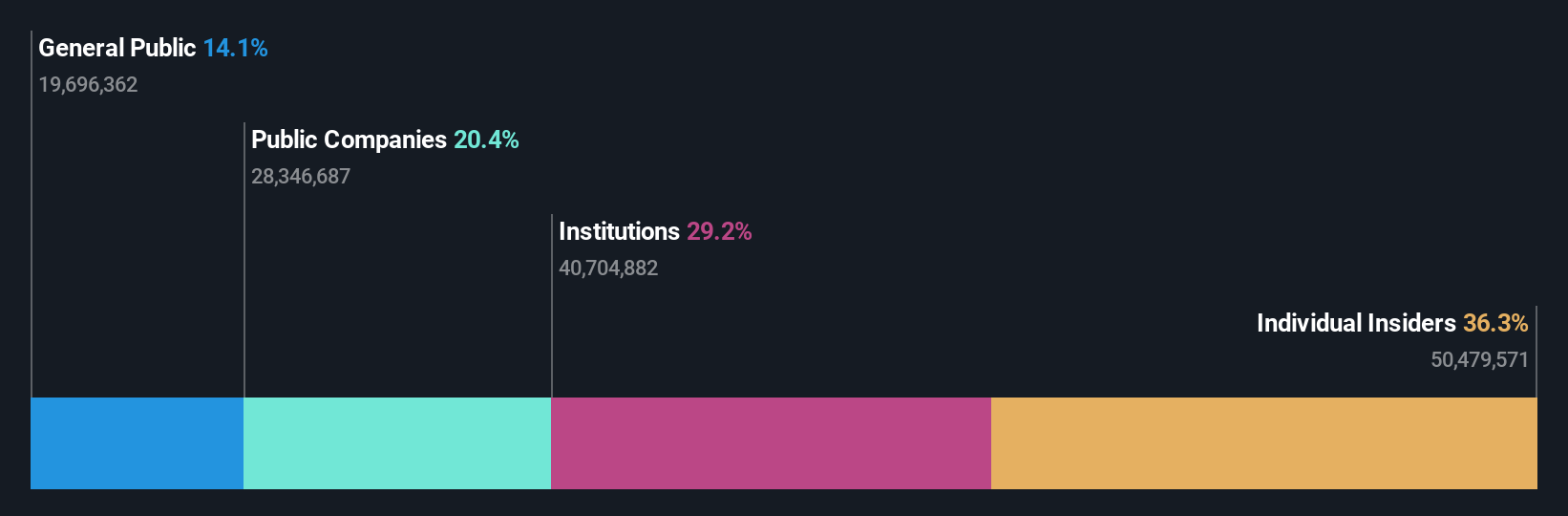

Insider Ownership: 36.3%

Revenue Growth Forecast: 14.8% p.a.

Futu Holdings is experiencing robust growth, with earnings rising by 87.5% over the past year and revenue forecasted to grow at 14.8% annually, outpacing the US market average of 9.9%. Its Price-To-Earnings ratio of 24.5x is slightly below industry standards, indicating potential value. Recent financials show significant revenue and net income increases for Q2 2025, highlighting strong operational performance despite no substantial insider trading activity in the last three months.

- Delve into the full analysis future growth report here for a deeper understanding of Futu Holdings.

- Our comprehensive valuation report raises the possibility that Futu Holdings is priced higher than what may be justified by its financials.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $3.14 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling $373.07 million.

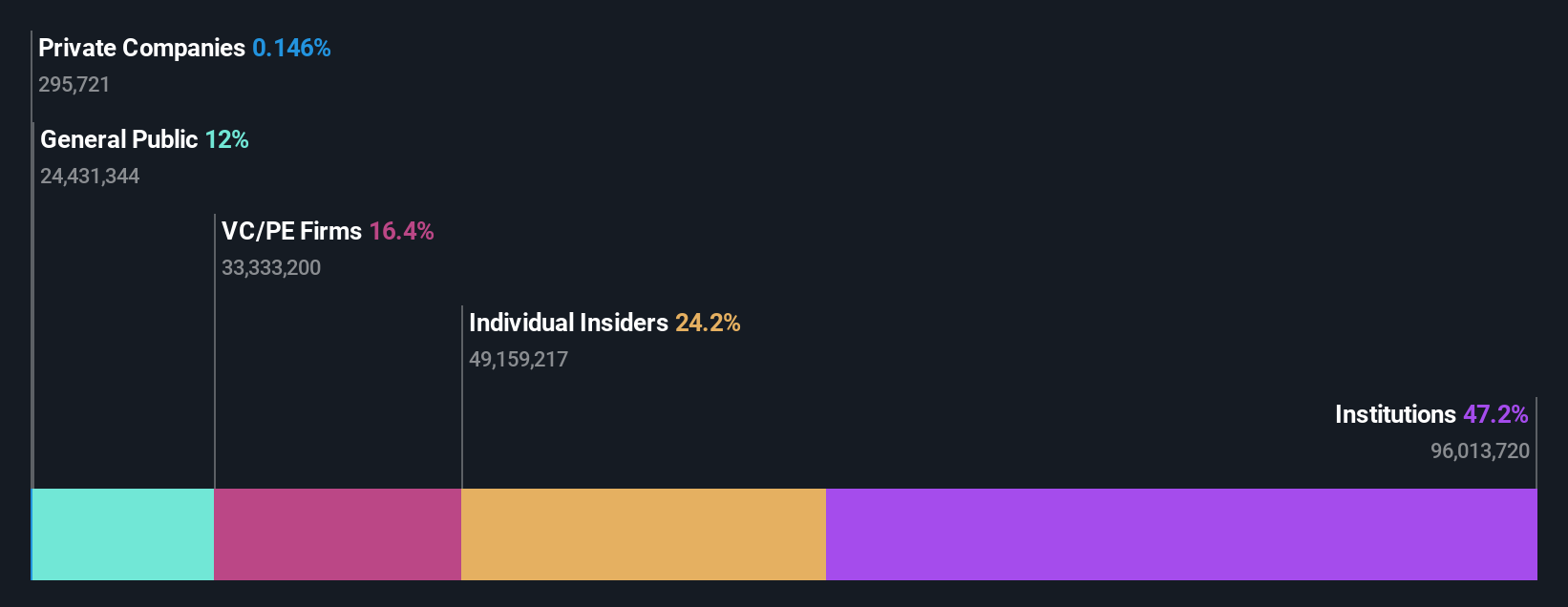

Insider Ownership: 27.4%

Revenue Growth Forecast: 16.9% p.a.

AvePoint's earnings are forecasted to grow by 83.82% annually, with a transition to profitability expected within three years, surpassing average market growth. Despite recent insider selling activity, the stock trades at 9.4% below its estimated fair value and analysts predict a 42.3% price increase. Recent strategic initiatives include an enhanced Global Partner Program aimed at boosting partner engagement and revenue streams in the growing data security sector, alongside improved Q2 financial results with net income of US$2.7 million from a previous loss.

- Click here and access our complete growth analysis report to understand the dynamics of AvePoint.

- The analysis detailed in our AvePoint valuation report hints at an inflated share price compared to its estimated value.

Frontier Group Holdings (ULCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Frontier Group Holdings, Inc. offers low-fare passenger airline services to leisure travelers in the United States and Latin America, with a market cap of $1 billion.

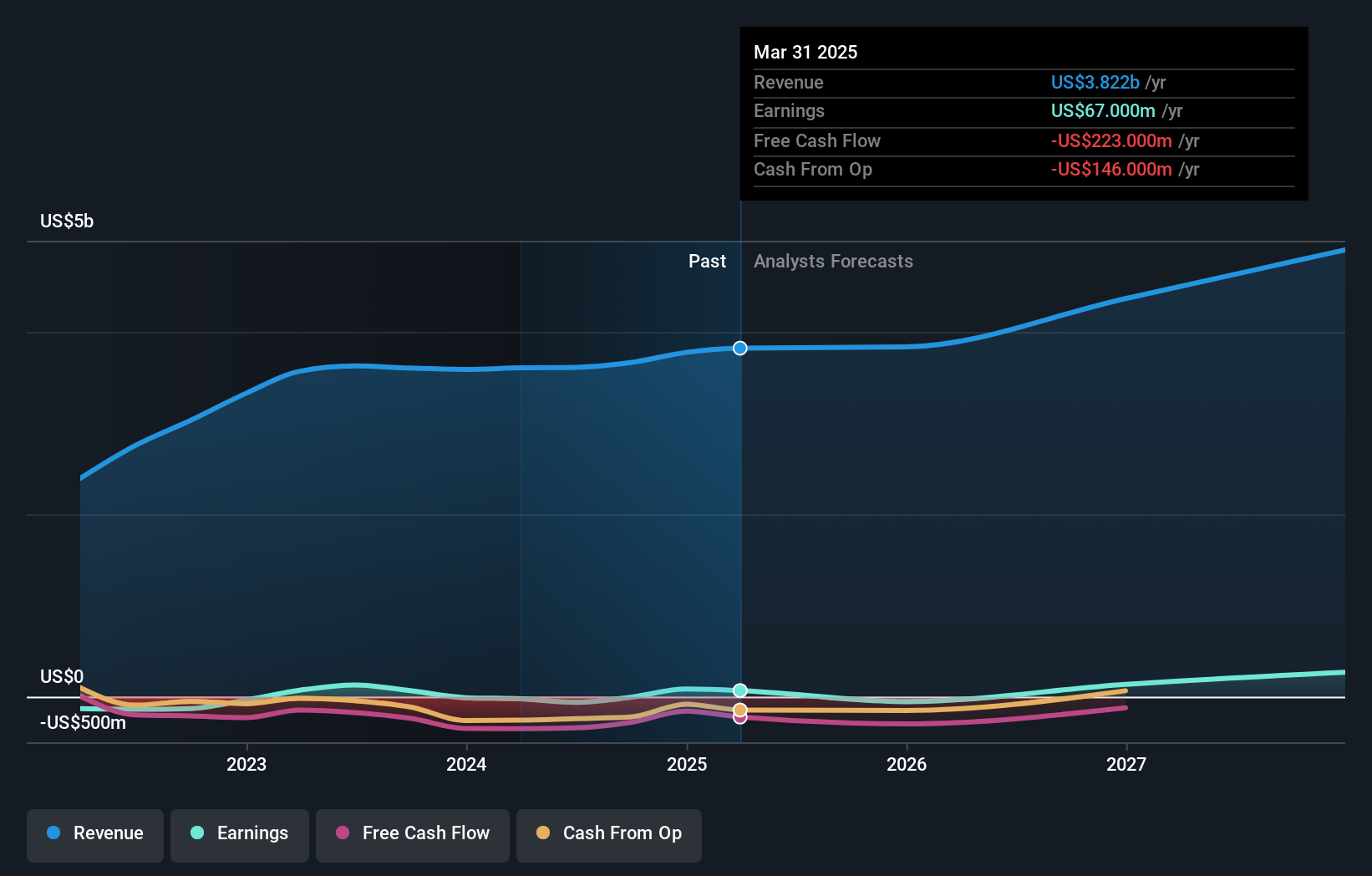

Operations: The company's revenue primarily comes from providing air transportation for passengers, totaling $3.78 billion.

Insider Ownership: 32.6%

Revenue Growth Forecast: 10.5% p.a.

Frontier Group Holdings is forecasted to achieve profitability within three years, with earnings growth expected at 95.62% annually, surpassing the US market's average. Despite recent insider selling and a volatile share price, it trades at a favorable value compared to peers. Recent financials show a Q2 net loss of US$70 million on revenue of US$929 million, but its projected revenue growth outpaces the broader market at 10.5% annually.

- Take a closer look at Frontier Group Holdings' potential here in our earnings growth report.

- Our valuation report unveils the possibility Frontier Group Holdings' shares may be trading at a discount.

Taking Advantage

- Gain an insight into the universe of 203 Fast Growing US Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives