- United States

- /

- Software

- /

- NasdaqGS:AUR

Assessing Aurora Innovation (AUR) Valuation After New Texas Route Expansion and Next-Gen Robotrucking Hardware Plans

Reviewed by Simply Wall St

Aurora Innovation (AUR) jumped about 13% as investors reacted to the company’s latest Texas expansion, which adds a second autonomous truck route and highlights new milestones in fully driverless freight operations.

See our latest analysis for Aurora Innovation.

That 13% pop sits against a choppier backdrop, with a strong 7 day share price return but a weaker year to date share price return and still impressive three year total shareholder return. This suggests long term optimism remains, while near term sentiment is rebuilding around milestones like the new Texas route and upcoming hardware upgrade.

If Aurora’s momentum has your attention, this is also a good moment to explore other high growth tech and AI names using our high growth tech and AI stocks for fresh ideas beyond autonomous trucking.

With shares still well below analyst targets despite a strong three year run, the key question now is whether Aurora remains undervalued on its long term robotrucking ambitions or if the market is already pricing in that future growth.

Price to Book of 3.9x: Is it justified?

Aurora Innovation’s recent close at $4.57 lines up with a mixed valuation picture, looking cheap next to peers but expensive versus the broader software industry.

The preferred metric here is the price to book ratio, which compares the company’s market value to its net assets on the balance sheet. For early stage, loss making software and autonomy players, this multiple often captures how much investors are willing to pay today for future technology potential rather than current earnings.

Against its directly comparable peers, Aurora trades at 3.9 times book value, below the peer average of 6.5 times. This implies investors are paying less for each dollar of net assets than in similar names. Yet when set against the wider US software industry, where the average price to book stands at 3.4 times, Aurora trades at a premium. This suggests the market is already factoring in stronger growth or strategic positioning than the typical software stock.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 3.9x (ABOUT RIGHT)

However, weak recent returns and ongoing heavy losses mean execution missteps, regulatory setbacks, or slower commercial uptake could quickly undermine the current optimism.

Find out about the key risks to this Aurora Innovation narrative.

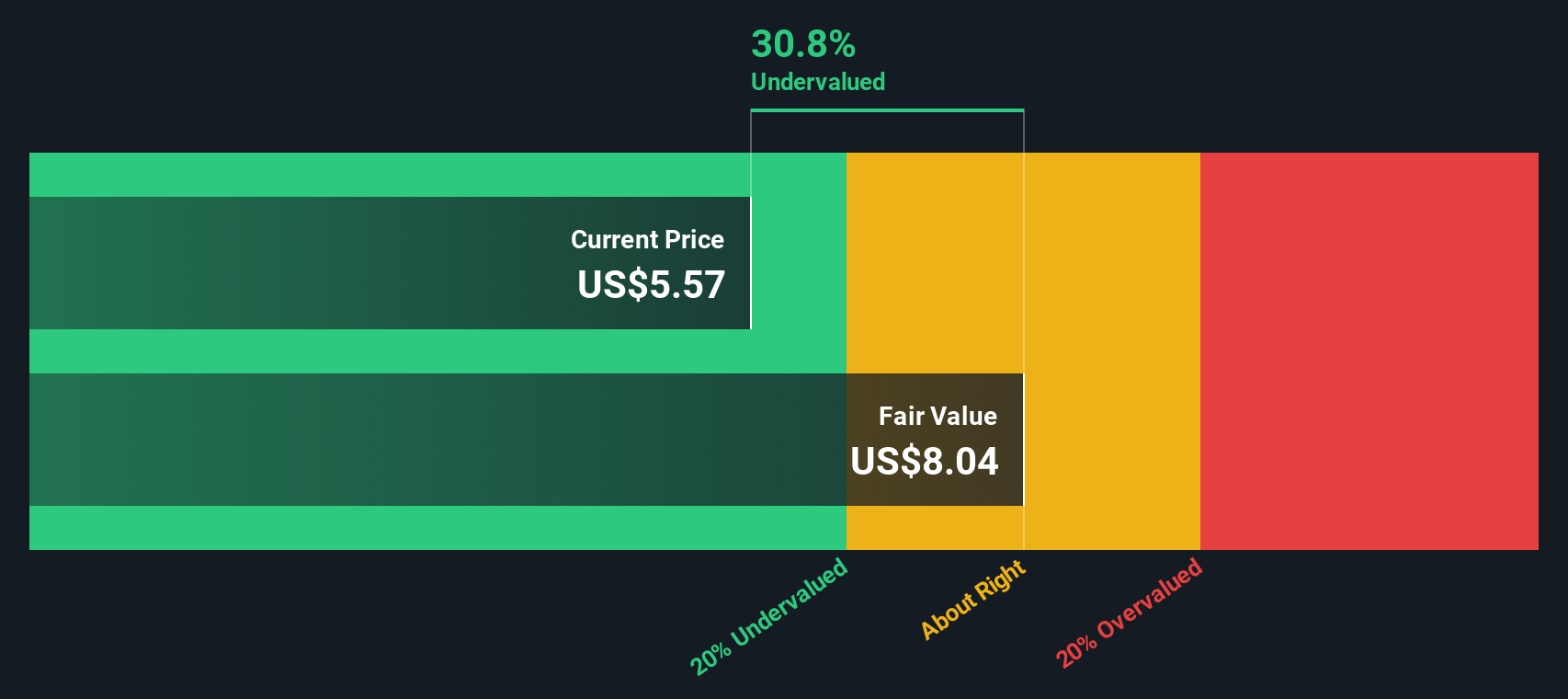

Another View: Our DCF Fair Value Check

While the 3.9 times book valuation looks roughly reasonable, our DCF model points to a fair value of about $6.28 per share, roughly 27% above the current price. If the market starts to believe in Aurora’s long term cash flow story, that gap could narrow.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aurora Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aurora Innovation Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in minutes, starting with Do it your way.

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by using the Simply Wall Street Screener to uncover focused stock ideas that match your strategy.

- Identify potential market mispricings by targeting companies flagged as undervalued on future cash flows through these 912 undervalued stocks based on cash flows before the rest of the market reacts.

- Explore opportunities in innovation by focusing on companies involved in AI through these 26 AI penny stocks while the theme remains a key area of interest.

- Support your income stream by prioritizing consistent payers with attractive yields using these 15 dividend stocks with yields > 3% so your portfolio can continue generating cash flow even when markets are less active.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)