- United States

- /

- Communications

- /

- NasdaqGM:AAOI

US High Growth Tech Stocks to Watch in November 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to rise for the fourth consecutive session, with major indexes like the Nasdaq and S&P 500 on track for their best week since June, investor sentiment remains buoyant ahead of the Thanksgiving break. In this environment of optimism and momentum, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience in adapting to evolving market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Pelthos Therapeutics | 47.08% | 110.99% | ★★★★★☆ |

| Workday | 11.27% | 32.65% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 17.52% | 32.59% | ★★★★★☆ |

| Circle Internet Group | 26.03% | 84.68% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.93% | 45.55% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Applied Optoelectronics (AAOI)

Simply Wall St Growth Rating: ★★★★★☆

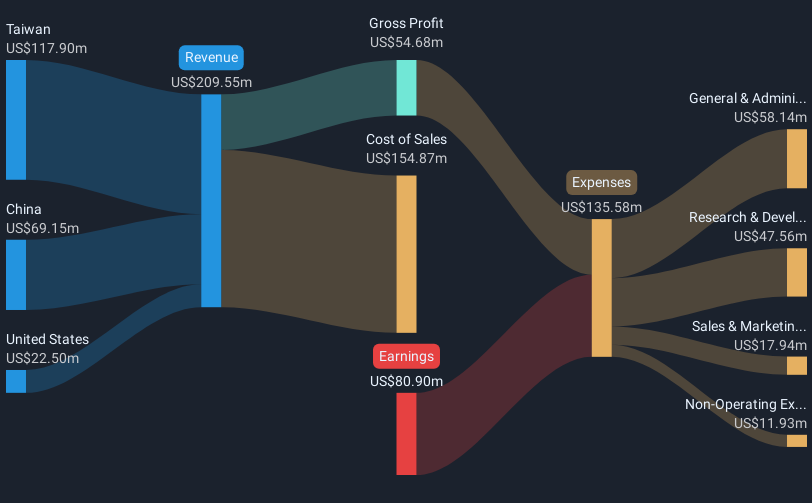

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market capitalization of approximately $1.75 billion.

Operations: The company generates revenue primarily from its optical networking equipment segment, which accounts for $421.71 million.

Applied Optoelectronics, Inc. (AOI) has demonstrated a significant rebound with its sales surging to $321.44 million over the past nine months, marking a robust annualized growth of 42.2%. This growth trajectory is underscored by recent strategic expansions, including a major onshoring initiative in Sugar Land, Texas, which is set to enhance AOI's manufacturing capabilities specifically for AI-focused data centers—a move aligning with industry demands for more localized and advanced production facilities. Despite facing challenges such as a net loss of $36.21 million in the same period, AOI's aggressive R&D efforts and innovative product launches like the 800G OSFP 2xSR4 multimode optical transceiver indicate a forward-thinking approach aimed at capturing emerging market opportunities in high-speed data transmission technologies. These strategic decisions are expected to position AOI favorably within the competitive tech landscape as it transitions towards profitability forecasted over the next three years.

Agilysys (AGYS)

Simply Wall St Growth Rating: ★★★★☆☆

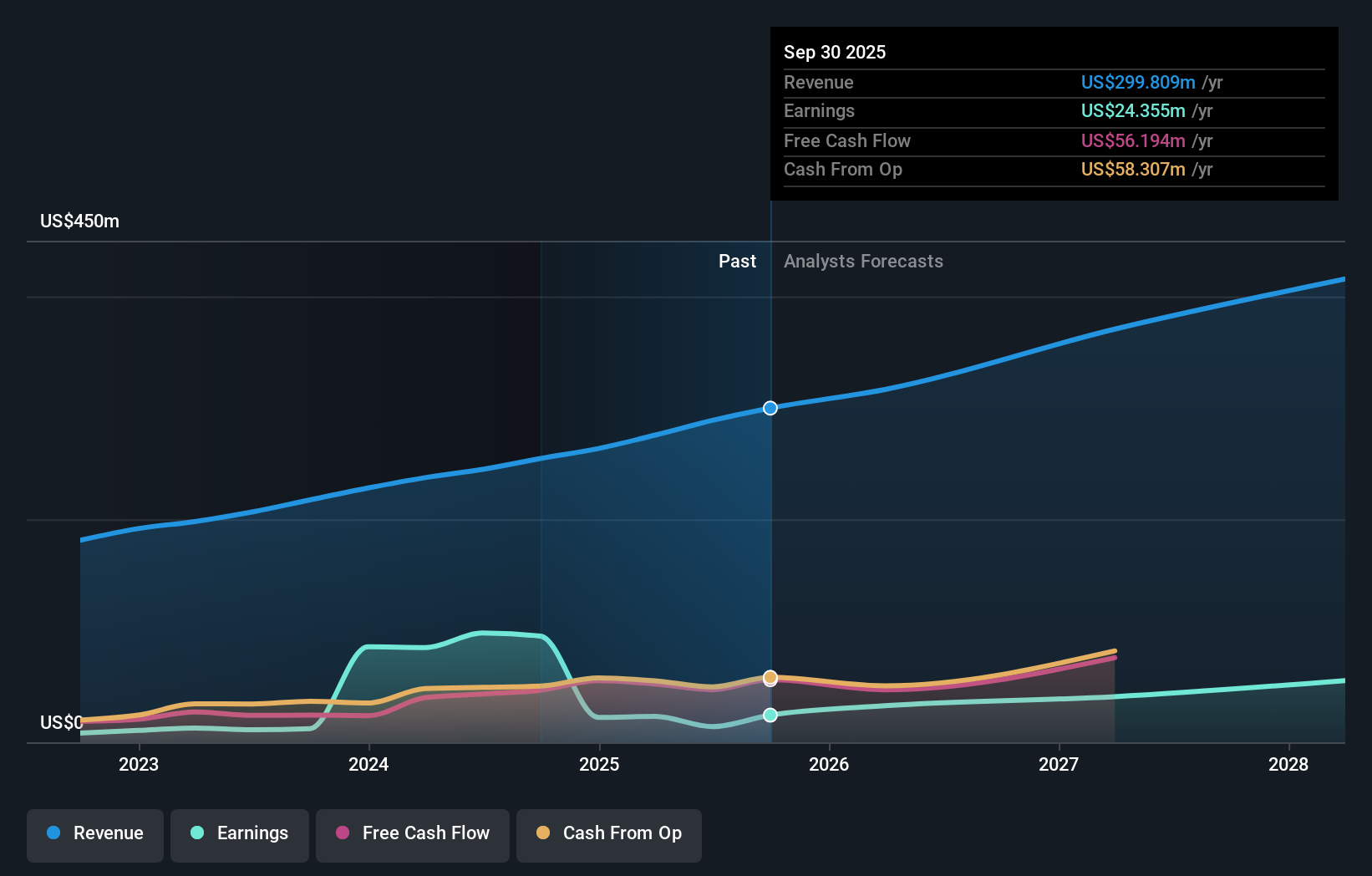

Overview: Agilysys, Inc. is a company that develops and markets software-enabled solutions and services for the hospitality industry across North America, Europe, the Asia-Pacific, and India, with a market capitalization of approximately $3.51 billion.

Operations: The company generates revenue primarily from providing software solutions to the global hospitality industry, amounting to $299.81 million.

Agilysys, Inc. has recently raised its fiscal 2026 earnings guidance, reflecting an optimistic outlook with projected total revenue between $315 million and $318 million. This adjustment accompanies a substantial increase in subscription revenue growth expectations to 29% year-over-year. The company's strategic moves, including the addition of Sudharshan Chary to the executive team, underscore its commitment to leveraging data-driven insights for operational excellence in the hospitality sector. Moreover, Agilysys is enhancing service delivery across multiple casino properties through integrated technology solutions like InfoGenesis POS and Eatec inventory systems, setting a new standard for efficiency and customer satisfaction within the industry. These initiatives are pivotal as Agilysys continues to outpace average market growth with a forecasted annual revenue increase of 13.7% and earnings growth of 29.4%.

- Unlock comprehensive insights into our analysis of Agilysys stock in this health report.

Assess Agilysys' past performance with our detailed historical performance reports.

Cheetah Mobile (CMCM)

Simply Wall St Growth Rating: ★★★★★☆

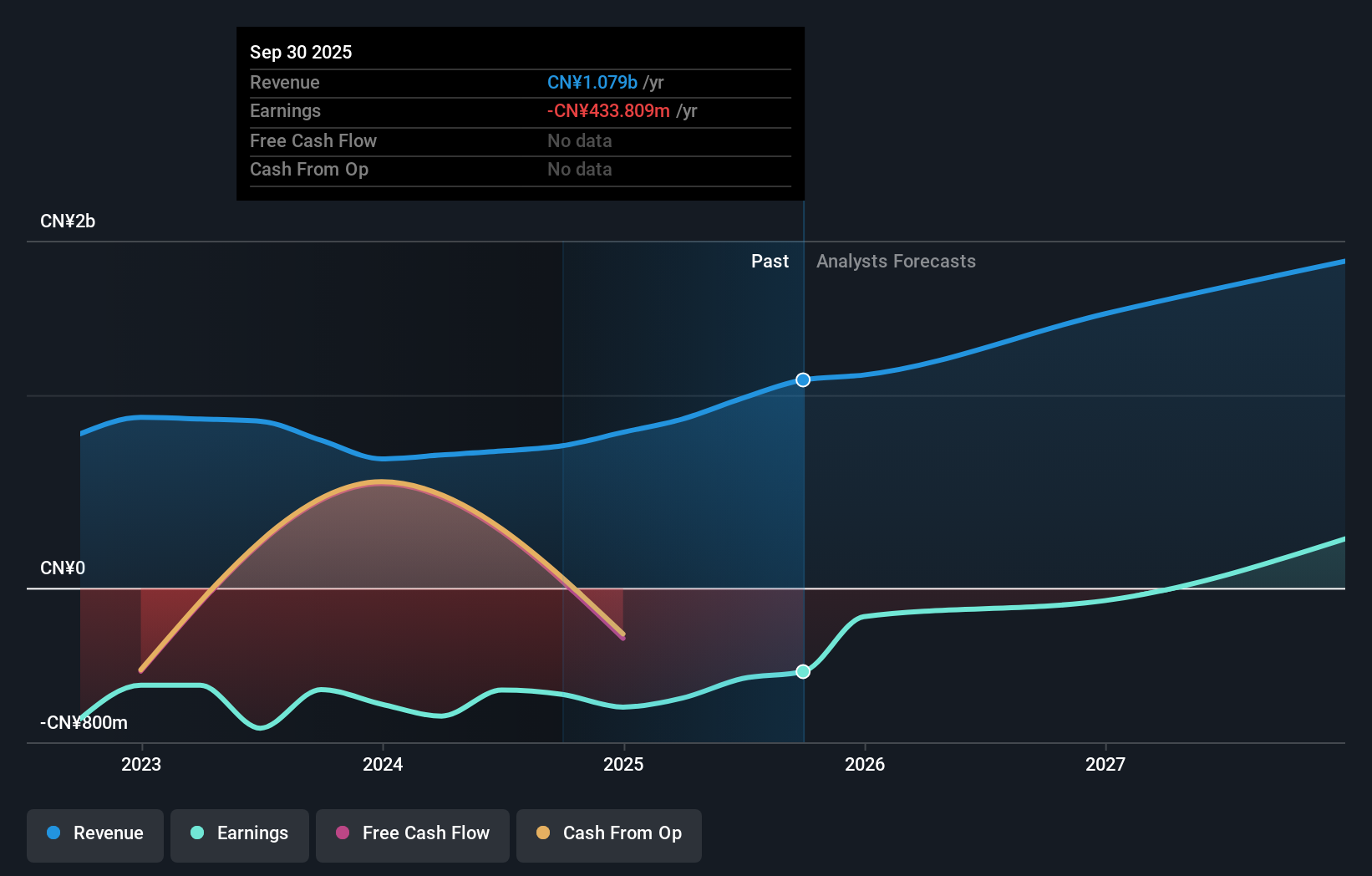

Overview: Cheetah Mobile Inc., along with its subsidiaries, offers internet and artificial intelligence services across China, Hong Kong, Japan, and other international markets, with a market capitalization of approximately $257.99 million.

Operations: Cheetah Mobile generates revenue primarily through its internet services and artificial intelligence offerings across multiple regions, including China, Hong Kong, and Japan. The company's operations are supported by a market presence in international markets.

Cheetah Mobile has shown a robust rebound in its financial performance, with revenue surging to CNY 841.59 million over nine months, marking a significant improvement from the previous year. This growth is underpinned by an aggressive reduction in net losses to CNY 66.97 million from CNY 250.77 million, reflecting tighter cost controls and operational efficiencies. Despite current unprofitability, the company is on a trajectory towards profitability with earnings expected to grow by an impressive 114.89% annually. This potential turnaround is supported by substantial R&D investments aimed at innovating and enhancing their software solutions, positioning them well within the competitive tech landscape as they move closer to achieving market parity in terms of revenue growth rates and industry benchmarks for return on equity forecasted at 7.5%.

- Click here and access our complete health analysis report to understand the dynamics of Cheetah Mobile.

Review our historical performance report to gain insights into Cheetah Mobile's's past performance.

Summing It All Up

- Unlock our comprehensive list of 72 US High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)