- United States

- /

- Software

- /

- NasdaqCM:AEYE

Imagine Owning AudioEye (NASDAQ:AEYE) While The Price Tanked 55%

AudioEye, Inc. (NASDAQ:AEYE) shareholders will doubtless be very grateful to see the share price up 33% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 55% in the period. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

View our latest analysis for AudioEye

AudioEye isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

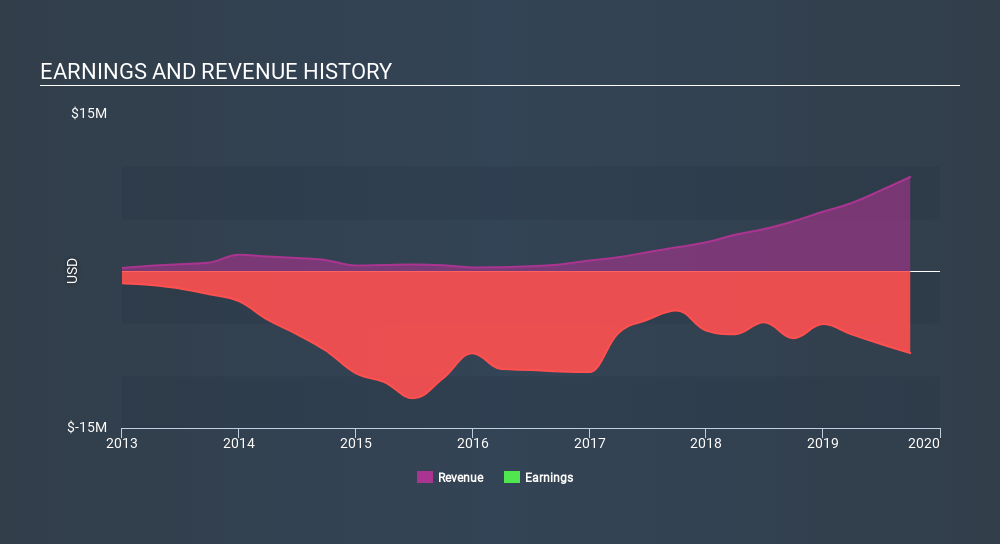

Over five years, AudioEye grew its revenue at 58% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 15% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

You can see below how earnings and revenue have changed over time.

If you are thinking of buying or selling AudioEye stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in AudioEye had a tough year, with a total loss of 26%, against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 15% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course AudioEye may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:AEYE

AudioEye

Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States and Europe.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives