- United States

- /

- Software

- /

- NasdaqGS:DDOG

Exploring 3 US High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements, with the S&P 500 and Nasdaq on winning streaks amid easing global trade tensions and stable economic data, investors are closely monitoring high-growth tech stocks for potential opportunities. In this dynamic environment, identifying promising tech companies that can enhance a portfolio involves considering factors such as innovation potential, scalability, and resilience to broader market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.28% | 37.43% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Legend Biotech | 26.73% | 59.51% | ★★★★★★ |

| Travere Therapeutics | 25.39% | 64.80% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Autodesk (NasdaqGS:ADSK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Autodesk, Inc. offers 3D design, engineering, and entertainment technology solutions globally with a market cap of approximately $63.54 billion.

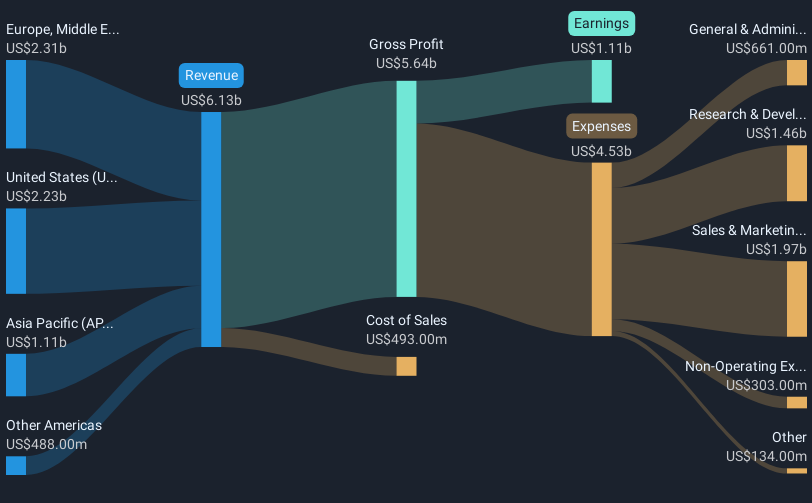

Operations: The company generates revenue primarily from its CAD/CAM software segment, which accounts for $6.13 billion.

Autodesk, despite not outpacing the software industry's earnings growth of 23.8% with its own 22.7%, shows robust financial health with a significant Return on Equity forecasted at 44.6% in three years. The company's strategic maneuvers, including the recent $1.5 billion unsecured revolving loan facility, underscore its readiness for future investments and operational flexibility. Innovations like integrating safety and change management tools into Autodesk Construction Cloud® highlight its commitment to enhancing construction project efficiency and transparency, positioning it well within the high-growth tech sector despite slower anticipated revenue growth compared to market leaders.

- Dive into the specifics of Autodesk here with our thorough health report.

Review our historical performance report to gain insights into Autodesk's's past performance.

CrowdStrike Holdings (NasdaqGS:CRWD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market capitalization of approximately $109.64 billion.

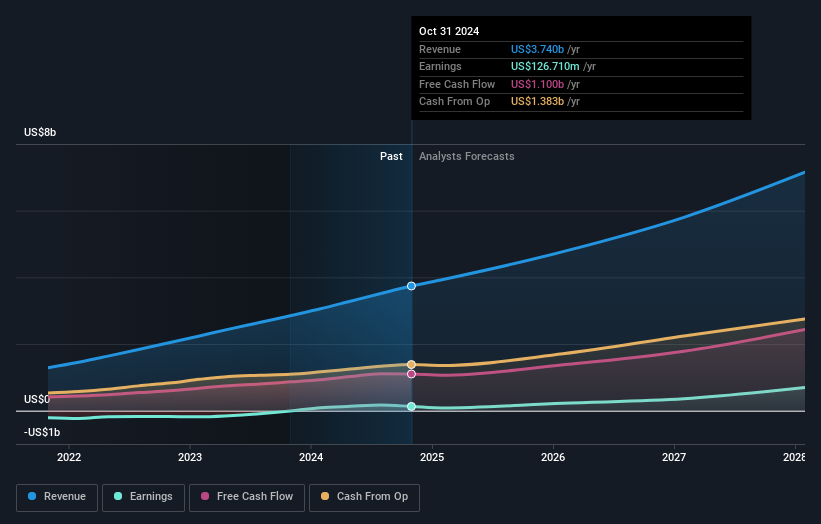

Operations: With a market cap of approximately $109.64 billion, CrowdStrike generates revenue primarily through its Security Software & Services segment, which amounts to $3.95 billion.

CrowdStrike Holdings continues to redefine cybersecurity with its AI-driven Falcon platform, particularly highlighted by its recent expansion of threat detection capabilities. In April 2025, the company unveiled significant enhancements to Falcon® Identity Protection and Next-Gen SIEM, addressing the sophisticated landscape of cloud threats and identity theft. These innovations not only strengthen security across hybrid environments but also streamline operations by eliminating the need for multiple security tools. This strategic focus on integrated solutions is crucial as CrowdStrike reported a notable revenue increase to $1.06 billion in Q4 FY2025, up from $845 million in the prior year, despite a shift to a net loss in the same period.

- Unlock comprehensive insights into our analysis of CrowdStrike Holdings stock in this health report.

Understand CrowdStrike Holdings' track record by examining our Past report.

Datadog (NasdaqGS:DDOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market capitalization of $40.51 billion.

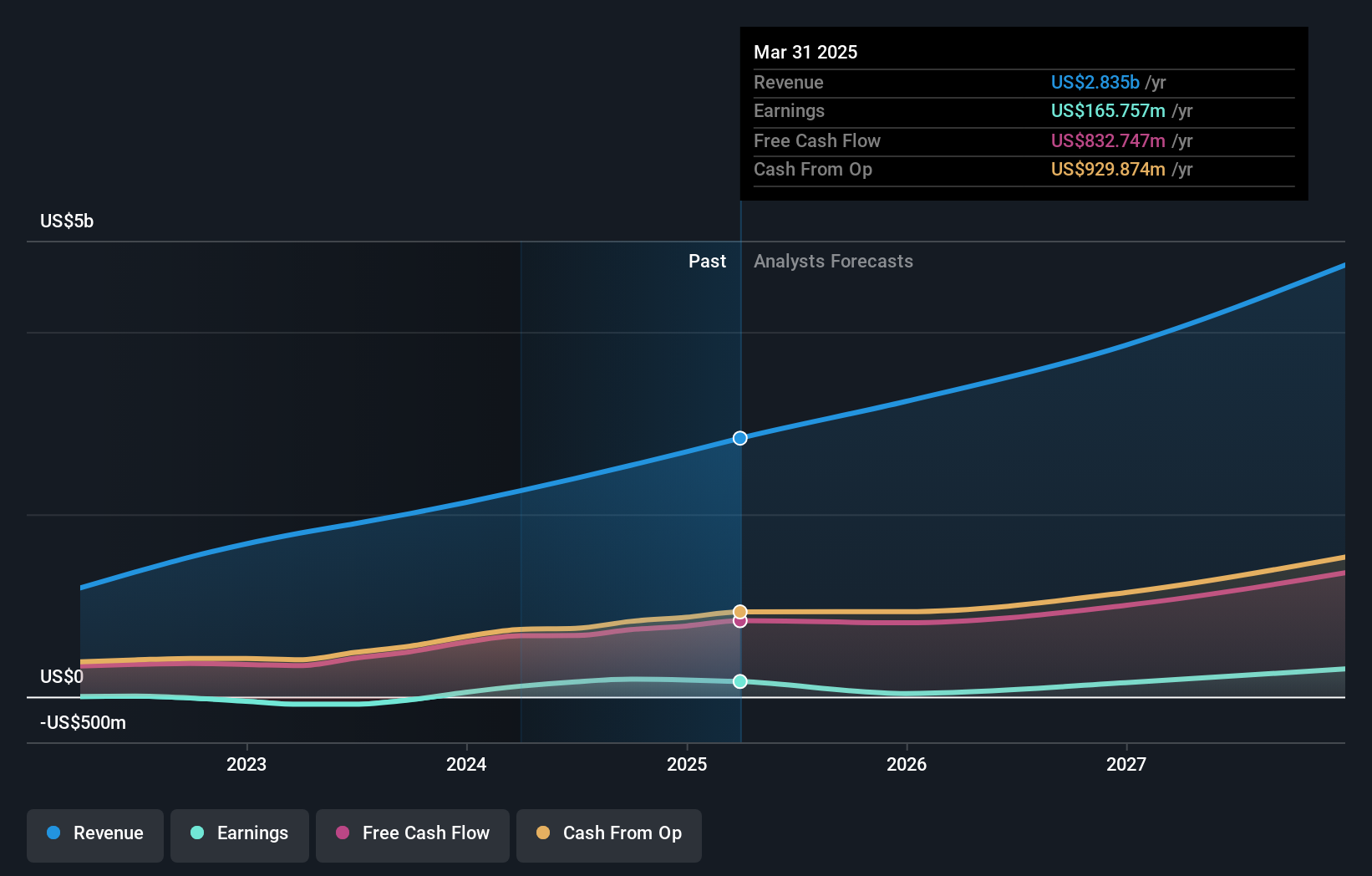

Operations: The company generates revenue primarily from its IT Infrastructure segment, which amounts to $2.83 billion. The platform serves both domestic and international markets, focusing on observability and security for cloud applications.

Datadog's strategic maneuvering in the tech landscape is underscored by its robust earnings growth of 43.8% over the past year, outpacing the software industry's average of 23.8%. Despite a dip in net income from $42.63 million to $24.64 million in Q1 2025, Datadog forecasts revenue growth between $787 million and $791 million for Q2 and anticipates reaching up to $3.235 billion annually. The partnership with Chainguard enhances its container observability solutions, promising more secure software delivery through proactive CVE remediation—a critical edge as it addresses pressing security vulnerabilities within tech infrastructures. This integration not only broadens Datadog’s service offerings but also solidifies its position in a competitive market by aligning enhanced security features with substantial revenue trajectories.

Turning Ideas Into Actions

- Discover the full array of 234 US High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)