- United States

- /

- Software

- /

- NasdaqGS:ACIW

Surge in Volatility and ROCE Could Be a Game Changer for ACI Worldwide (ACIW)

Reviewed by Simply Wall St

- In recent days, ACI Worldwide has seen a significant rise in options market volatility alongside strong growth in its return on capital employed (ROCE), which now stands at 15%, notably above the software industry average of 9.2%.

- This combination of heightened implied volatility and improved efficiency has drawn increased market attention, highlighting investor anticipation of potential major developments in the company’s operations or financials.

- We'll examine how the heightened options activity and ROCE improvement could influence ACI Worldwide's future investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ACI Worldwide Investment Narrative Recap

To hold ACI Worldwide, an investor needs confidence in the company's ability to turn operational improvements into lasting financial gains, especially as it adapts to rapid changes in digital payments. The recent spike in options market volatility signals short-term uncertainty, but unless it translates into material changes in contract timing, technology adoption, or customer behavior, it may not significantly alter the leading catalyst, continued growth from the next-generation Connetic platform, or the main risk of revenue and margin unpredictability linked to payment software contract cycles.

Among recent announcements, the integration of UK and global payment capabilities into ACI's Connetic platform in May stands out. This development directly supports one of the stock's key catalysts, as Connetic's AI-driven fraud prevention and real-time payments address growing demand for security and speed in financial transactions, a trend likely to influence both top-line performance and recurring revenues moving forward. Yet, in contrast, investors should be aware of ongoing volatility in Payment Software segment revenue, especially as...

Read the full narrative on ACI Worldwide (it's free!)

ACI Worldwide's narrative projects $2.0 billion in revenue and $277.3 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $26.2 million earnings increase from current earnings of $251.1 million.

Uncover how ACI Worldwide's forecasts yield a $64.60 fair value, a 26% upside to its current price.

Exploring Other Perspectives

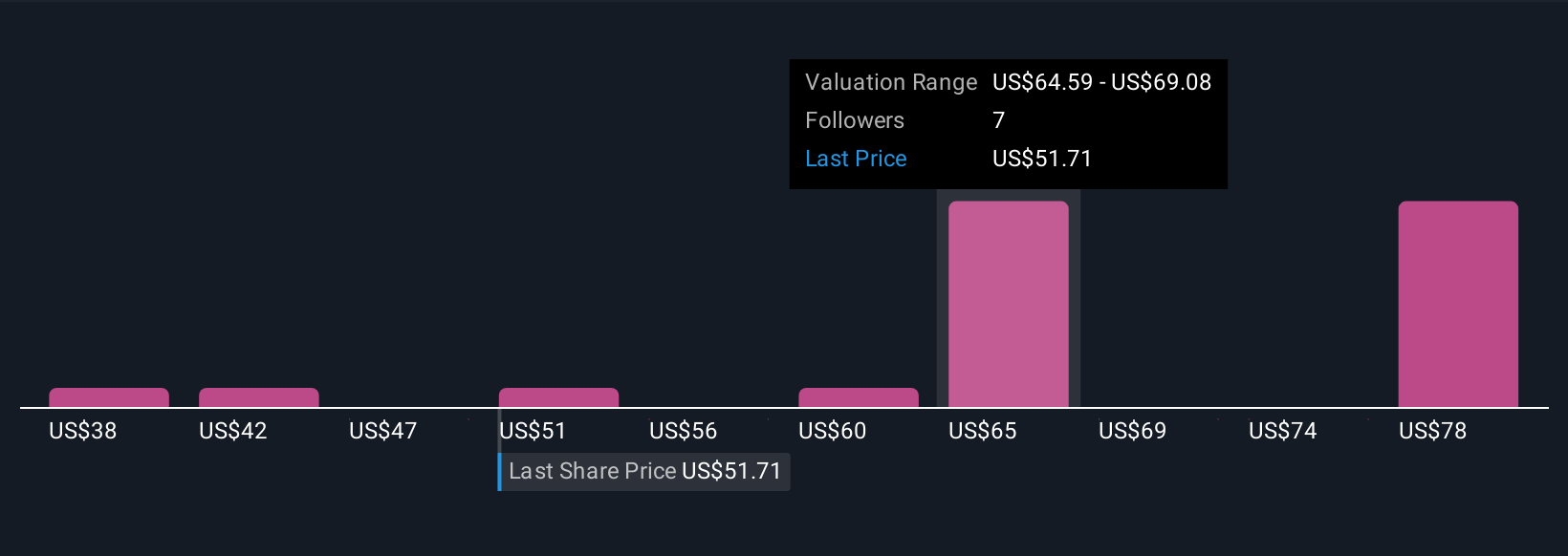

Six separate fair value estimates from the Simply Wall St Community range from US$37.66 to US$83.32 per share. While some see room for upside, the recurring volatility in contract-related revenues is a reminder that market participants are weighing both opportunity and uncertainty when considering ACI Worldwide’s future, consider comparing these viewpoints and risks for a broader understanding.

Explore 6 other fair value estimates on ACI Worldwide - why the stock might be worth as much as 63% more than the current price!

Build Your Own ACI Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACI Worldwide research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ACI Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACI Worldwide's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives