- United States

- /

- Software

- /

- NasdaqGS:ACIW

ACI Worldwide and BitPay Crypto Integration Might Change The Case For Investing In ACI Worldwide (ACIW)

Reviewed by Sasha Jovanovic

- On October 16, 2025, ACI Worldwide announced a strategic alliance with BitPay to expand digital asset payment acceptance and management for merchants and payment service providers within its Payments Orchestration Platform.

- The integration allows seamless handling of cryptocurrencies and stablecoins, reflecting rising global retail interest in digital currency payments and positioning ACI to address evolving merchant needs.

- To further explore the impact, we'll examine how the BitPay partnership supports ACI's ambitions in digital payment innovation and growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

ACI Worldwide Investment Narrative Recap

For investors considering ACI Worldwide, belief in the company’s ability to drive recurring revenue and margin growth through digital payment innovation is key. The BitPay partnership reinforces ACI’s commitment to alternative payment types, supporting the short-term catalyst of rising digital asset adoption, though its immediate impact does not materially shift the main risk: ongoing revenue volatility from contract cycles and competitive threats in core software.

Among recent announcements, Solaris SE’s selection of ACI Connetic to centralize SEPA instant payments stands out because it directly ties to one of ACI's primary catalysts: expanding the adoption of its cloud-native payments hub to improve operational efficiency and scale with new fintech and BaaS clients. As real-time payment technology rolls out globally, these platform wins are tightly linked to recurring growth and margin potential, the central themes for ACI’s near-term story.

However, it remains crucial for investors to understand the growing competitive pressure from new and traditional payment providers, particularly as...

Read the full narrative on ACI Worldwide (it's free!)

ACI Worldwide’s outlook anticipates $2.0 billion in revenue and $277.3 million in earnings by 2028. This is based on a 5.1% annual revenue growth rate and a $26.2 million increase in earnings from the current level of $251.1 million.

Uncover how ACI Worldwide's forecasts yield a $64.60 fair value, a 33% upside to its current price.

Exploring Other Perspectives

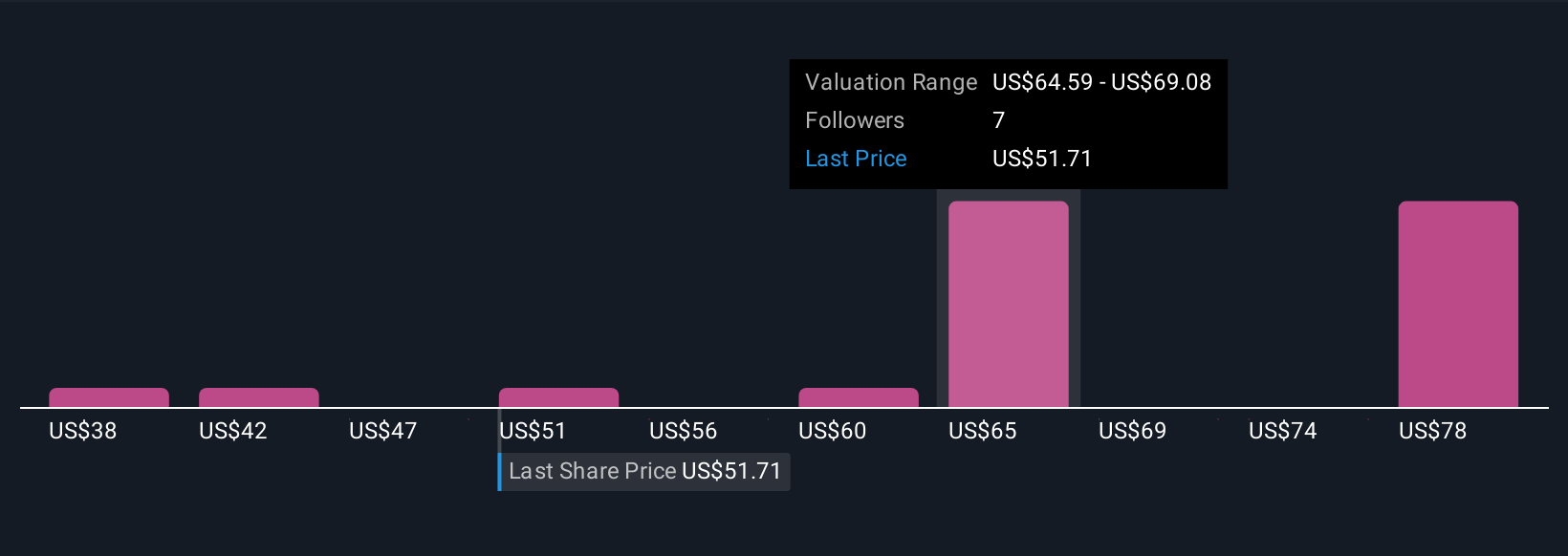

Six independent fair value estimates from the Simply Wall St Community range from US$37.66 to US$82.28 per share, reflecting broad divergence in outlooks. Platform competition and digital payment adoption can swing sentiment and outcomes, so consider these varied viewpoints as you form your own expectations.

Explore 6 other fair value estimates on ACI Worldwide - why the stock might be worth as much as 69% more than the current price!

Build Your Own ACI Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free ACI Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACI Worldwide's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)