- United States

- /

- Semiconductors

- /

- NasdaqGS:RMBS

Rambus Inc.'s (NASDAQ:RMBS) Share Price Could Signal Some Risk

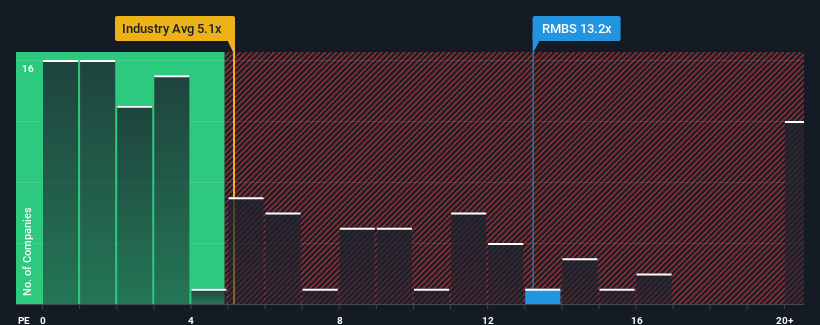

Rambus Inc.'s (NASDAQ:RMBS) price-to-sales (or "P/S") ratio of 13.2x might make it look like a strong sell right now compared to the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 5.1x and even P/S below 1.9x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Rambus

How Rambus Has Been Performing

While the industry has experienced revenue growth lately, Rambus' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rambus.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Rambus' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 85% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 26% each year, which is noticeably more attractive.

In light of this, it's alarming that Rambus' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Rambus trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Rambus (2 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Rambus' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RMBS

Rambus

Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives