- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

The Rigetti Computing, Inc. (NASDAQ:RGTI) Analysts Have Been Trimming Their Sales Forecasts

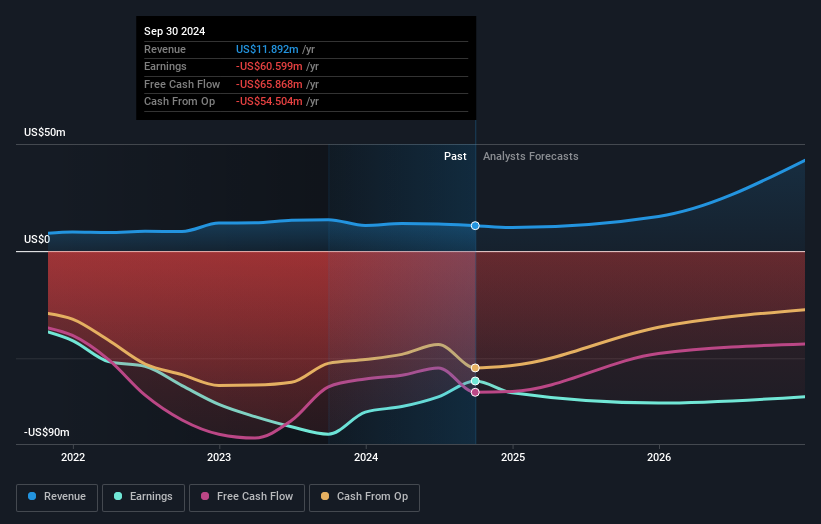

Market forces rained on the parade of Rigetti Computing, Inc. (NASDAQ:RGTI) shareholders today, when the analysts downgraded their forecasts for next year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. Shares are up 8.4% to US$1.55 in the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

Following the downgrade, the latest consensus from Rigetti Computing's five analysts is for revenues of US$16m in 2025, which would reflect a huge 36% improvement in sales compared to the last 12 months. Losses are expected to increase slightly, to US$0.34 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$24m and losses of US$0.33 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for Rigetti Computing

There was no major change to the consensus price target of US$2.88, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 28% growth on an annualised basis. That is in line with its 25% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 19% per year. So it's pretty clear that Rigetti Computing is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses next year, suggesting all may not be well at Rigetti Computing. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Rigetti Computing after today.

That said, the analysts might have good reason to be negative on Rigetti Computing, given dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)