- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (NasdaqCM:RGTI) Completes $350M Equity Offering

Reviewed by Simply Wall St

Rigetti Computing (NasdaqCM:RGTI) experienced a notable share price movement, increasing by 41% over the last quarter. This shift coincided with its transition from value-oriented to growth-focused indexes, suggesting a re-evaluation of its market positioning. The company's strategic realignment under growth benchmarks appears to have played a role in this valuation change. While the broader market remained flat amid ongoing trade uncertainties, Rigetti's refined index listings and collaborative efforts in quantum technology may have contributed positively. Additionally, the successful completion of a $350 million equity offering likely supported investor confidence in its growth ambitions.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, Rigetti Computing has achieved a very large total return of over 900%. This considerable increase in shareholder value contrasts with the broader US market, which returned 11.4% in the same period, and the US Semiconductor industry, which returned 16.6%. The move into growth-focused indexes and successful capital raising initiatives may have significantly influenced this upward trajectory.

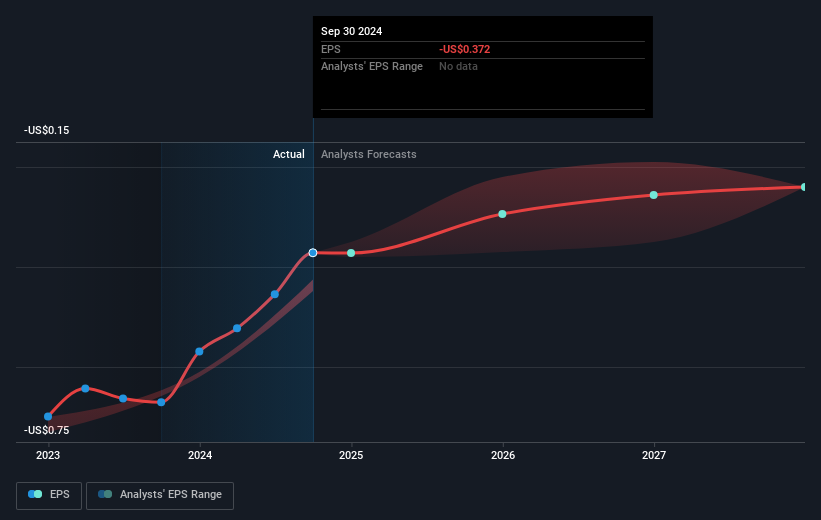

Rigetti's transition to growth-oriented benchmarks, as noted earlier, may positively impact its revenue and earnings forecasts. The company's efforts to position itself within the growth sector, combined with strategic collaborations in quantum computing, could foster potential revenue growth. However, despite these measures, analysts expect Rigetti to remain unprofitable in the near future. Regarding price movement, the current share price remains below the consensus analyst target, indicating a forecasted potential uplift of around 21.8%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)