- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (NasdaqGS:ON) Posts 30% Price Surge Over Last Month Despite Q1 2025 Net Loss

Reviewed by Simply Wall St

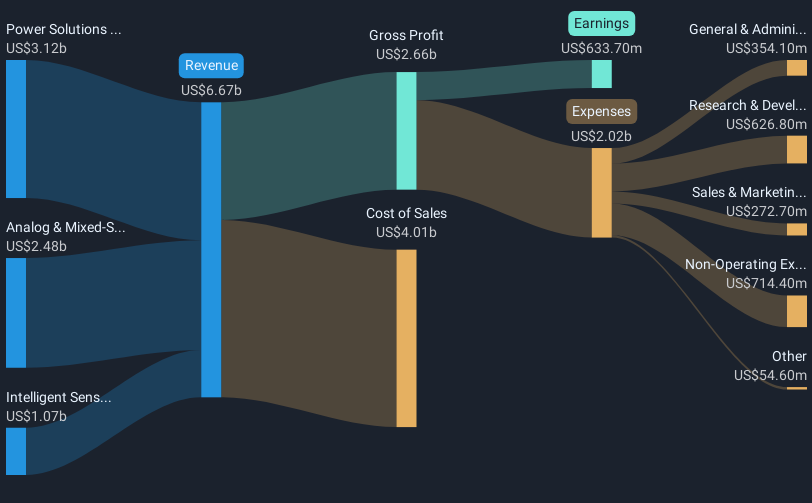

ON Semiconductor (NasdaqGS:ON) has been actively engaging in a share buyback program, with a significant tranche completed that may have bolstered investor confidence. Despite reporting a net loss for the first quarter of 2025, alongside reduced sales figures, the company's stock price increased by 30% over the last month. This sharp rise contrasts the broader market's more modest 4% uptick, suggesting that ON's ongoing share repurchases, despite negative earnings news, may have contributed positively to investor sentiment and possibly influenced the significant share price movement within this timeframe.

You should learn about the 2 weaknesses we've spotted with ON Semiconductor.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent news of ON Semiconductor's share buyback program, despite the unfavorable earnings report, has seemingly influenced investor sentiment positively, leading to a notable rise in its share price. This upward movement contrasts with the company's performance over the past year, where it underperformed against the US Semiconductor industry's 18.5% return. Over a five-year period, however, ON Semiconductor's total return, including share price growth and dividends, was 195.67%, highlighting its stronger long-term performance.

The current narrative points to ON Semiconductor's efforts to revitalize its growth through the Fab-Right strategy and expansion into silicon carbide technology, particularly in automotive and AI data centers. This could potentially translate into positive impacts on revenue and earnings forecasts. Analysts expect a moderate revenue growth of 4% and significant earnings growth of 33.5% annually over the next three years, indicating an optimistic outlook contingent on overcoming current challenges.

The company's share price increase to US$38.51 still sits below the consensus price target of US$48.23 as of today, reflecting a 20.1% discount to the analysts' fair value estimation. While the analysts have varied expectations, with targets ranging from US$33.0 to US$72.12, the divergence suggests different perspectives on how ON Semiconductor's strategies will evolve. Investors should evaluate how the company's strategic initiatives in R&D and market expansion are likely to impact its financial outcomes relative to these targets.

Review our historical performance report to gain insights into ON Semiconductor's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)