- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Examining ON Stock Value After Weak Outlook Spurs 18% Slide in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with ON Semiconductor stock right now? You are not alone. This chipmaker is always a hot topic when investors look for growth potential in the ever-evolving semiconductor sector. With shares closing at $49.27 recently, it is fair to say ON Semiconductor has been on a bit of a rollercoaster. The stock is down 1.8% over the past week, up 3.1% for the month, and still clinging to a remarkable 87% gain over the past five years. Of course, the year-to-date and last 12 months have been tougher, both showing negative returns as the semiconductor space cooled following recent years of breakneck demand and shifting market dynamics.

One reason for the recent price swings is the lingering uncertainty in global chip demand, as well as changes in technology adoption and supply chain news that keep putting ON Semiconductor in the spotlight. Although the stock has lost some momentum from its pandemic highs, stronger interest in electric vehicles and smart infrastructure continues to shine a light on its long-term growth prospects.

If you are wondering whether this is a bargain or a value trap, the company's current valuation score is a 3 out of 6, meaning it passes half of the most common undervaluation checks. That is a solid foundation for a valuation-focused discussion. Next, let us break down ON Semiconductor's valuation from multiple angles before diving into a smarter, more holistic approach that could change how you look at the numbers for good.

Why ON Semiconductor is lagging behind its peers

Approach 1: ON Semiconductor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For ON Semiconductor, this approach relies on a 2 Stage Free Cash Flow to Equity model using cash flow projections in US dollars.

Currently, ON Semiconductor is generating free cash flow of around $962 million. Analysts forecast solid growth, with free cash flow projected to reach $2.33 billion by 2029, more than doubling within five years. While analyst estimates extend for five years, estimates beyond that are modeled to continue the trend at more modest growth rates to reflect potential market realities.

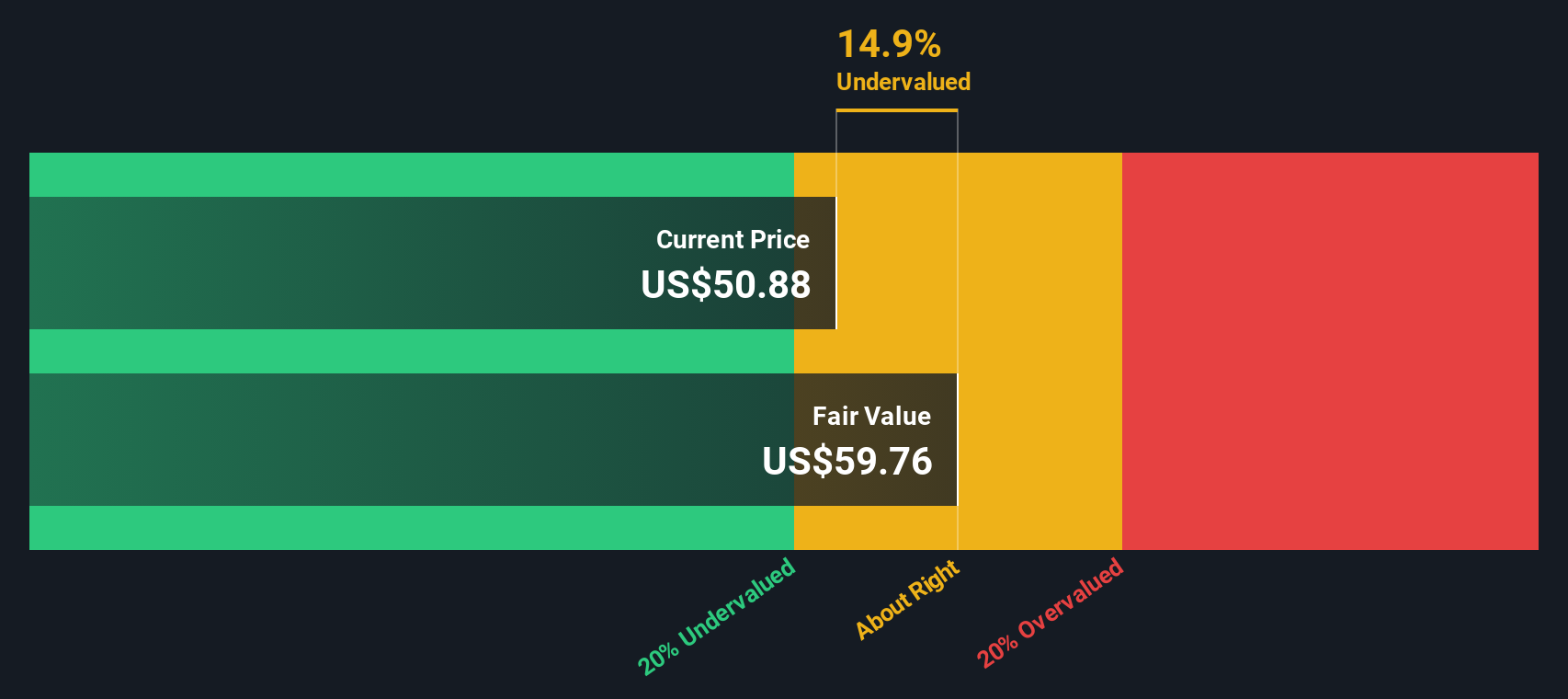

Based on these projections, the DCF model calculates an intrinsic value of $59.79 per share for ON Semiconductor. Compared to the recent share price of $49.27, this signals a notable discount, about 17.6% undervalued on a cash flow basis. This suggests the market might be underestimating ON Semiconductor’s long-term earning power as reflected in future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ON Semiconductor is undervalued by 17.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ON Semiconductor Price vs Earnings

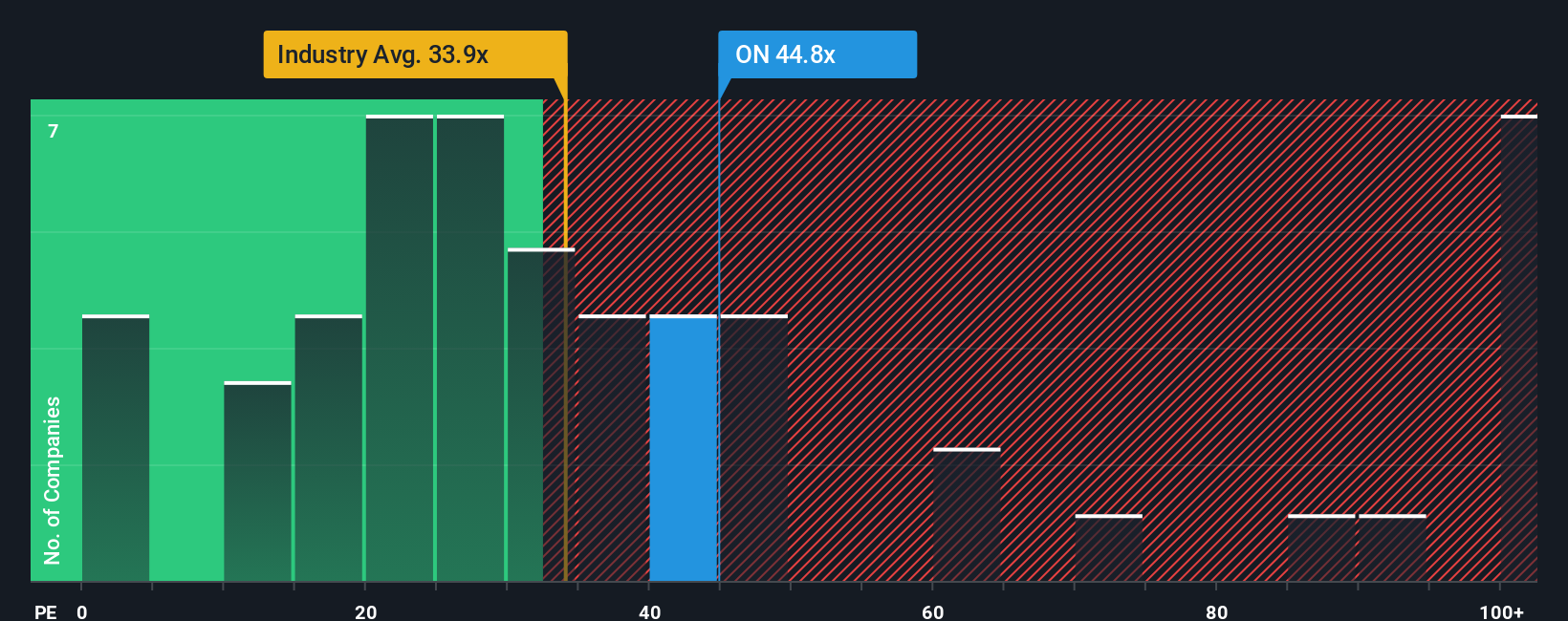

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like ON Semiconductor. It offers investors a quick snapshot of how much they are paying for each dollar of current earnings. As a company grows and demonstrates it can generate reliable profits, the PE ratio becomes increasingly useful in judging whether the stock is relatively cheap or expensive compared to its profit potential.

However, what counts as a "normal" or fair PE ratio depends on factors such as expected earnings growth, the risks facing the business, and how confident the market is in its outlook. For fast-growing, stable companies, investors might accept a higher PE ratio. Conversely, slower-growth or riskier companies often trade at lower multiples.

- ON Semiconductor’s current PE ratio: 43.26x

- Semiconductor industry average PE: 37.04x

- Peer average: 49.28x

Beyond just comparing with peers or the industry, Simply Wall St’s proprietary Fair Ratio adds a further layer of analysis. The Fair Ratio, here calculated at 48.26x, takes into account ON Semiconductor’s unique earnings growth, profit margins, industry, market cap, and specific risk profile. This holistic benchmark provides a much more tailored view than basic industry or peer multiples, adjusting for what is most relevant to this business right now.

With the current PE ratio of 43.26x being quite close to the Fair Ratio of 48.26x, ON Semiconductor’s valuation appears reasonable for its profile and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ON Semiconductor Narrative

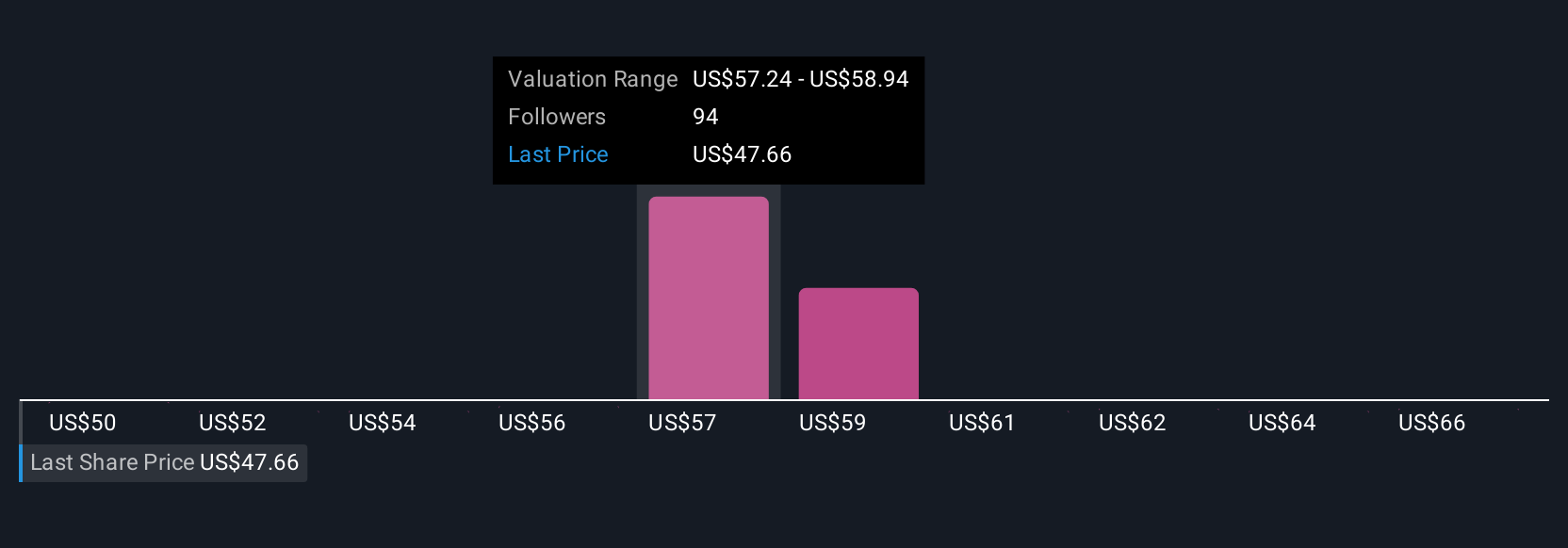

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your take on the numbers behind a company. It is the story you believe about ON Semiconductor’s future, paired directly with your own fair value estimate based on assumptions for revenue, earnings, and profit margins.

Instead of only focusing on today’s ratios, Narratives help connect what is happening at the company, such as new partnerships, product launches, or market shifts, to your financial forecasts and, in turn, to a fair value you can actually use for smarter investing.

Millions of investors share and refine Narratives on the Simply Wall St Community page, making it easy for you to create, compare, and update your own with just a few clicks. Because they are updated dynamically as new earnings or news arrives, your view stays current without endless recalculations.

Narratives make it simple to translate your perspective (whether bullish or cautious) into action, since you can check if the current price looks attractive compared to your own fair value or those shared by others.

For example, ON Semiconductor’s current Narratives range from an optimistic fair value of $70 with aggressive AI and EV growth assumptions, to a cautious outlook near $40 for those focused on cyclical risks and industry headwinds.

Do you think there's more to the story for ON Semiconductor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)