- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI): Profit Margin Decline Challenges Bullish Narrative Despite Strong Growth Rates

Reviewed by Simply Wall St

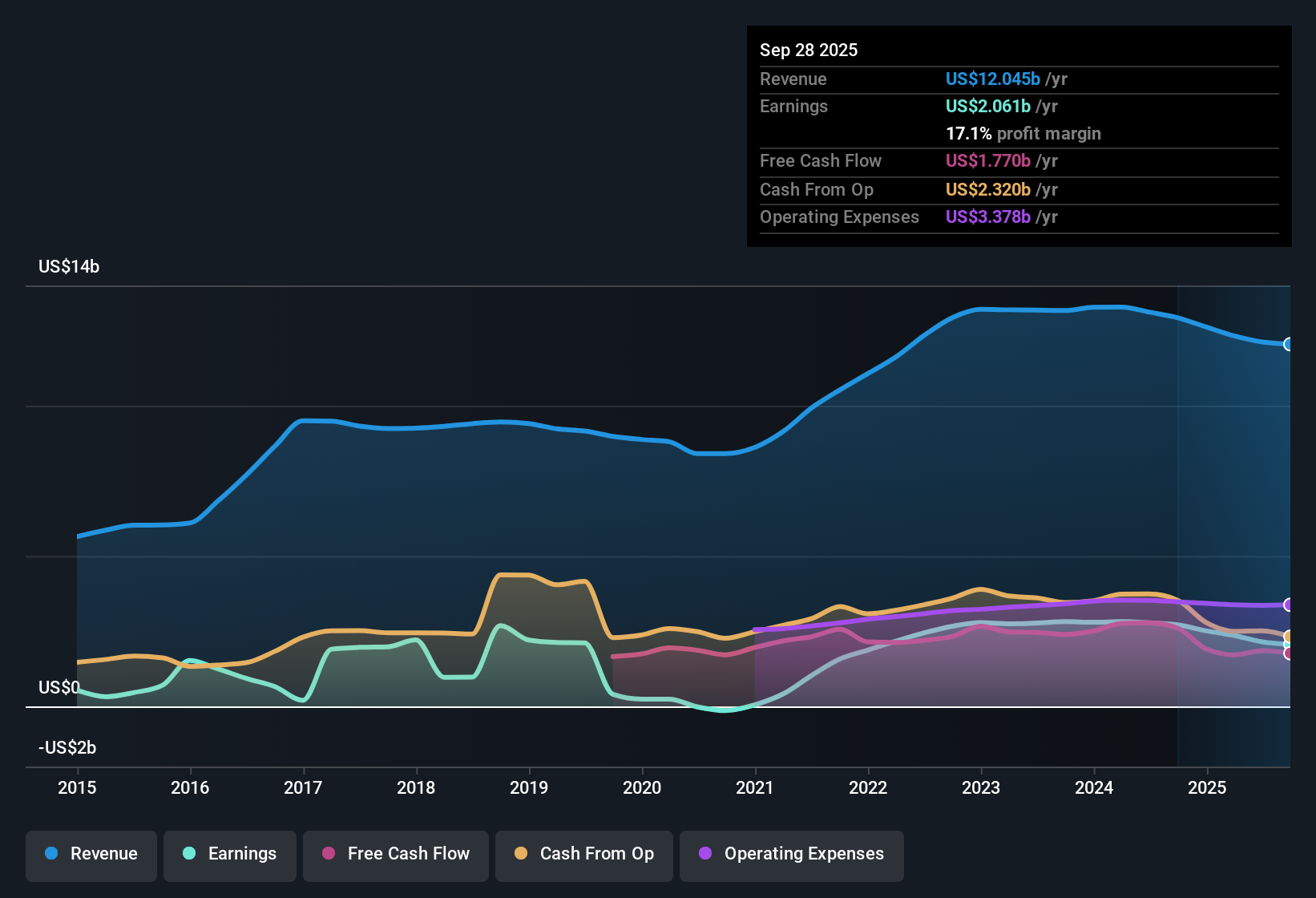

NXP Semiconductors (NXPI) posted an annual earnings growth rate of 20.5% over the last five years, with its latest net profit margin coming in at 17.1%, down from 21% a year earlier. Revenue is projected to rise 7.9% per year, while earnings are forecast to grow even faster at 17.75% annually, outpacing the broader US market's expected profit growth of 15.6%. In this context, NXP's stock is trading just above its estimated fair value but remains below most analyst price targets, underscoring positive momentum despite a recent dip in margins.

See our full analysis for NXP Semiconductors.Next, we will see how these headline numbers compare to the most popular narratives in the market and whether the results will reinforce or challenge the story so far.

See what the community is saying about NXP Semiconductors

Auto Segment to Drive Margin Recovery

- Analysts expect profit margins to rise from 17.7% today to 22.4% in three years, marking a clear recovery off current levels.

- According to the analysts' consensus view, normalization of automotive inventory and strong demand in the sector, along with NXP’s recent design wins, are positioned to support both higher revenue growth and margin expansion.

- Robust global demand for automotive semiconductors, including electrification and ADAS adoption, is expected to lift margins as vehicle content grows.

- The shift from channel inventory burn to shipping directly to end demand gives NXP better earnings visibility through coming quarters.

Consensus narrative suggests analyst targets hinge on continued recovery in margins and demand stabilization. See how the full picture stacks up in the community’s consensus view. 📊 Read the full NXP Semiconductors Consensus Narrative.

Valuation Sits Below Peer Multiples

- NXP’s 26.1x price-to-earnings ratio is well below the US semiconductor average of 40.3x and peer average of 41x, suggesting a relative value on both industry and peer benchmarks.

- Analysts' consensus sees NXP’s fair value backed by several metrics, despite the share price ($212.96) trading above the DCF fair value ($210.45) but still 17% below the consensus price target of $258.12.

- Ongoing earnings quality, recent profitability trends, and a lower-than-sector-average PE ratio shape the bullish angle for valuation upside.

- However, any disappointment in earnings trajectory or margin recovery could impact the current value thesis.

Growth Outlook Relies on Key Acquisitions

- Strategic acquisitions such as TTTech Auto, Kinara, and Aviva Links are cited as central to accelerating NXP’s medium- and long-term revenue and bolstering its gross margin profile as those businesses scale.

- Under the analysts' consensus narrative, these acquisitions are a double-edged sword: while they can enhance NXP’s position in automotive and Edge AI, they carry short-term risk by adding operating expenses without immediate revenue contribution.

- If integration delivers, consensus expects these moves to pay off in higher gross margin and top-line growth.

- But any setbacks or higher-than-expected costs could weigh on net margins and challenge earnings outperformance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NXP Semiconductors on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Bring your perspective to the forefront by crafting your own narrative in just minutes: Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

NXP’s future depends on a swift margin recovery and successful integration of recent acquisitions. However, any setbacks or cost overruns could undermine earnings stability.

If you’d rather focus on companies with more consistent revenue and profit trends, use our stable growth stocks screener (2115 results) to spot those delivering steady growth through all kinds of markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026