- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Surges 8% With Xeon 6 AI Processor Launch

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) recently launched its Xeon 6 processors, enhancing core counts and AI capabilities, a move paired with the introduction of advanced Ethernet solutions and broad adoption by over 500 partners, including industry giants like AT&T and Verizon. This suite of innovative offerings could have reinforced positive sentiment around Intel's growth trajectory. The chipmaker's stock surged 8% last month, reflecting optimism amid robust product launches and potential M&A activity with Silver Lake for Altera Corp. The broader market context reveals a volatile environment, with the S&P 500 and Nasdaq Composite posting consecutive weekly declines despite a solid economic outlook from the Federal Reserve Chair. Notably, AI-focused companies, such as Broadcom and Nvidia, experienced ups and downs, influencing semiconductor investor sentiment. While tech stocks, like Nvidia, saw mixed results, rising the day Musk's Tesla extended declines, Intel's strategic product developments aligned with investor interest, contributing to its notable price increase in February.

Click to explore a detailed breakdown of our findings on Intel.

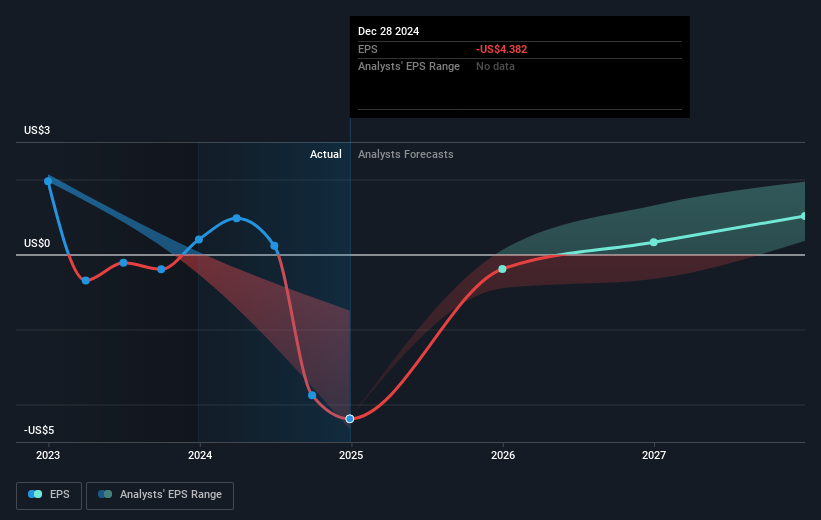

Over the past three years, Intel's total shareholder return, including share price and dividends, declined by 51.81%. This period saw Intel grappling with various challenges impacting its long-term stock performance. Intel's underperformance is evident compared to the broader US market, which returned 11.9% over the past year, and the US Semiconductor industry, which saw a 10% return.

Key factors influencing this downturn include the Q3 2024 earnings report, which revealed a sales decline to US$13.28 billion and a net loss of US$16.64 billion. The suspension of dividends starting the fourth quarter of 2024 prioritized liquidity for investments but affected investor sentiment. In terms of strategic decisions, Intel's ongoing litigation, such as the patent infringement lawsuits, continued to present financial uncertainties. Lastly, the CEO transition announced in December 2024 could have introduced some volatility as the company navigated executive leadership changes during a critical period.

- Discover whether Intel is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Intel and understand their potential impact—click to learn more.

- Got skin in the game with Intel? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives