- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Enhances AI Laptop Features Through Elliptic Labs Partnership

Reviewed by Simply Wall St

Recent developments surrounding Intel (NasdaqGS:INTC), including its new partnership with Elliptic Labs to enhance AI capabilities in next-generation laptops, have contributed to a 10% increase in its share price over the last month. This collaboration focuses on transforming PCs with intelligent sensing technology. Additionally, Intel's expanding alliances, like the collaboration with NetApp on enterprise AI adoption and Lenovo on supply chain security, likely added supportive momentum. Despite broader market fluctuations, including fluctuating Treasury yields and a recovering tech sector, Intel's strategic moves in AI and partnerships play a significant role in its positive market performance.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

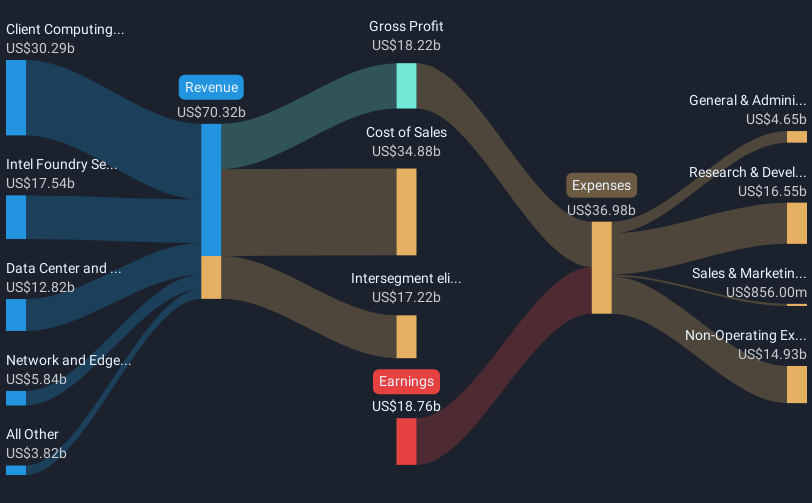

The recent developments involving Intel's efforts to enhance AI capabilities through strategic partnerships, such as with Elliptic Labs, could play a pivotal role in reshaping revenue and earnings forecasts. By focusing on intelligent sensing technology in next-gen laptops and expanding its alliances, Intel is positioning itself to improve its product mix, potentially increasing revenue streams. With a current share price of US$19.94, Intel is trading slightly above the consensus analyst price target of US$21.39, suggesting that market expectations may reflect anticipated growth from these initiatives. However, uncertainties remain due to macroeconomic factors and the complexity of executing these transformations.

Over the past year, Intel experienced a total return, including dividends, of 33.73% loss, highlighting challenges within the broader market context. When compared to the US Semiconductor industry, which delivered a return of 12.3% over the same period, Intel's performance has lagged. This contrast underscores potential internal hurdles that may have hindered its capacity to capitalize on broader sector gains. The focus on AI and operational restructuring could serve to better align Intel's future performance with industry trends and investor expectations.

Understand Intel's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)