- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Collaborates on AI Education in Ohio Amid Earnings Report

Reviewed by Simply Wall St

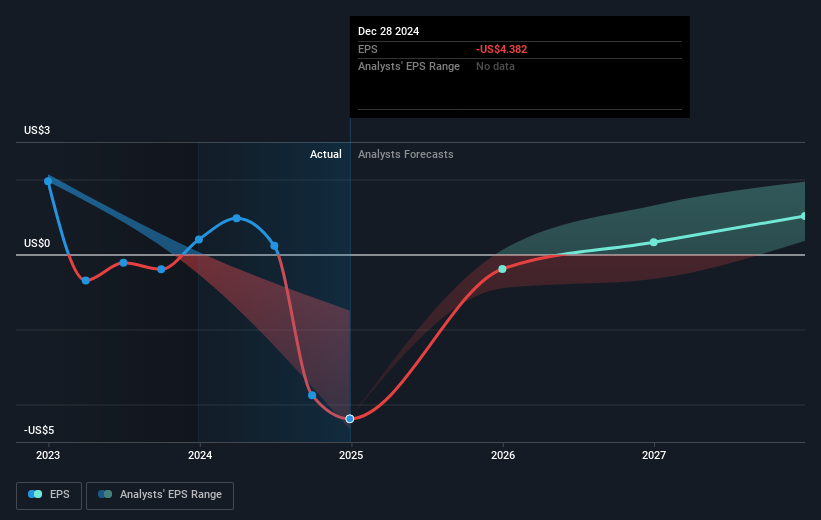

In the recent period, Intel (NasdaqGS:INTC) experienced a 14% price increase, coinciding with significant events, including the launch of Ohio's AI Education Network and the announcement of its Q1 earnings results. The company's collaboration in the AI initiative, aiming to boost education in the state, may have provided a positive sentiment. However, the notable aspects were the Q1 results revealing a drop in sales and a higher net loss, which could have weighed against broad market gains. While broader market trends showed a positive shift, Intel's specific events, especially its future outlook, likely influenced its stock volatility during the period.

We've spotted 1 possible red flag for Intel you should be aware of.

The recent developments surrounding Intel, including its collaboration with Ohio's AI Education Network and the Q1 earnings announcement, may have contributed positively to its short-term share price increase of 14%. However, these events also bring to light challenges reflected in the company's longer-term performance, where its total return, including share price and dividends, was a 38.15% decline over the past year. This significant decrease indicates broader challenges for Intel beyond the immediate news, mirroring larger headwinds faced in its business operations.

In terms of market position, Intel underperformed both the broader US market and the US Semiconductor industry over the one-year span, which saw respective returns of 7.9% and 9.9%. This relative underperformance may factor into analysts' revenue and earnings forecasts, as Intel grapples with pressures in the AI and data center sectors potentially influencing future financial outcomes. Revenue forecasts suggest modest growth, yet competitive pricing strategies could impact profit margins.

Despite the share price currently standing at US$21.53, it trades closely to the consensus analyst price target of US$22.11, suggesting limited upside according to prevailing market expectations. The recent increase in share value potentially narrows this gap, reflecting cautious optimism about Intel's strategic initiatives and upcoming projects such as Granite Rapids and Panther Lake. Investors are encouraged to consider these elements when evaluating the company's future trajectory and its alignment with analyst projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives