- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Climbs 7% With New Xeon 6 Processor Launch

Reviewed by Simply Wall St

In February 2025, Intel (NasdaqGS:INTC) launched its new Xeon 6 processors and Ethernet solutions, marking a vital advancement in data center and network infrastructure performance. Coupled with its partnership with Wind River, aimed at enhancing cloud-native infrastructure solutions, these initiatives likely influenced market perception, contributing to the company's 7.4% uptick over the past month. Meanwhile, discussions regarding the potential acquisition of Intel's programmable chips unit by Silver Lake could have amplified investor sentiment. Despite a broader market trend of declining tech stocks due to tariff jitters—illustrated by the Nasdaq’s 1.1% drop—Intel's stock performance stood out in the tech industry. As broader markets grappled with these economic uncertainties and the fluctuating performance of other major tech stocks like Marvell and Nvidia, Intel's endeavors captured investor attention, signaling confidence in its strategic direction.

Unlock comprehensive insights into our analysis of Intel stock here.

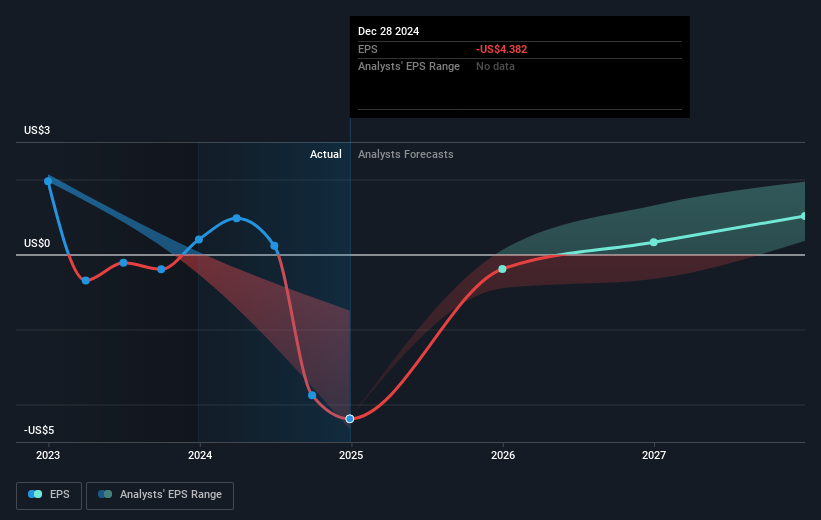

Over the last year, Intel's total shareholder return, including share price and dividends, experienced a significant decline of 52.76%. This stark decrease contrasts with the US Semiconductor industry's 10.3% rise and a broader US market gain of 14%. Key events contributing to this downturn include Intel's financial struggles, with revenue slipping to US$53.1 billion and a net loss reaching US$18.76 billion for the year, as reported in January 2025. The departure of CEO Pat Gelsinger in December 2024 may have unsettled investors, despite the concurrent appointment of Michelle Johnston Holthaus as CEO.

Furthermore, merger discussions, such as Qualcomm's approach in September 2024, indicated challenges in Intel's market position. Although rumors of possible acquisitions highlighted interest in Intel, these have yet to translate into positive investor confidence. January 2025 saw Intel complete a share repurchase program amounting to US$102.76 billion cumulatively, though shareholder returns remain adversely affected by the lack of buybacks in the most recent quarter.

- Get the full picture of Intel's valuation metrics and investment prospects—click to explore.

- Assess the downside scenarios for Intel with our risk evaluation.

- Is Intel part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.