- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

Is There an Opportunity in GlobalFoundries After Its Recent 8% Share Price Rebound?

Reviewed by Bailey Pemberton

If you’re wondering what to do with GlobalFoundries stock these days, you’re definitely not alone. The past year’s choppy ride has left more than a few investors scratching their heads, especially when the company’s share price has stumbled by nearly 17% over the past twelve months and is down 19% year-to-date. That kind of drop certainly grabs your attention, but look closer and you’ll spot some waves of optimism, too. GlobalFoundries shares recently rebounded 8.6% over the past month, even after a dip of 4.3% last week. All of this action hints at a mix of growth potential and shifting views on risk as the market tries to price in the company’s longer-term prospects in a changing global chip landscape.

So, is GlobalFoundries undervalued, fairly priced, or still too risky? That’s where things get interesting. When we break down the numbers using six classic valuation checks, the company scores a 2, meaning it’s undervalued on two out of six measures. That’s not a blowout value signal, but it does suggest there may be bargains for patient investors willing to dig a little deeper.

In the next section, we’ll look at exactly which valuation tests GlobalFoundries is passing (and which it isn’t) to get a clear sense of how the company stacks up right now. And if you’re curious about the bigger picture, why traditional valuation methods sometimes miss the forest for the trees, stick around for a perspective you won’t want to miss at the end.

GlobalFoundries scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GlobalFoundries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This helps investors judge whether the current share price properly reflects expectations for the future.

For GlobalFoundries, the latest reported Free Cash Flow stands at $192.6 Million. Analysts forecast significant growth, with Free Cash Flow projected to climb to $1.15 Billion by 2028. Looking further ahead, projections suggest Free Cash Flow could reach approximately $1.32 Billion by 2035, although estimates after 2028 are extrapolated rather than based on direct analyst input.

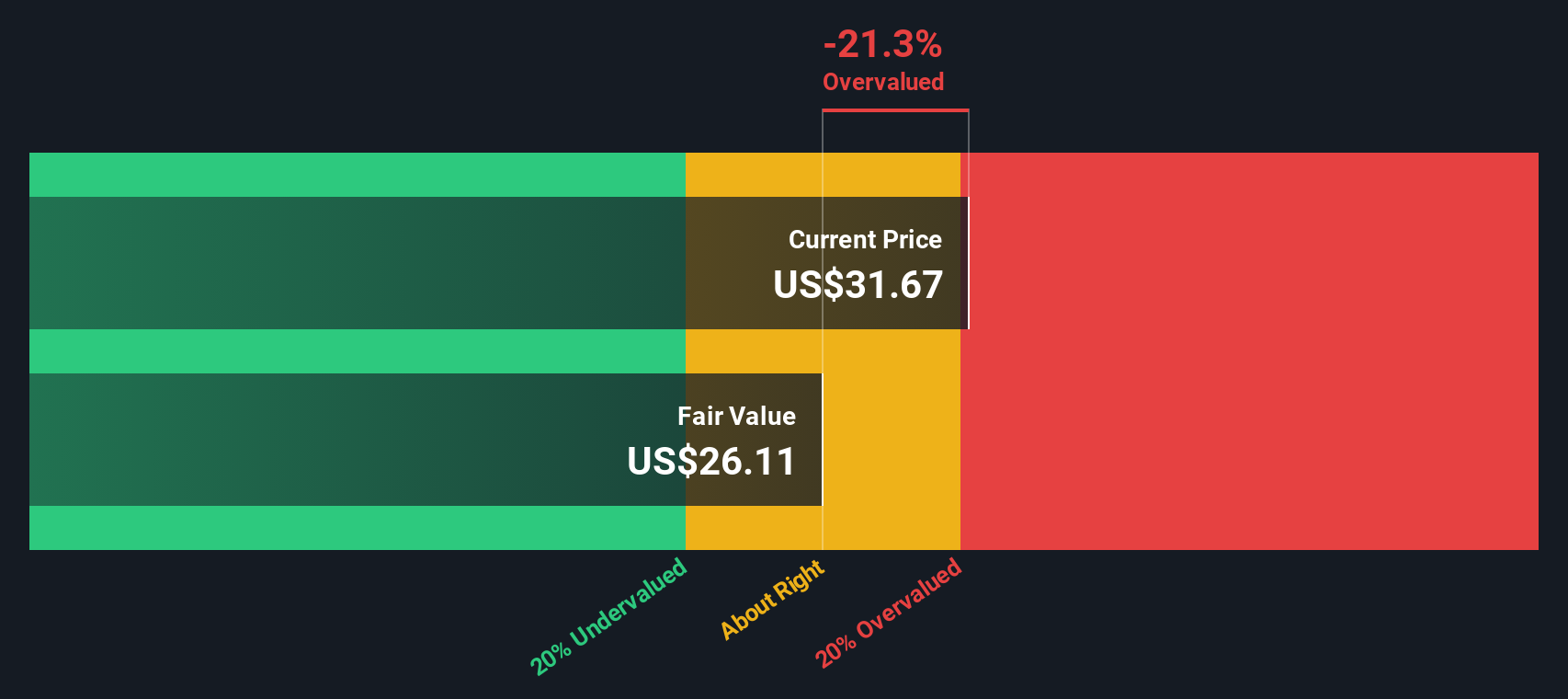

After factoring in these growth rates and discounting future cash flows to present value, the DCF model produces an estimated intrinsic value of $25.68 per share. Compared to the current share price, this suggests the stock is about 33.9% overvalued at today’s levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GlobalFoundries may be overvalued by 33.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: GlobalFoundries Price vs Sales

For companies like GlobalFoundries in the semiconductor sector, the Price-to-Sales (P/S) ratio is often a solid valuation tool, especially when earnings can swing due to industry cycles or large investments. This multiple helps investors compare a company's share price with its total revenue. It is particularly useful when profitability is uneven but sales remain robust.

Growth expectations and risk play a key role in what makes a “normal” or “fair” P/S ratio. High sales growth, improving profit margins, or industry leadership can support a higher multiple. In contrast, slower growth or sector risks usually mean the market prefers a lower ratio.

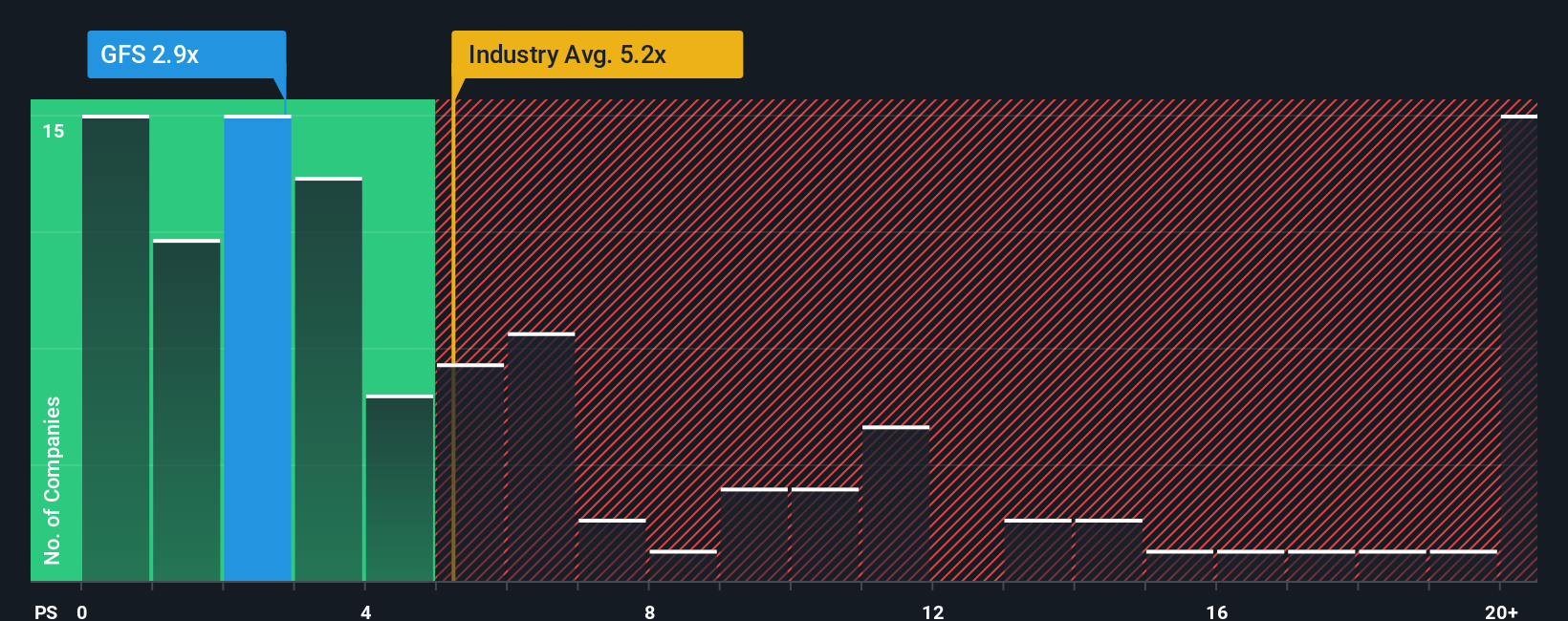

GlobalFoundries currently trades at a P/S ratio of 2.79x. This stands below the semiconductor industry average of 5.16x and is well under the peer group average of 20.17x, suggesting investors are placing a discount on the stock compared with rivals. However, looking only at raw peer or industry multiples can miss subtle differences between companies.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio adjusts for GlobalFoundries’ specific growth prospects, profit margins, market cap, and risk profile, aiming for a more tailored benchmark. In this case, the proprietary Fair Ratio for GlobalFoundries is 2.53x, just a hair below where shares are currently valued.

The narrow gap between the Fair Ratio and the actual P/S multiple means the market is pricing shares about in line with their fundamentals right now.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GlobalFoundries Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you tell about a company, your personal perspective on where it’s headed, backed up by your assumptions for future revenue, margins, and fair value. Unlike just looking at the numbers in isolation, Narratives link GlobalFoundries’ business outlook to a financial forecast and fair value, making your investment logic clear and actionable.

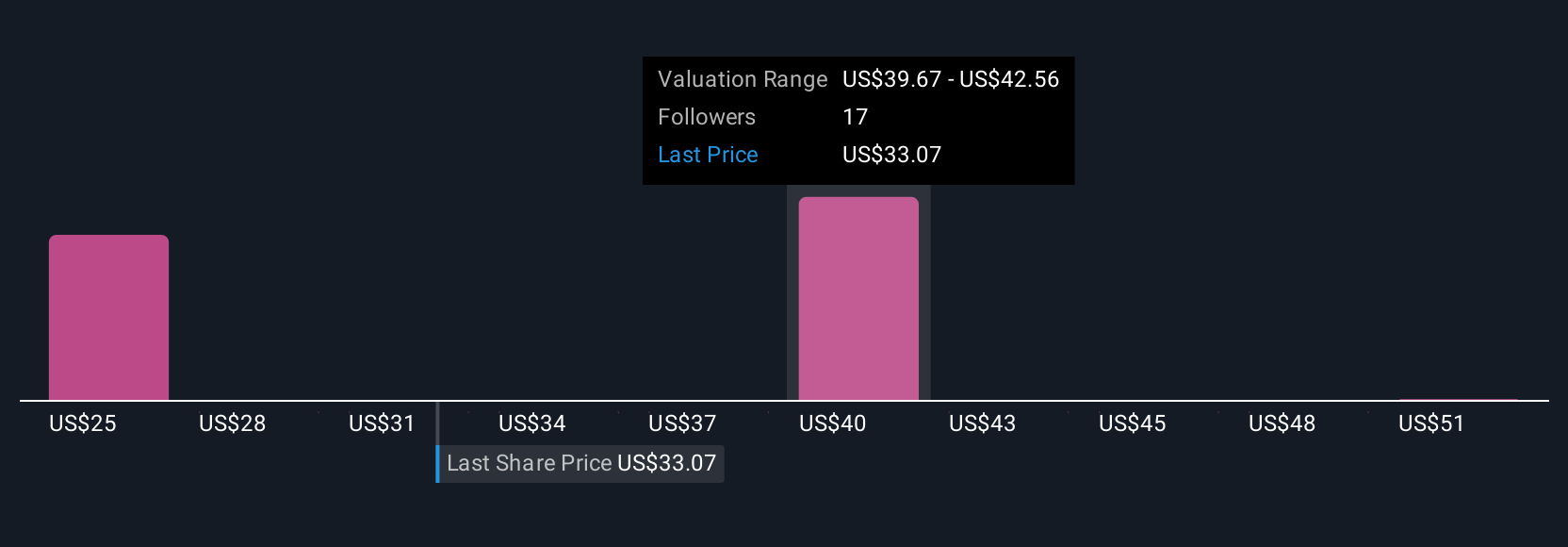

Narratives are easy to create and share on Simply Wall St’s Community page, used by millions of investors. They help you decide when to buy or sell by comparing your Fair Value estimate with the current Price in real time, so you’re always responding to the latest news or earnings updates, not yesterday’s headlines. For example, some GlobalFoundries investors have crafted optimistic stories that highlight expanding US and European capacity, forecasting strong future earnings and price targets as high as $50. Others focus more on margin pressure and global risk, resulting in more cautious price targets of $35. This shows that different assumptions lead to different fair values and strategies. Narratives let you see and test both sides quickly, helping you invest smarter and more confidently.

Do you think there's more to the story for GlobalFoundries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion