- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

GlobalFoundries (GFS): Revisiting Valuation After Sam Franklin’s Promotion to Chief Financial Officer

Reviewed by Simply Wall St

GlobalFoundries (GFS) just promoted insider Sam Franklin to Chief Financial Officer, and that kind of move usually tells you more about the company’s next chapter than any quarterly headline ever could.

See our latest analysis for GlobalFoundries.

The timing is interesting, with the share price now at $40.42 after a sharp 16.1% 1 month share price return and a 27.6% 3 month share price return. However, the 1 year total shareholder return is still negative and longer term performance shows momentum only recently starting to rebuild.

If this CFO move has you watching GlobalFoundries more closely, it could also be a smart moment to explore other chip and infrastructure names using our high growth tech and AI stocks for fresh ideas beyond a single stock.

With profits still patchy, a modest value score, and the share price now sitting slightly above analyst targets, investors have to ask: is GlobalFoundries quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 2.5% Overvalued

With GlobalFoundries closing at $40.42 versus a narrative fair value near $39.43, the story frames today’s price as slightly ahead of fundamentals but still closely tethered to long term growth assumptions.

The company's focus on differentiated technologies (such as FD SOI, RF, and power management platforms) and recent MIPS acquisition strengthens its value proposition in edge AI, automotive, and data center markets, deepening customer partnerships and enabling premium pricing, which is likely to drive sustained improvements in revenue visibility and margin stability.

Curious what kind of revenue runway, margin lift, and future earnings power have to line up to support that valuation story, especially in a capital heavy foundry business, and how optimistic those numbers really are? Click through to see exactly what assumptions sit under this fair value call.

Result: Fair Value of $39.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in mobile chips and heavy capital spending needs could squeeze margins and derail the expected earnings and valuation ramp.Find out about the key risks to this GlobalFoundries narrative.

Another View: Market Ratios Signal a Different Story

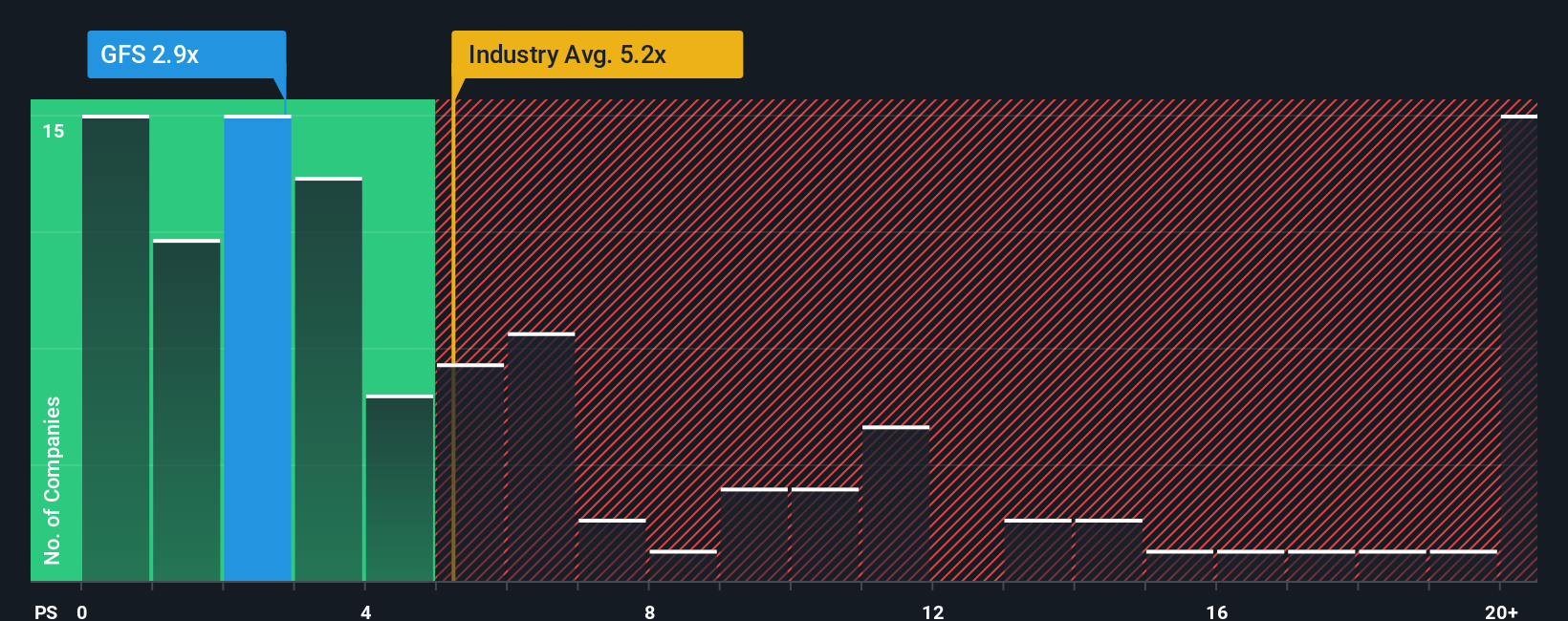

While the narrative fair value suggests GFS is only about 2.5% overvalued, its 3.3x price to sales looks cheaper than the US semiconductor average of 5.4x and peer average of 9.3x. However, it is still above its 2.5x fair ratio, hinting at both upside and downside risk. Which side do you think wins out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GlobalFoundries Narrative

If you are not fully aligned with this view or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Ready for your next investing move?

Before you move on, sharpen your edge by using the Simply Wall St Screener to uncover fresh ideas that match your strategy, risk appetite, and goals.

- Capitalize on mispriced opportunities by targeting companies that look cheap on cash flows with these 908 undervalued stocks based on cash flows.

- Ride structural trends in automation and data by hunting for innovators among these 26 AI penny stocks.

- Strengthen your income stream by focusing on companies in these 12 dividend stocks with yields > 3% that offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026