- United States

- /

- Food

- /

- NasdaqGM:FRPT

3 US Stocks Estimated To Be Trading At Discounts Of Up To 46.5%

Reviewed by Simply Wall St

As the United States approaches a pivotal presidential election and anticipates a Federal Reserve rate decision, stock markets have shown signs of caution with recent declines in major indices. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities amidst market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.55 | $36.67 | 49.4% |

| MVB Financial (NasdaqCM:MVBF) | $18.89 | $37.09 | 49.1% |

| California Resources (NYSE:CRC) | $52.86 | $104.55 | 49.4% |

| Cadence Bank (NYSE:CADE) | $33.02 | $64.54 | 48.8% |

| Range Resources (NYSE:RRC) | $30.56 | $60.18 | 49.2% |

| Enphase Energy (NasdaqGM:ENPH) | $87.46 | $171.07 | 48.9% |

| Constellium (NYSE:CSTM) | $11.19 | $21.86 | 48.8% |

| EVERTEC (NYSE:EVTC) | $33.02 | $65.79 | 49.8% |

| First Western Financial (NasdaqGS:MYFW) | $19.00 | $37.36 | 49.1% |

| Open Lending (NasdaqGM:LPRO) | $6.14 | $12.21 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

Freshpet (NasdaqGM:FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe with a market cap of approximately $6.48 billion.

Operations: Freshpet operates in the pet food industry by producing and selling natural fresh meals and treats for dogs and cats across North America and Europe.

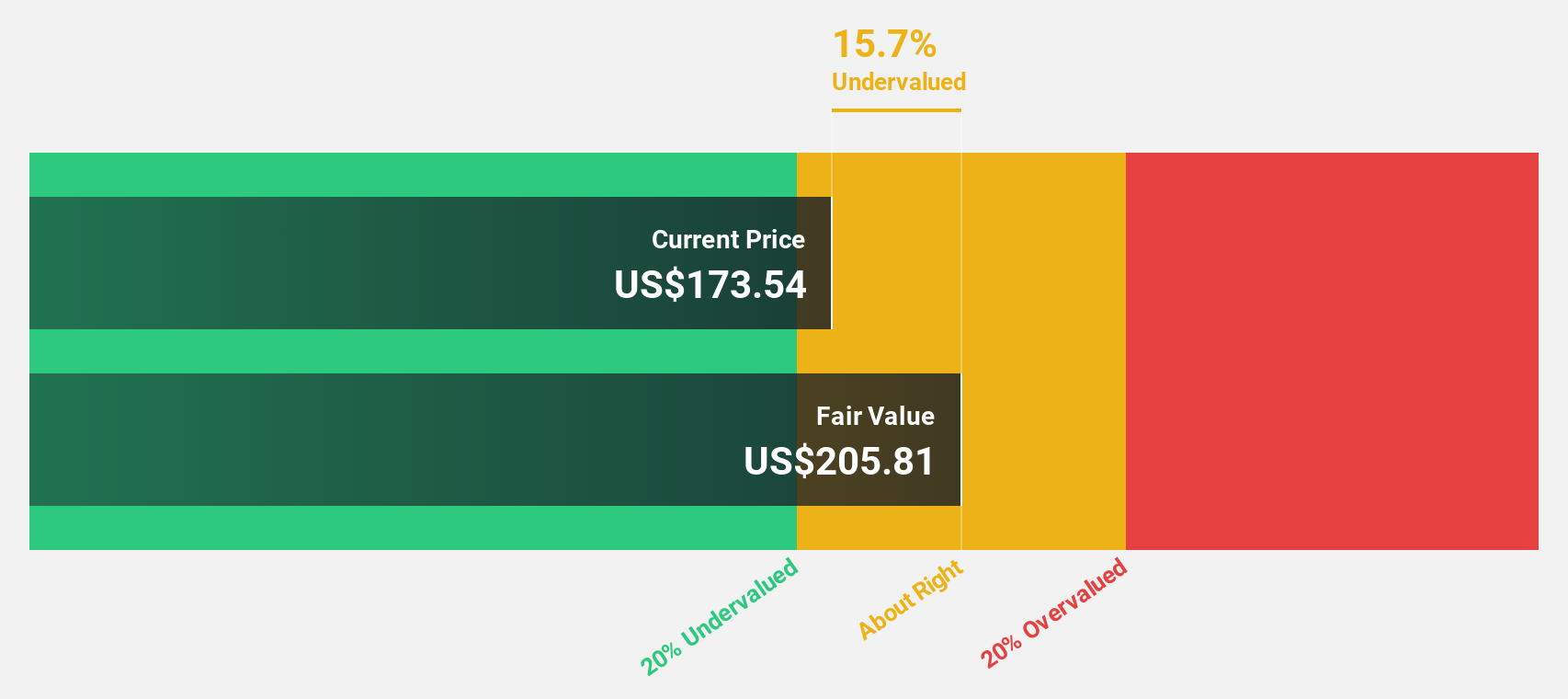

Estimated Discount To Fair Value: 38.8%

Freshpet's recent earnings report highlights a transition to profitability with net income of US$11.9 million for Q3 2024, compared to a loss the previous year. The company raised its full-year sales guidance to approximately US$975 million, reflecting robust growth. Trading at 38.8% below its estimated fair value of US$246.08, Freshpet appears undervalued based on discounted cash flow analysis, despite projected slower revenue growth than some peers but faster than the broader market.

- According our earnings growth report, there's an indication that Freshpet might be ready to expand.

- Unlock comprehensive insights into our analysis of Freshpet stock in this financial health report.

First Solar (NasdaqGS:FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic solar energy solutions across the United States, France, Japan, Chile, and internationally, with a market cap of approximately $21.94 billion.

Operations: The company generates revenue primarily from its Modules segment, which accounted for $3.85 billion.

Estimated Discount To Fair Value: 46%

First Solar's recent earnings report shows a strong financial performance with Q3 2024 net income at US$312.96 million, up from US$268.4 million the previous year. The company is trading at 46% below its estimated fair value of US$393.27, suggesting undervaluation based on discounted cash flow analysis. Despite significant insider selling recently, First Solar's earnings are projected to grow faster than the U.S. market, supported by high-quality non-cash earnings and robust profit growth expectations.

- Our comprehensive growth report raises the possibility that First Solar is poised for substantial financial growth.

- Navigate through the intricacies of First Solar with our comprehensive financial health report here.

Viking Holdings (NYSE:VIK)

Overview: Viking Holdings Ltd operates in passenger shipping and other forms of passenger transport across North America, the United Kingdom, and internationally, with a market cap of $17.11 billion.

Operations: The company's revenue primarily comes from its Viking River segment, generating $2.44 billion, followed by the Viking Ocean segment with $2.04 billion.

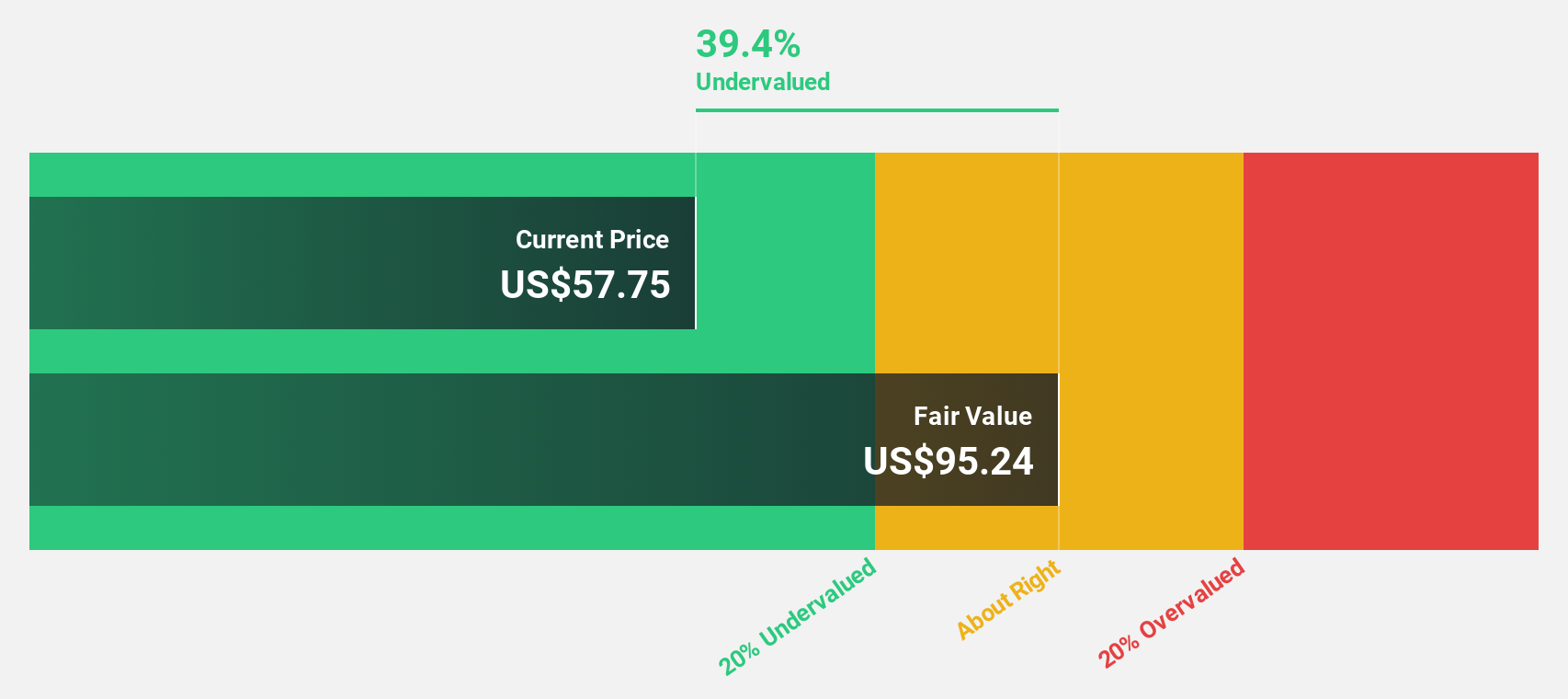

Estimated Discount To Fair Value: 46.5%

Viking Holdings is trading at a significant discount, 46.5% below its estimated fair value of US$74.66, according to discounted cash flow analysis. Despite reporting a net loss for the first half of 2024, revenue grew by 22.2% year-over-year and is forecasted to grow faster than the U.S. market at 14.6% annually. The company recently raised US$930 million through an equity offering and expanded its fleet with new Nile River ships, indicating strategic growth initiatives.

- Our growth report here indicates Viking Holdings may be poised for an improving outlook.

- Dive into the specifics of Viking Holdings here with our thorough financial health report.

Taking Advantage

- Click through to start exploring the rest of the 194 Undervalued US Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Freshpet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives