- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

3 Stocks That Could Be Trading At A Discount

Reviewed by Simply Wall St

As U.S. markets enjoy a robust rally ahead of the Thanksgiving break, with major indexes on track for their best week since June, investors are keenly eyeing opportunities that might be trading at a discount. In such an environment, identifying undervalued stocks becomes crucial as they have the potential to offer significant value when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.26 | $17.99 | 48.5% |

| Warrior Met Coal (HCC) | $78.72 | $155.07 | 49.2% |

| Super Group (SGHC) (SGHC) | $10.93 | $21.73 | 49.7% |

| Perfect (PERF) | $1.73 | $3.46 | 50% |

| Freshworks (FRSH) | $12.01 | $24.01 | 50% |

| Flutter Entertainment (FLUT) | $199.92 | $391.12 | 48.9% |

| Fifth Third Bancorp (FITB) | $43.33 | $83.54 | 48.1% |

| Elastic (ESTC) | $69.94 | $135.95 | 48.6% |

| Circle Internet Group (CRCL) | $72.64 | $140.58 | 48.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.98 | $37.29 | 49.1% |

Underneath we present a selection of stocks filtered out by our screen.

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic (PV) solar energy solutions across the United States, France, India, Chile, and other international markets with a market cap of approximately $27.94 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of CdTe solar modules, totaling $5.05 billion.

Estimated Discount To Fair Value: 44%

First Solar is trading at US$272.21, significantly below its estimated fair value of US$486.25, suggesting it may be undervalued based on cash flows. The company forecasts robust earnings growth of 24.2% annually, outpacing the broader market's 16%. Recent expansions include a new US$1.1 billion manufacturing facility in Louisiana and a planned South Carolina plant to enhance domestic production capacity, underscoring its strategic focus on expanding American manufacturing capabilities and supporting energy independence goals.

- The analysis detailed in our First Solar growth report hints at robust future financial performance.

- Get an in-depth perspective on First Solar's balance sheet by reading our health report here.

Flutter Entertainment (FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally; it has a market cap of $34.28 billion.

Operations: The company's revenue is derived from its operations in the United States ($6.44 billion) and the United Kingdom and Ireland ($3.63 billion).

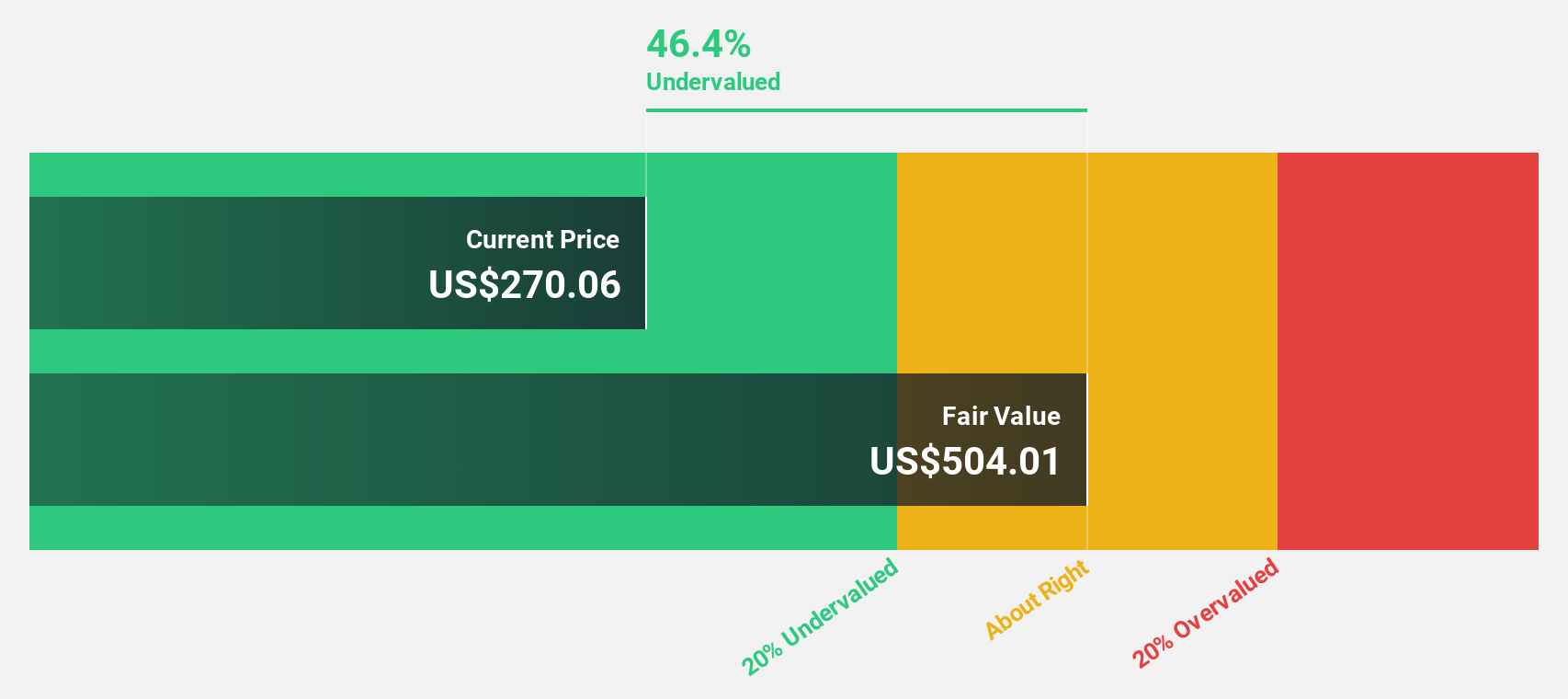

Estimated Discount To Fair Value: 48.9%

Flutter Entertainment is trading at US$199.92, considerably below its fair value estimate of US$391.12, indicating potential undervaluation based on cash flows. Despite reporting a net loss of US$690 million for Q3 2025, the company expects annual revenue growth of 13.1%, surpassing the US market's average. Analysts forecast a high return on equity and significant profit growth over the next three years, aligning with expectations for profitability and enhanced shareholder value.

- The growth report we've compiled suggests that Flutter Entertainment's future prospects could be on the up.

- Take a closer look at Flutter Entertainment's balance sheet health here in our report.

Pure Storage (PSTG)

Overview: Pure Storage, Inc. offers data storage and management technologies, products, and services globally, with a market cap of approximately $27.33 billion.

Operations: The company's revenue segment primarily consists of computer storage devices, generating $3.35 billion.

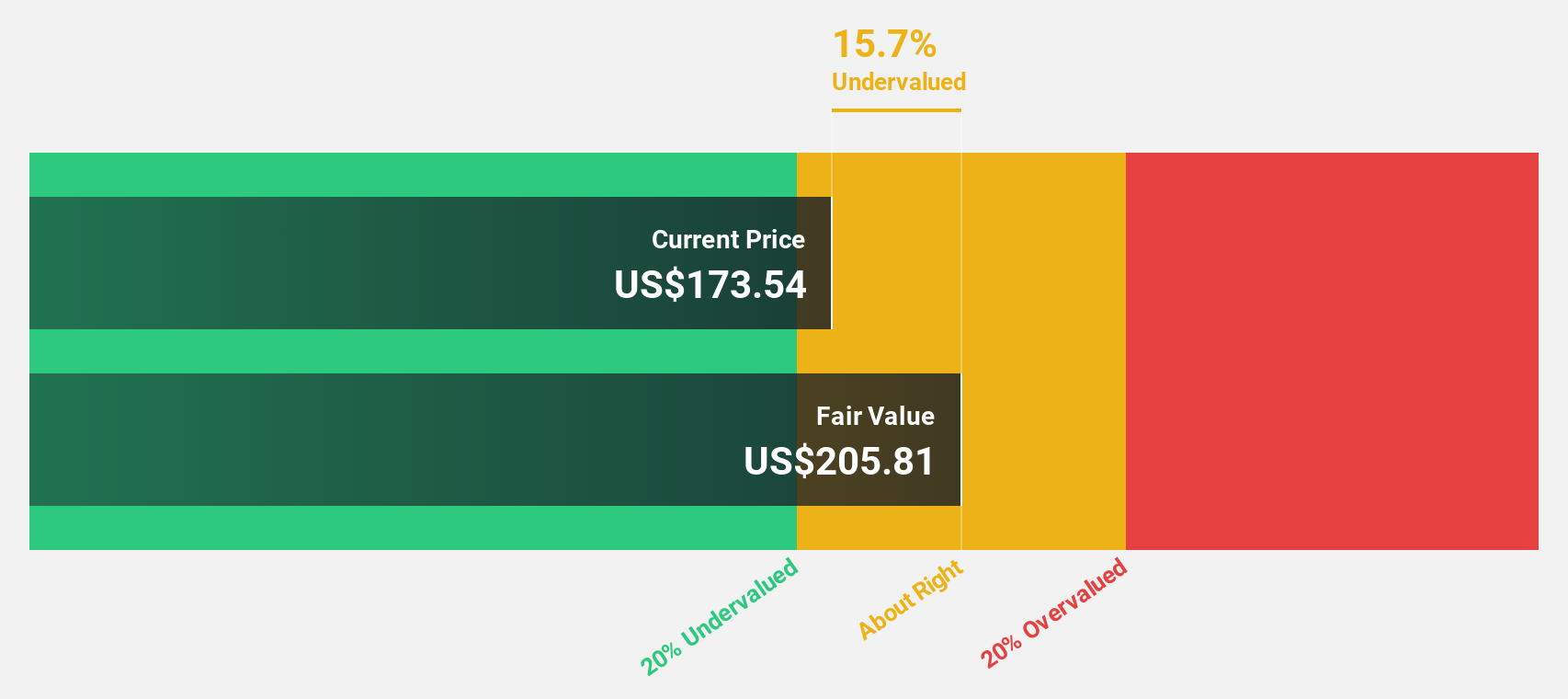

Estimated Discount To Fair Value: 15.5%

Pure Storage is trading at US$85.77, below its estimated fair value of US$101.48, suggesting potential undervaluation based on cash flows. The company reported a net income increase to US$47.12 million for Q2 2025 and anticipates revenue growth of 13.3% annually, outpacing the broader market's average. Despite significant insider selling recently, analysts project high earnings growth and a substantial return on equity over the next three years, enhancing its investment appeal.

- Our comprehensive growth report raises the possibility that Pure Storage is poised for substantial financial growth.

- Click here to discover the nuances of Pure Storage with our detailed financial health report.

Where To Now?

- Reveal the 211 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)