- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Verra Mobility And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

Amid ongoing U.S.-China tariff talks and fluctuating market indices, investors are seeking opportunities in undervalued stocks that may offer potential value. In this environment, identifying stocks priced below their estimated worth can be a strategic move, especially as the market reacts to economic policies and global trade developments.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $18.52 | $36.74 | 49.6% |

| Quaker Chemical (NYSE:KWR) | $104.51 | $205.79 | 49.2% |

| First Internet Bancorp (NasdaqGS:INBK) | $23.06 | $45.33 | 49.1% |

| Excelerate Energy (NYSE:EE) | $27.50 | $54.11 | 49.2% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.30 | $18.49 | 49.7% |

| Ready Capital (NYSE:RC) | $4.38 | $8.67 | 49.5% |

| Live Oak Bancshares (NYSE:LOB) | $26.62 | $52.45 | 49.2% |

| StoneCo (NasdaqGS:STNE) | $13.81 | $27.35 | 49.5% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.70 | $29.22 | 49.7% |

| Verra Mobility (NasdaqCM:VRRM) | $24.28 | $47.80 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Verra Mobility (NasdaqCM:VRRM)

Overview: Verra Mobility Corporation offers smart mobility technology solutions across the United States, Australia, Europe, and Canada with a market capitalization of $3.54 billion.

Operations: Revenue Segments (in millions of $): Government Solutions $404.60, Commercial Services $324.20, and Parking Solutions $53.70.

Estimated Discount To Fair Value: 49.2%

Verra Mobility is trading at US$24.28, significantly undervalued compared to its estimated fair value of US$47.8, presenting a potential opportunity based on discounted cash flow analysis. Despite facing challenges with reduced profit margins and high debt levels, its earnings are projected to grow substantially over the next three years at 47% annually, outpacing the broader market's growth expectations. Recent earnings reports show steady revenue increases and reaffirmed guidance for 2025 revenue between $925 million and $935 million.

- Upon reviewing our latest growth report, Verra Mobility's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Verra Mobility with our detailed financial health report.

Enphase Energy (NasdaqGM:ENPH)

Overview: Enphase Energy, Inc. designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry globally and has a market cap of approximately $5.74 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of solutions for the solar photovoltaic industry, generating $1.42 billion.

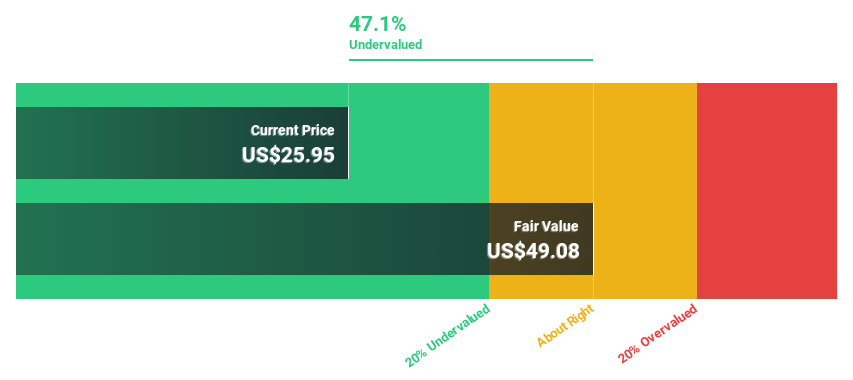

Estimated Discount To Fair Value: 11%

Enphase Energy is trading at US$49.05, below its estimated fair value of US$55.12, indicating it may be undervalued based on cash flows. The company reported a significant turnaround in net income for Q1 2025 and forecasts robust earnings growth of 26.4% annually, surpassing the broader market's expectations. Recent product launches and strategic expansions bolster its position in key markets, although insider selling could pose concerns for potential investors evaluating long-term prospects.

- According our earnings growth report, there's an indication that Enphase Energy might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Enphase Energy.

Dutch Bros (NYSE:BROS)

Overview: Dutch Bros Inc., along with its subsidiaries, operates and franchises drive-thru coffee shops in the United States, with a market cap of approximately $11.07 billion.

Operations: Dutch Bros generates revenue primarily through the operation and franchising of drive-thru coffee shops across the United States.

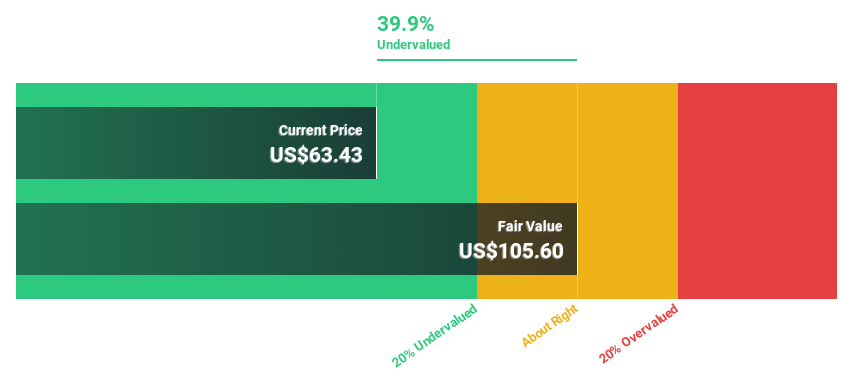

Estimated Discount To Fair Value: 41.3%

Dutch Bros, trading at US$64.45, is significantly undervalued with an estimated fair value of US$109.86. Its earnings are projected to grow 40.4% annually, outpacing the broader market's growth rate of 13.9%. Recent Q1 results showed a substantial increase in revenue and net income year-over-year, though insider selling may raise caution for some investors. The company's strategic product launches and retail expansion efforts further support its growth trajectory in the competitive beverage sector.

- Our expertly prepared growth report on Dutch Bros implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Dutch Bros with our comprehensive financial health report here.

Make It Happen

- Click through to start exploring the rest of the 173 Undervalued US Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives